- Bitcoin is buying and selling above the main EMA, indicating a powerful short-term pattern and purchaser management.

- Consolidation close to the $94,000 midband suggests an exit earlier than a attainable continuation of the rally.

- Open curiosity and spot flows point out managed leverage and selective push shopping for.

Bitcoin prolonged its short-term rally on the 4-hour chart as the value stabilized close to current highs. This transfer got here after a decisive breakout of the $90,000-$91,000 threshold, resetting market expectations.

Merchants are actually assessing whether or not the decline alerts a continuation or a pause earlier than the subsequent financial growth. Present value tendencies recommend that consumers are nonetheless in management, regardless that volatility stays excessive. In consequence, consideration has shifted to key expertise ranges and placement information for verification.

Power of short-term structural alerts

Bitcoin continues to commerce above the four-hourly 20, 50, 100, and 200 exponential transferring averages. This association displays a powerful pattern construction and sustained upside management.

Moreover, the earlier downtrend resistance trendline is performing as help and reinforcing our bullish conviction. Value compression beneath current highs signifies digestion quite than depletion. Subsequently, merchants interpret this construction as constructive whereas momentum cools.

Bollinger bands clearly spotlight this motion. Value not too long ago broke above the higher band, confirming constructive momentum through the breakout section. Moreover, the band stays broadly prolonged, reflecting elevated volatility following the rally.

In trending markets, present consolidation close to the higher band typically precedes a continuation. The mid-band round $94,000 acts as the primary dynamic help.

Resistance stays outlined between $97,800 and $98,600, which sellers have been defending up to now. A clear transfer above $98,600 would open up the psychological $100,000 zone. Subsequently, merchants see this area as triggering new momentum.

Associated: Cardano Value Prediction: ADA Stays Bullish Construction Regardless of Decrease Leverage…

On the draw back, rapid help lies round $95,000, coinciding with the confluence of the Fibonacci and EMA. A deeper decline may check $92,800, indicating a stronger help cluster. The $91,000 space continues to be the bottom for the broader vary.

Including context with derivatives and spot flows

Open curiosity tendencies help a more healthy market construction. Open curiosity has grown together with the value and now stands at practically $66 billion. Importantly, it has moderated quite than aggressively rallied through the current pullback. This sample suggests an unwinding of the place quite than a short-term accumulation of the place. Subsequently, leverage seems to be underneath management regardless that costs are rising.

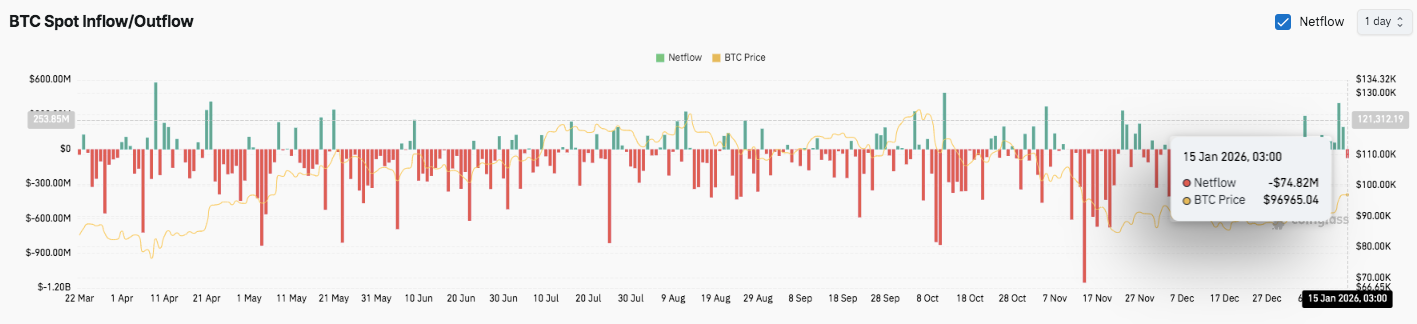

Spot circulation information provides one other layer. Outflows dominate broader tendencies, indicating distribution or cautious positioning. Nevertheless, speedy inflows happen throughout short-term rebounds, indicating selective market shopping for.

The current sluggish outflow of practically $75 million signifies restraint quite than panic. Importantly, this steadiness helps integration quite than reversal.

Bitcoin (BTC) technical outlook

Key ranges stay well-defined as Bitcoin trades in a short-term consolidation close to current highs.

The upside stage consists of rapid hurdles at $97,800 and $98,600. If a breakout above $98,600 is confirmed, a transfer in direction of the $100,000 psychological zone may lengthen.

On the draw back, $95,000 serves as the primary help, adopted by the confluence of the Fibonacci and EMA at $92,800. The $91,000 stage stays the bottom and pattern help for the broad vary.

Trying on the technical scenario, we will see that BTC is consolidating after an impulsive breakout and the Bollinger Bands are nonetheless widening. This construction favors continuation over reversal.

Will Bitcoin go up?

The short-term bias hinges on whether or not consumers defend $95,000. Holding this zone maintains upside strain. Failure to carry $92,800 may set off a deeper imply reversion. For now, Bitcoin stays in an necessary consolidation zone, which may result in extra volatility sooner or later.

Associated: Horizen Value Prediction: ZEN Value Agency After Breakout as Momentum Stays Bullish

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.