- BTC holds $87,000 assist, however short-term bias stays susceptible until EMA is recovered

- Rising open curiosity contrasts with persistent spot outflows, suggesting cautious positioning

- El Salvador and IMF talks elevate coverage dangers, prompting merchants to concentrate on technical confirmations

Bitcoin is seeking to stabilize after weeks of heightened volatility as merchants steadiness altering macro and coverage developments with technical alerts. On the 4-hour chart, BTC is buying and selling close to $87,600, reflecting a short-term restoration in a broader correction.

Trying on the value development, we see that sellers stay energetic close to key resistance zones despite the fact that patrons are defending latest lows. Because of this, market individuals stay cautious as Bitcoin struggles to regain its key shifting averages that decide its short-term path.

Bitcoin value construction stays fragile

Bitcoin has rebounded from the $84,000 to $85,000 demand zone, indicating short-term purchaser curiosity. Nevertheless, the construction stays impartial to bearish whereas the value stays beneath the 100 and 200 EMAs. Importantly, BTC is at the moment stabilizing above the supertrend assist close to $87,000, which serves as a short-term pivot.

Resistance ranges are concentrated between $88,300 and $88,900, the place the short-term shifting averages converge. Moreover, stronger resistance seems between $91,000 and $91,500, coinciding with the long-term EMA.

Associated: Ethereum Worth Prediction: Sellers defend trendline as ETH struggles close to $3,000

Failure to clear these zones may result in renewed draw back stress in the direction of $86,000 and $84,000. Due to this fact, bulls require a decisive breakout to verify a development reversal.

Watch out for derivatives and spot stream alerts

Bitcoin futures open curiosity has proven a long-term growth development, regardless of cooling not too long ago. Throughout an aggressive rally earlier this yr, open curiosity peaked at over $80 billion. At the moment, that degree is hovering round $59 billion, reflecting partial deleveraging quite than market exit. Because of this, leverage stays excessive in comparison with the scenario firstly of the yr.

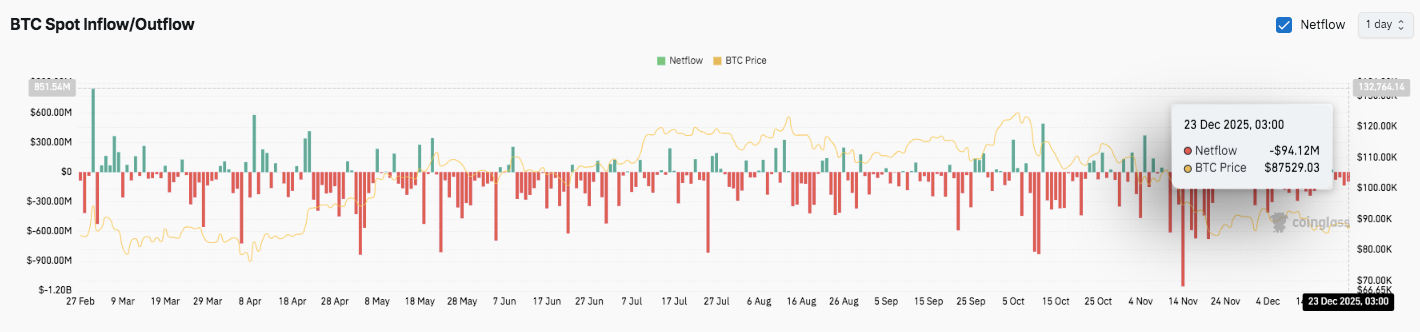

Nevertheless, spot market tendencies paint a extra defensive image. Outflows proceed to exceed inflows in most periods, indicating continued deliveries. Furthermore, sudden spikes in outflows usually coincide with declines in native costs. Latest web outflows of practically $94 million have strengthened weak point in spot demand as BTC trades beneath $88,000.

El Salvador talks enhance coverage uncertainty

Moreover, Bitcoin has obtained renewed consideration from coverage discussions involving El Salvador and the IMF. The authorities reported progress in negotiations relating to the government-backed sale of Cibo Pockets. Discussions proceed round a broader Bitcoin initiative, with a concentrate on transparency and danger mitigation.

Associated: Solana Worth Prediction: SOL faces impartial bearish bias throughout key indicators

These negotiations are aimed toward unlocking additional IMF funding for El Salvador’s economic system. Nevertheless, the outcomes may affect how the market perceives Bitcoin’s position in nationwide fiscal technique. Because of this, merchants proceed to carefully monitor each technical ranges and macro developments.

Technical outlook for Bitcoin value

Bitcoin’s technical construction stays well-defined as the value dips beneath main development resistance ranges. On the 4-hour chart, BTC is buying and selling close to $87,600, compressed between restoration momentum and broader correction stress. This setup suggests {that a} decisive transfer could also be close to as volatility will increase.

- High degree: Fast resistance lies between $88,300 and $88,900, the place the 20-year and 50-year EMAs converge. A confirmed breakout above this zone may open the way in which to $91,000 to $91,500 together with the 100 and 200 EMAs. Above that, $94,600 turns into a key Fibonacci retracement degree, and $103,200 turns into a macro growth goal if a bullish continuation performs out.

- Lower cost degree: Preliminary assist ranges from $87,000 to $86,900 and is enhanced by SuperTrend assist. Lack of this space would lead to a lack of $86,000, adopted by a stronger demand base close to $84,000. Failure to defend $84,000 may speed up draw back stress in the direction of the $80,700 macro assist zone.

- Higher restrict of resistance: The $91,000-$91,500 band stays a key degree for a transition to a medium-term bullish shift. Retrieving this zone would point out renewed development power and improved momentum construction.

Technically, Bitcoin seems to be compressing inside a restoration vary inside a broader correction. This kind of construction usually precedes elevated volatility, with path decided by breakout affirmation and follow-through quantity.

Will Bitcoin go up?

Bitcoin’s near-term outlook relies on whether or not patrons can maintain assist above $86,900 and problem the resistance cluster at $88,900. Continued consolidation favors volatility breakout situations.

If the bullish momentum strengthens together with enhancing inflows, BTC may retest $91,500 and prolong in the direction of $94,600. Nevertheless, failure to carry $86,900 dangers renewed stress on $86,000 and $84,000. For now, Bitcoin stays at a essential inflection level, the place convictions and confirmations will decide its subsequent massive transfer.

Associated: Shiba Inu Worth Prediction: Low SHIB Take a look at Vary Retains Sellers in Management

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.