- The short-term pattern of BTC continues to be bearish because the excessive value continues to fall close to the crucial degree.

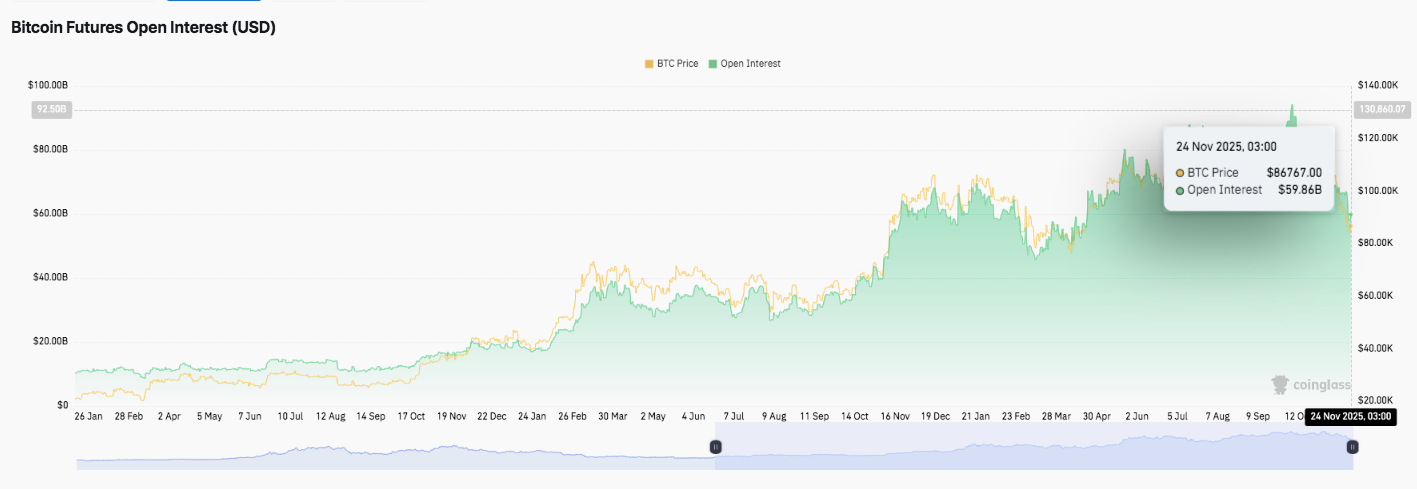

- Futures knowledge exhibits open curiosity is cooling as merchants unleverage amid the weak spot.

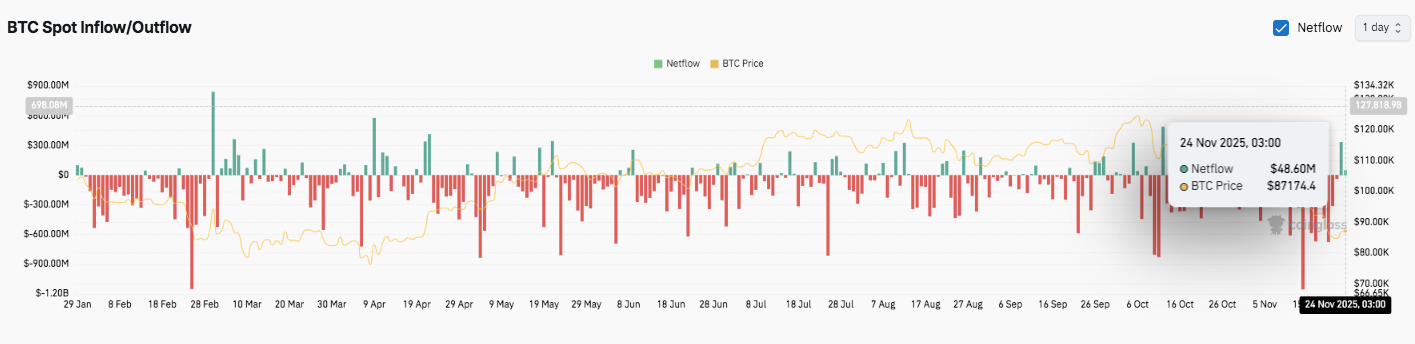

- Spot inflows counsel easing of promoting strain, however sentiment stays cautious close to assist.

Bitcoin continues to commerce beneath vital technical strain because the 4-hour construction exhibits sustained weak spot throughout pattern indicators. The asset has underperformed short-term risky benchmarks and continues to hover on the decrease facet of the Donchian Channel.

This surroundings exhibits the market struggling to take care of momentum after repeated makes an attempt to regain misplaced floor. Moreover, latest value actions have been taking part in out inside a compressed vary, including additional stress on shorter time frames. Consequently, merchants are conserving an in depth eye on key ranges because the downtrend stays sturdy.

Brief-term pattern stays downward

Bitcoin’s sample of falling highs and falling lows remained in place till November. All makes an attempt to maneuver larger into the mid-price vary of the channel failed, indicating regular promoting curiosity. Moreover, the latest pullback from the $84,000-$85,000 zone offered momentary reduction, however the broader construction remained unchanged.

The slope of the Donchian band continued to say no, however the short-term EMA restricted any restoration makes an attempt over the previous two weeks. Due to this fact, market individuals think about $86,000 to be a key pivot. An in depth above that degree might counsel early energy. Nonetheless, a transparent pattern change would require the value to interrupt above $88,183 and maintain that degree.

Help from $86,418 to $86,000 stays essential. A failure there would expose decrease clusters round $85,029, $84,310, and $80,537. These ranges fashioned the strongest cushion in the course of the latest decline.

Futures Market Exhibits Reducing Leverage

Bitcoin futures markets are additionally reflecting altering developments. Open curiosity grew steadily all year long, reaching over $90 billion in the course of the large rally. This progress exhibits aggressive positioning from either side of the market. Nonetheless, the newest readings on November 24 confirmed that open curiosity had fallen to $59.86 billion as the value retreated in direction of $86,767.

Associated: Ethereum Value Prediction: Can Patrons Break Resistance and Lastly Reverse Downtrend?

Moreover, the decline means that merchants have decreased leverage after months of hypothesis. This correction additionally coincides with decrease volatility over a number of classes.

Spot flows point out easing of promoting strain

Spot flows continued to indicate a dominant outflow pattern all year long, confirming continued distribution from massive holders. Vital crimson durations in February, April, and October coincide with notable value declines.

Nonetheless, latest exercise has modified considerably. Bitcoin traded at a value near $87,000 on November twenty fourth, with web inflows of $48.6 million. Furthermore, whereas the rebound signifies a waning of promoting strain, it’s not sufficient to point a change in broader sentiment.

Technical outlook for Bitcoin value

Whereas the market is present process a chronic correction, Bitcoin’s technical construction stays well-defined. Merchants are keeping track of the interplay between trendline resistance and the decrease band of the Donchian Channel, with key ranges framing the near-term outlook.

Prime degree: Quick hurdles are $86,561 (EMA 9), $88,082, and $88,183. A break above this cluster might strengthen momentum and pave the best way for $90,450 and $92,300.

Cheaper price degree: $86,418 and $86,000 stay the primary assist zones. Under this space, key ranges are $85,029 and $84,310, adopted by deeper assist at $80,537.

Essential resistance higher restrict: The higher facet of the Donchian band close to $88,183 stays a key degree for a reversal for a sustained bullish try. Recovering this threshold signifies pattern exhaustion and permits value to interrupt out of a multi-week downtrend.

The broader construction exhibits Bitcoin compressing inside a descending channel, with every rebound establishing decrease highs. This sample displays a decline in momentum and decreased volatility, and is commonly arrange upfront of a stronger directional break.

Can Bitcoin flip round from right here?

Bitcoin’s trajectory now is determined by how lengthy consumers can defend the $86,000 area whereas trying to get well the EMA 9. If this degree stays secure, the value might nonetheless problem an important short-term pivot, the $88,082-$88,183 band.

Technical compression and declining futures open curiosity counsel the market is bracing for extra volatility. If inflows strengthen and the value rises above the highest of the Donchian band, Bitcoin might re-challenge the $90,450 and $92,300 ranges.

Associated: Hedera Value Prediction: Bulls Maintain Help However Face Technical Resistance

Nonetheless, failure to defend the $86,000 zone dangers the value reverting to a deeper assist pocket between $85,029 and $84,310. A breakdown there would reveal the broader $80,537 space, which stays the strongest structural assist on the chart.

For now, Bitcoin is in a decisive zone. Restoration efforts are persevering with, however no affirmation has but been made. A decisive transfer above $88,183 and subsequent larger lows will decide whether or not the following leg helps bullish continuation or one other leg to the draw back.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.