- Bitcoin traded in a variety, rebounding from $88,000, however its momentum is proscribed.

- Futures open curiosity has been steadily rising, indicating leverage management and dealer engagement.

- Whereas spot flows stay unfavorable, company holdings verify earlier Bitcoin accumulations.

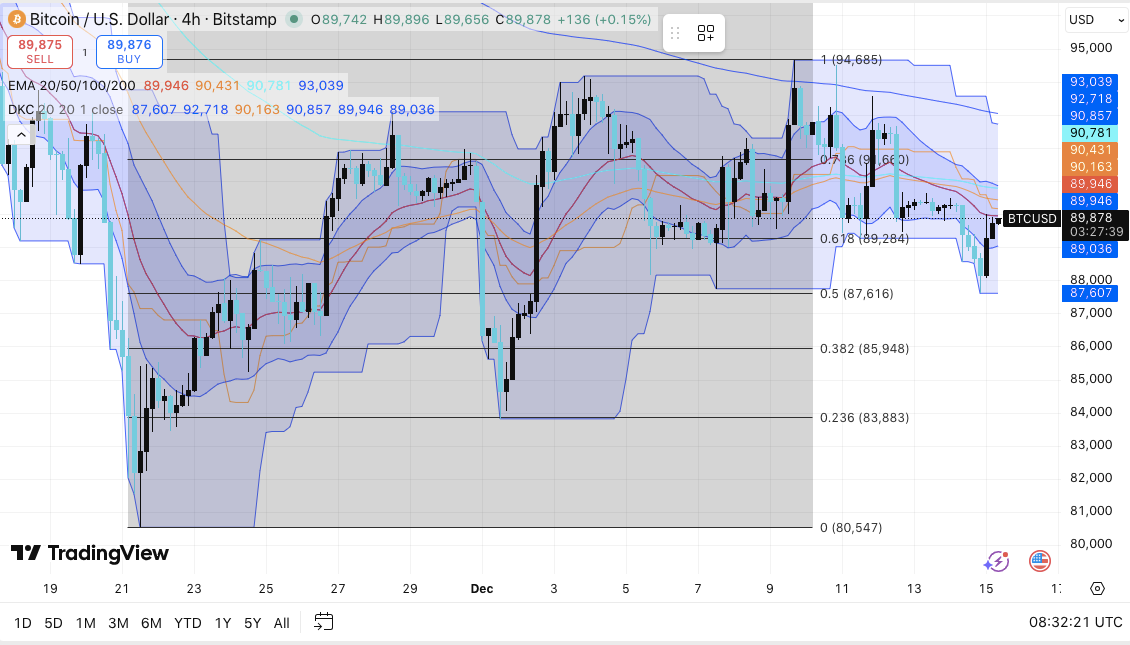

Bitcoin hovered round $89,800 over the previous 4 buying and selling hours as merchants assessed vary circumstances and new company indicators. The restoration occurred after falling beneath $88,000, with consumers absorbing liquidity and rebalancing the value. Nonetheless, the broader construction nonetheless exhibits consolidation relatively than pattern growth. Consequently, market individuals proceed to look to established ranges and by-product exercise for directional cues.

Vary construction defines short-term route

On the 4-hour chart, Bitcoin continues to commerce inside a large horizontal vary. Costs rebounded as liquidity fell beneath $88,000, indicating power in near-term demand.

Nonetheless, the rally stalled beneath the downtrend line and mid-price resistance. Due to this fact, the momentum has not shifted to the impulsive stage.

Speedy assist lies between $89,000 and $89,300, which presently acts as a steadiness zone. Under that, the $87,600 stage matches the 0.5 Fibonacci retracement and locks within the vary construction. A lack of this stage would weaken the setup after which expose $85,950. Moreover, $83,880 stays a significant draw back line of protection for bulls.

Associated: Solana Worth Prediction: SOL trades in a good vary as merchants reassess danger

Resistance stays above the present value. The $90,400 to $90,800 area hosts a good EMA cluster that limits the rally. Moreover, the $92,700 stage is the excessive of the vary and marks the earlier rejection zone. If the four-hour shut above this space continues, the main focus will shift to the $94,600 provide zone.

Derivatives information exhibits engagement, not extra

Bitcoin futures open curiosity continues to pattern upward over time, reflecting deepening participation in derivatives. The preliminary stage exhibits sluggish development as costs rise, indicating managed use of leverage. As soon as Bitcoin entered excessive value territory, open curiosity expanded quicker, confirming a brand new positioning relatively than a mass exit.

Through the correction section, open curiosity briefly decreased, however this coincided with a leverage flash relatively than a pattern breakdown. Just lately, open curiosity has held above $60 billion and the value has stabilized round $88,000.

Consequently, merchants seem engaged however not overly aggressive. Rising open curiosity with out sharp declines suggests balanced publicity and rising market maturity.

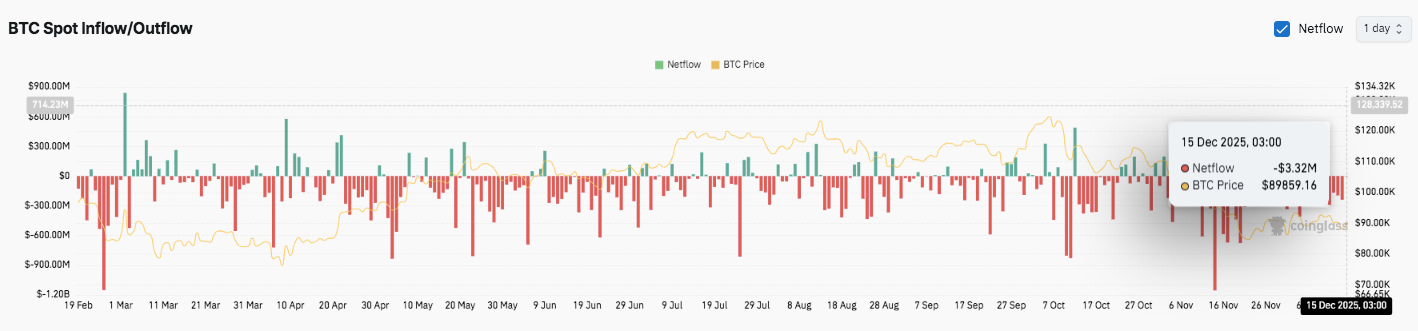

Spot flows and company indicators add distinction

Spot circulate information exhibits a extra cautious image. Internet overseas alternate flows stay principally unfavorable, with outflows persevering with to exceed inflows. This short-term surge in inflows is unsustainable, indicating that assured shopping for is proscribed. Due to this fact, merchants look like managing danger round resistance relatively than accumulating massive quantities of danger.

Associated: Cardano Worth Prediction: ADA Stays Supported With out Clear Bullish Conviction

Moreover, company exercise got here again into focus after Technique Chairman Michael Saylor shared an replace on Bitcoin accumulation monitoring. Market individuals broadly settle for indicators comparable to affirmation of buy completion. Technique presently holds roughly 660,000 Bitcoins value roughly $59 billion, with a mean price of roughly $74,700.

Technical outlook for Bitcoin value

The important thing ranges stay well-defined as Bitcoin trades inside a variety heading into the approaching classes.

Upside ranges are positioned at $90,400 to $90,800 as the primary resistance cluster, adopted by a spread excessive at $92,700. If a breakout above $92,700 is confirmed, the transfer might lengthen in the direction of the $94,600 to $94,700 provide zone.

On the draw back, $89,000 to $89,300 acts as fast balancing assist. Under that, $87,600 stays a key stage to guard, with additional decline doubtlessly exposing $85,950 and $83,880.

The technical construction means that Bitcoin is compressing inside a spread, indicating the potential of extra volatility. Momentum indicators stay impartial, reflecting declining confidence on each side.

Will Bitcoin go up?

The outlook for Bitcoin value relies on whether or not consumers are capable of maintain on to $87,600 and get better $92,700. If the power above resistance persists, bullish momentum might resume in the direction of the prime quality.

Nonetheless, failure to defend $87,600 dangers a deeper decline to the decrease assist zone. For now, Bitcoin stays at an vital inflection level, and the route will doubtless be decided by the following vary break.

Associated: Shiba Inu Worth Prediction: SHIB slides into channel each time Bounce sells

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.