- Bitcoin value is at the moment hovering round $107,700 and is struggling beneath the important thing EMA, with assist between $104,000 and $105,000 being monitored.

- BlackRock’s sell-off forward of the Fed assembly has weighed on sentiment, and repeated 300 BTC blocks are rising downward stress.

- Web outflows of $200 million won’t offset institutional promoting, leaving BTC weak except resistance at $112,000 is regained.

Bitcoin value is buying and selling round $107,700 at this time, beneath stress following repeated promoting from institutional desks. The transfer introduced consideration again to the $104,000 to $105,000 assist band because the market remained cautious of the Fed’s resolution.

BTC value pattern struggles beneath main EMA

BTC value motion reveals a transparent rejection from the 20-day and 50-day exponential transferring averages centered round $112,500 to $113,800. Value has fallen beneath the dotted uptrend line, retesting the broader demand zone of $107,000 to $105,000.

The 200-day EMA at $108,000 additionally grew to become a ceiling after failing to rebound. The Relative Power Index (RSI) is hovering round 39, confirming weak momentum and leaving draw back dangers if consumers are unable to maintain this zone.

As a consequence of this technical backdrop, Bitcoin value predictions proceed to lean towards a retest of the October lows except the bulls regain the $112,000 threshold.

BlackRock sale will increase stress

The information circulation sharply turned unfavorable when reviews surfaced that BlackRock had bought Bitcoin forward of the Fed assembly. Based on buying and selling information, corporations are unloading blocks of 300 BTC at common intervals, additional weighing on market sentiment.

Associated: Cardano Value Prediction: ADA faces vary stress as momentum cools

Such exercise has sparked debate over whether or not the promoting is said to rebalancing, liquidity wants, or makes an attempt to place stress on leveraged positions. Merchants argue that this explains why Bitcoin costs at this time had been unable to maintain above $110,000 regardless of a short lived bailout rebound.

For buyers, the selloff highlights why Bitcoin value volatility stays excessive within the lead-up to main macro occasions.

Forex outflows additionally can not offset promoting.

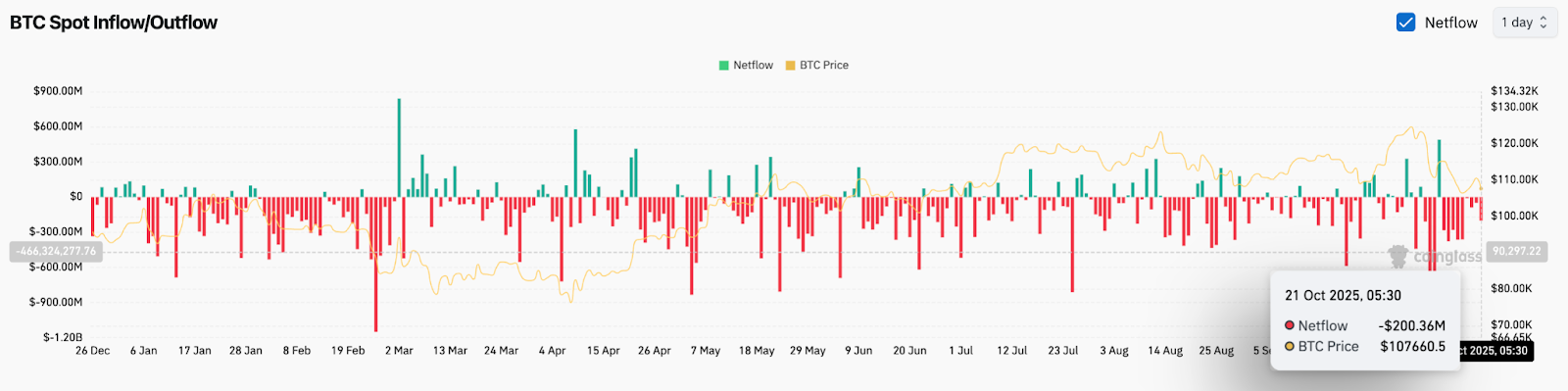

On-chain flows present one other piece of the puzzle. The BTC spot influx/outflow chart reveals internet outflows of over $200 million on October twenty first, with whole change flows remaining unfavorable over the previous month.

Usually, sustained outflows could be interpreted as accumulation, however sustained promoting by institutional buyers has masked these indicators. This divergence means that whereas some buyers are transferring cash off exchanges, the influence on the order e-book from large-scale liquidations is figuring out short-term actions.

Bitcoin value updates mirror this tug-of-war, with spot ranges locked between robust promoting stress and resilient however weakening assist.

Technical Outlook: Upward and Downward Situations

Within the brief time period, $104,000 to $105,000 is a must-hold zone. A decisive breakout would expose $100,000 and deeper assist at $92,000, which was final examined in early spring. RSI momentum is close to oversold ranges, warning of potential depletion, however the path of least resistance shall be decrease till consumers reclaim $112,000.

On the upside, a clear restoration above $113,800 would neutralize the bearish setup and pave the way in which again in direction of $120,000. The above cluster of EMAs stays the principle barrier that bulls want to beat to take care of a bullish Bitcoin value prediction.

Outlook: Will Bitcoin Rise?

For now, Bitcoin value updates point out a fragile equilibrium. The bears have the higher hand within the brief time period as institutional promoting and macro uncertainty dominate the narrative. If the $104,000 stage stays supported and inflows decide up once more after the Fed occasion, bulls nonetheless have an opportunity.

Associated: Chainlink Value Prediction: Are Fed Valuations and Oracle Power Sufficient to Cease the Drop?

A rebound above $113,800 may reset momentum and set off a broader restoration, however failure to defend present ranges is more likely to end in an additional decline in direction of $100,000 earlier than consumers can confidently intervene.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.