- Bitcoin is buying and selling round $113,700 after rejecting $124,000, with the $113,000 trendline help in focus.

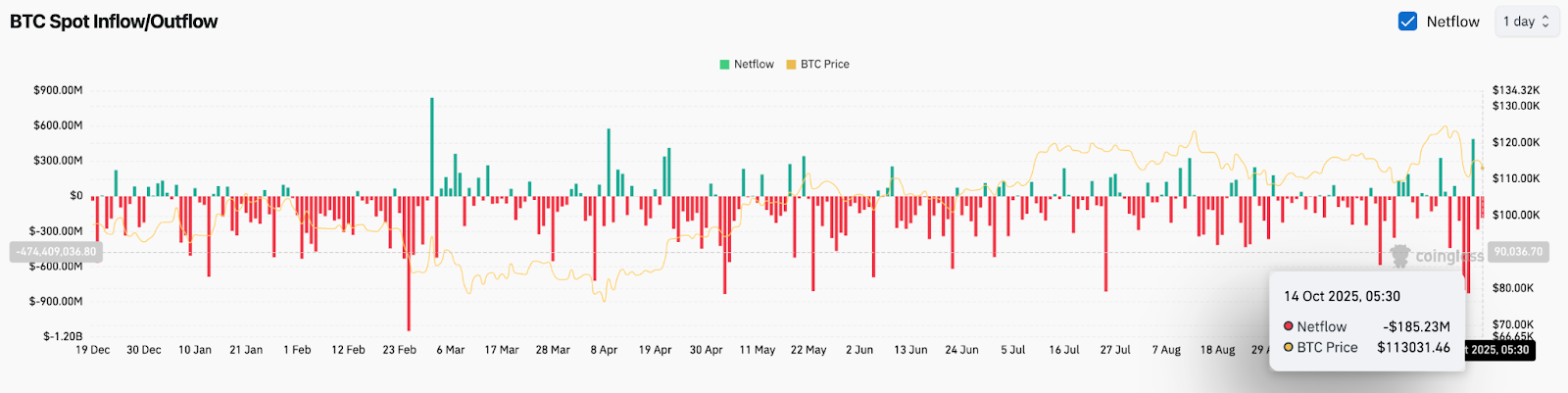

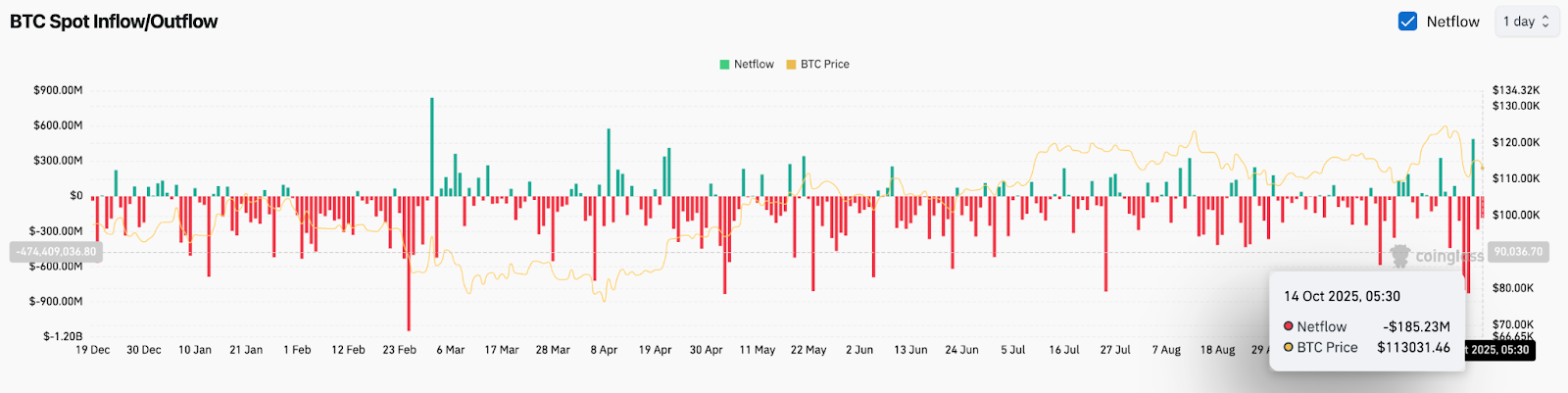

- On-chain flows present internet outflows of $185 million, indicating accumulation regardless of latest corrections.

- BlackRock CEO Larry Fink has known as Bitcoin a “reliable different asset,” reinforcing demand from institutional buyers.

Bitcoin value is buying and selling round $113,700 immediately, consolidating after a pointy drop from the $124,000 resistance zone. The decline is close to the $113,500 stage, coinciding with key trendline help that features the 100-day EMA and any main corrections since Could. The bulls now face the check of regaining momentum by reclaiming $116,500 earlier than deeper draw back ranges emerge.

Bitcoin value check subchannel help

On the each day chart, Bitcoin stays inside a broad ascending channel that has been in place since April. Value not too long ago rejected the $124,400 resistance space the place the supertrend turned bearish and triggered short-term profit-taking. The 20-day EMA is at $116,630, whereas the 50-day EMA is close to $115,600 and the 100-day EMA is at $113,560, at the moment appearing as clustered help ranges.

Momentum indicators spotlight cooling traits. The RSI has fallen in direction of 47, indicating impartial momentum after being overbought final week, whereas the MACD line stays flat beneath zero, suggesting much less shopping for stress. Proper now, the $113,500 to $113,000 vary is borderline. Holding this decrease sure would maintain the broader uptrend, however a breakout may push the 200-day EMA to $108,000.

On-chain flows present new accumulation

In keeping with spot buying and selling information from Coinglass, internet outflows on October 14 have been $185.23 million, indicating buyers are shifting cash off exchanges, a typical signal of accumulation. Regardless of the latest correction, sustained outflows replicate rising confidence amongst long-term holders.

Historic patterns present that as provide within the spot market tightens, a part of value stabilization is commonly preceded by comparable outflows. This dynamic may restrict draw back dangers, particularly as ETF-related purchases and company bonds proceed to soak up cyclical provide.

BlackRock CEO calls Bitcoin a ‘reliable different asset’

In a broadly watched interview on CBS’ 60 Minutes, BlackRock CEO Larry Fink known as Bitcoin “a reliable different asset like gold to diversify your portfolio.” Fink’s remarks mark a notable shift in tone, highlighting the evolving position of cryptocurrencies inside institutional methods.

“There’s a position for crypto, identical to there’s a position for gold. For these trying to diversify, this isn’t a nasty asset,” he stated. His feedback come as regular inflows into BlackRock’s Spot Bitcoin ETF proceed, reinforcing the notion that Bitcoin is a dependable retailer of worth amid international uncertainty.

Backing from the world’s largest asset supervisor may lend additional legitimacy to Bitcoin’s long-term story and counter any short-term technical weaknesses. Analysts recommend that such institutional validation may act as a ground for market sentiment in periods of volatility.

Outlook: Will Bitcoin Rise?

Bitcoin’s fast path depends upon sticking to the $113,000 ground. On-chain information reveals regular accumulation, and institutional investor sentiment is constructive following help from Larry Fink.

If the value holds above $113,000 and regains $116,500, analysts count on it to regain momentum in direction of $120,000 and $124,000. Nonetheless, dropping this zone may widen the correction to $108,000 earlier than new bids emerge. Total, Bitcoin is in a wholesome consolidation part inside a bigger bullish cycle, awaiting affirmation of the subsequent leg up.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.