- BlackRock’s $1 billion Bitcoin sale additional deepened the bearish momentum under the important thing assist at $106,000.

- Open curiosity rising to $73 billion indicators confidence, however will increase liquidation danger.

- Heavy forex outflows recommend long-term accumulation regardless of short-term weak point.

Bitcoin stays below intense promoting stress because it didn’t maintain a key assist degree close to $106,000. The world’s largest cryptocurrency continues to development downward as institutional buyers intensify, with experiences that BlackRock offered about 9,000 BTC value about $1 billion earlier right now. This vital drop additional strengthened the bearish momentum that started after Bitcoin rejected its $126,000 peak earlier this month.

Market tendencies and know-how outlook

Bitcoin’s 4-hour chart reveals a constant formation of highs and lows, indicating a transparent downtrend. The asset is presently buying and selling under all main exponential transferring averages (20, 50, 100, 200), confirming bearish sentiment in each the brief and medium time period.

Speedy resistance lies between $110,000 and $113,000, coinciding with the 20 EMA and the 0.236 Fibonacci degree. If it can not regain this zone, the worth might strategy $102,000.

Moreover, the 0.382 to 0.5 Fibonacci vary between $113,000 and $116,000 is clustered with resistance from the upper EMA. A detailed above $118,000 would require 0.618 fib to point a sustained reversal. In the meantime, $105,927 stays an vital short-term assist. A decisive drop under this might speed up losses in the direction of $100,000.

Investor conduct and derivatives exercise

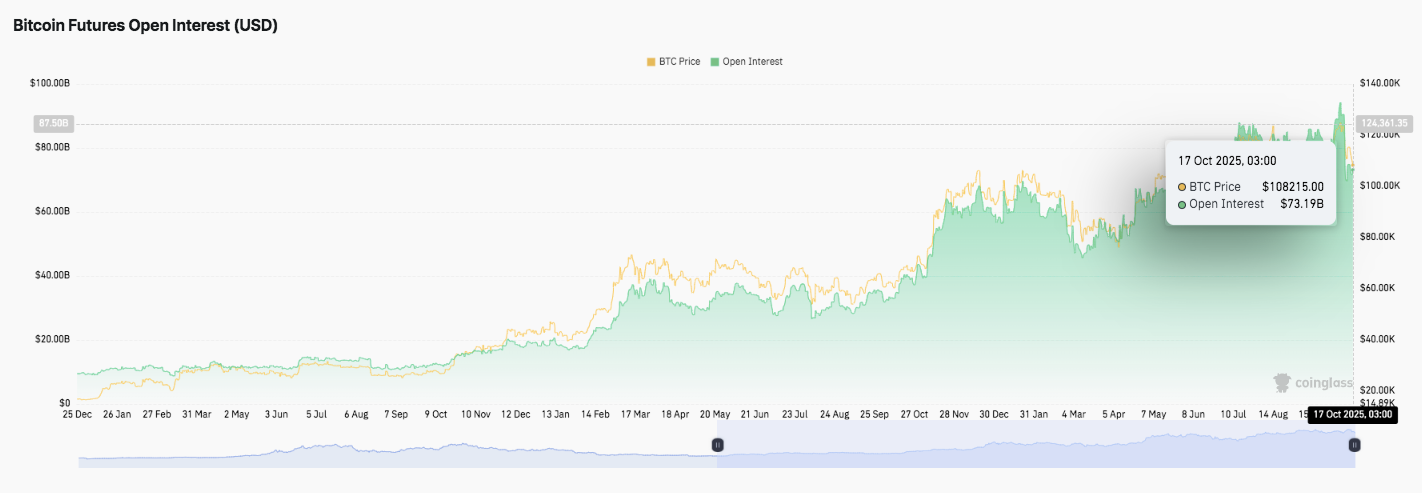

Regardless of the correction, market participation in Bitcoin futures stays sturdy. Open curiosity elevated steadily all through 2025, rising from lower than $20 billion in January to greater than $70 billion in mid-October.

As of October 17, whole open curiosity was $73.19 billion, reflecting elevated speculative exercise. This degree of leverage typically signifies confidence amongst merchants, but it surely additionally will increase liquidation danger if costs drop sharply.

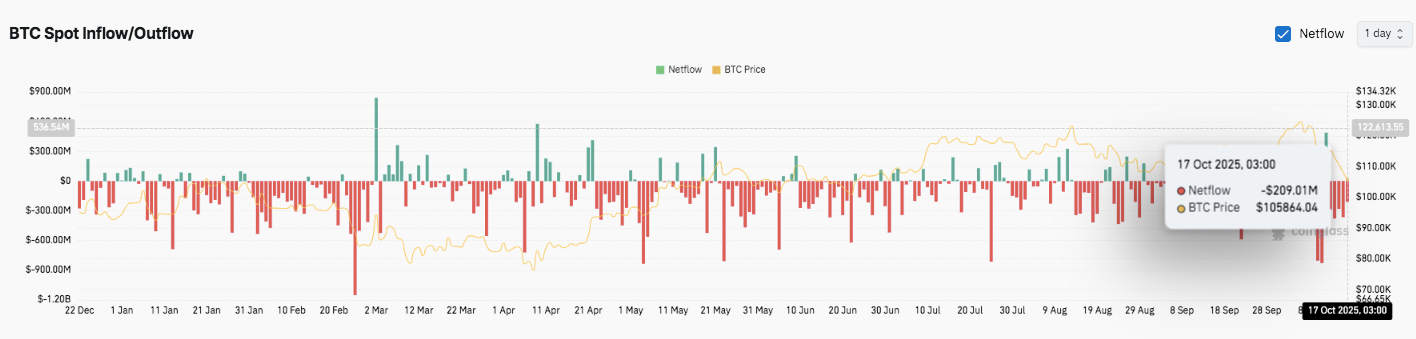

Foreign money flows point out long-term holding

In accordance with the trade’s influx/outflow graph knowledge, Bitcoin outflows have been dominant since February. Giant withdrawals in April, June, and early October recommend that many buyers choose self-custody over trade storage. On October seventeenth, an outflow of $209 million was recorded whereas the worth hovered round $105,864. This sample signifies long-term accumulation regardless of short-term value declines.

Technical outlook for Bitcoin value

Key ranges stay effectively outlined for late October.

- Prime degree: $110,700 (0.236 Fib), $113,700 (0.382 Fib), and $116,100 (0.5 Fib) are the closest resistance zones. A breakout above these can unfold within the following instructions: $118,500 and $121,900Right here, the Fibonacci retracement of 0.618 and 0.786 coincides with the long-term transferring common.

- Cheaper price degree: Help is at your fingertips $105,900adopted by $103,000 and $102,000marks the decrease sure of the current consolidation vary. A sustained break under $102,000 might set off an extra decline to $102,000. $100,000 psychological assist.

- Higher restrict of resistance: of 200EMA close to $115,300 This stays an vital degree for reaching a bullish reversal over the medium time period.

Technical settings recommend that Bitcoin is compressing inside a downward channel, indicating elevated volatility forward of the subsequent decisive transfer.

Will Bitcoin rebound or will the correction be prolonged?

Bitcoin value predictions for October rely on whether or not the bulls can defend the $105,900-$103,000 demand zone lengthy sufficient to reclaim the short-term EMA. A powerful shut above $111,000-113,000 might validate a short-term restoration with the subsequent goal at $118,500.

Nevertheless, a sustained rejection within the 20-50 EMA cluster will affirm the continuation of the bearish construction. Rising open curiosity and institutional promoting, together with BlackRock’s $1 billion liquidation, suggests extra volatility forward. For now, Bitcoin is at a important juncture the place it holds vital assist and will set off a pullback, however failure would reveal the subsequent draw back in the direction of $100,000.

Associated: Dogecoin value prediction: Musk’s tweet reignites hype, however resistance continues

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.