- Bitcoin value is buying and selling round $102,436 at present after shedding its multi-month trendline and falling beneath all main EMAs.

- BlackRock recorded $131 million in ETF outflows, whereas an extra $25.5 million has left the change within the spot market, with indicators of distribution.

- If the every day shut is beneath $100,000, there’s a $98,500 potential, with deeper draw back danger in the direction of the $92,000 demand zone.

Bitcoin value at present is buying and selling close to $102,436 after falling beneath a multi-month trendline, placing rapid strain on consumers as value retests the important thing $100,000 to $98,500 assist band.

BlackRock leak will increase strain as spot streaming continues

Institutional traits have turned bearish once more. BlackRock clients withdrew $131 million from a Bitcoin ETF on Friday. The asset supervisor has skilled a sequence of outflows in latest trades, indicating a shift in urge for food for publicity as volatility rises.

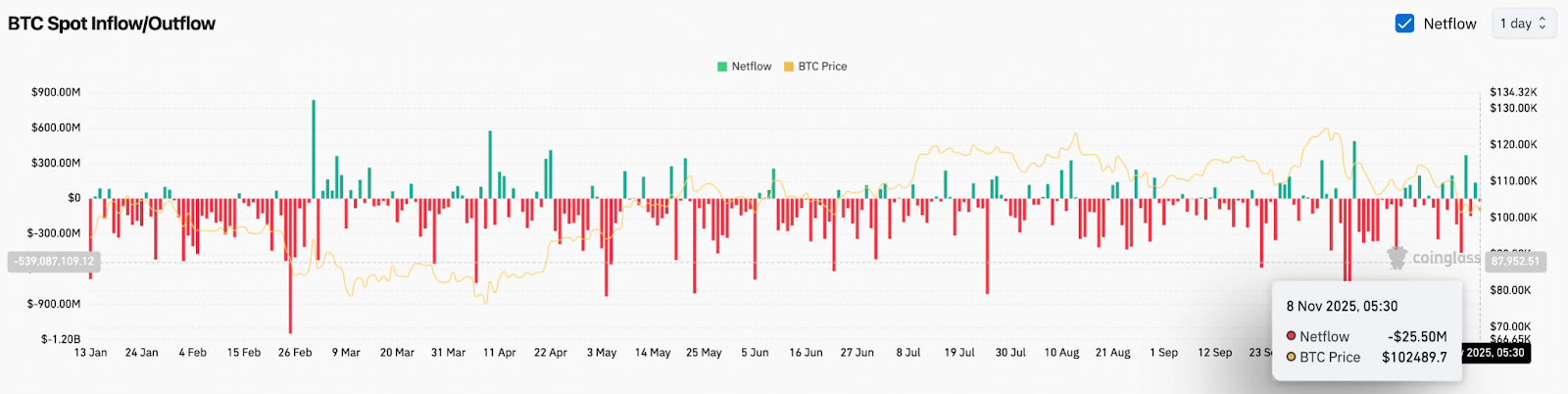

In the meantime, web spot outflows amounted to $25.5 million previously 24 hours, in response to Coinglass knowledge. Low costs and sustained outflows point out that offer is flowing into the market somewhat than being held or amassed. When redemptions of ETFs for institutional traders and spot inflows to exchanges happen on the similar time, the decline tends to extend.

Construction cautious as a consequence of development line breakdown

Bitcoin has damaged beneath the uptrend line that began in April. This trendline acted as multi-month assist, resulting in greater lows and reinforcing the bullish construction. As soon as costs fell beneath that stage, the character of the market modified. Sellers at the moment are defending the restoration try somewhat than being compelled to chase the upside breakout.

At the moment, the value is beneath the 20-day, 50-day, 100-day, and 200-day EMA. These transferring averages type a stacked resistance zone between $107,565 and $111,413. The supertrend indicator stays crimson, including additional draw back strain.

Foremost resistance ranges:

- Preliminary resistance: $107,565 (20-day EMA)

- Structural resistance: $111,413 (100-day EMA)

- Major restrict: $116,289 (the place the earlier denial was shaped)

Now helps zones:

- On the spot assist: $100,000 to $98,500

- Key demand zone: $92,000, beforehand aggressively populated by consumers.

A lack of $100,000 on the every day closing value would verify a full retest of the $98,500 liquidity shelf. Deeper assist close to $92,000 stays the final defensive zone earlier than the market is vulnerable to a broader correction.

Brief-term value compression suggests a choice is imminent

The intraday chart reveals that Bitcoin is forming a value squeeze. Downward resistance from November’s highs intersects with an ascending base forming round $99,000. This construction reveals that the excessive is being compressed right into a flat assist line. It is a typical continuation setup and normally resolves within the path of prevailing momentum.

On decrease time frames:

- VWAP acts as a dynamic resistance

- Value continues to fail at intraday downtrend line

The vendor retains management except the value stays above $102,988. Patrons are coming in for almost $99,000. Nonetheless, the rebound has no follow-through. This means demand on the base, however consumers lack the arrogance to problem the overhead resistance.

The longer the value stays beneath VWAP and the intraday downtrend line, the extra doubtless it’s that assist will ultimately break.

Will Bitcoin go up?

Bitcoin is in a choice section. A breakdown beneath trendline assist and an acceleration of outflows point out that sellers stay energetic. ETF outflows from BlackRock verify that distributions are coming from institutional traders somewhat than particular person merchants.

- Bullish case: Bitcoin defends $100,000 and breaks above $107,565 earlier than rising quantity and clearing $111,413. This variation turns the corrective construction into restoration, paving the way in which for $124,000.

- Bearish case: A every day shut beneath $100,000 exposes the subsequent main demand zone at $98,500 after which $92,000.

Associated: With STRE’s technique to boost its providing to $715 million, what’s subsequent for Bitcoin value?

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.