- Bitcoin has consolidated round $101,000, going through resistance beneath the key EMA and the October excessive.

- BTC futures open curiosity reached $68.82 billion, suggesting elevated exercise from leveraged buyers.

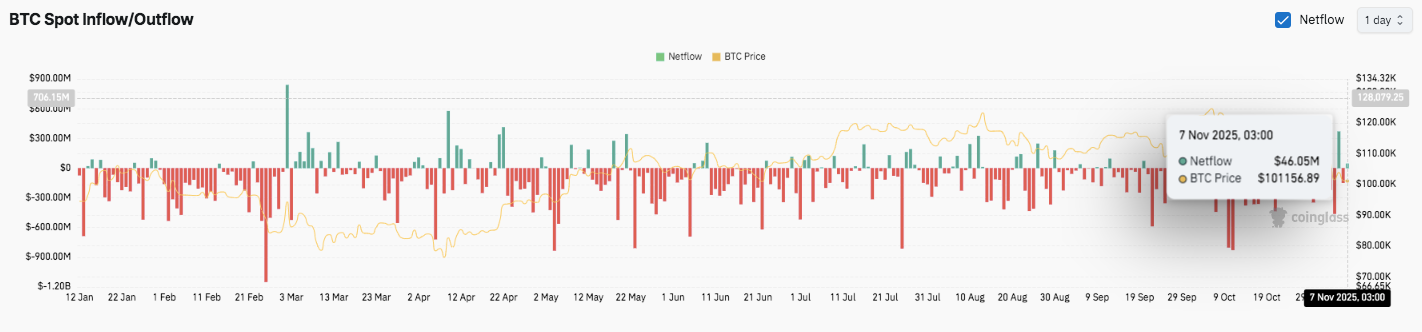

- Forex outflows proceed, indicating long-term holding regardless of non permanent inflow-driven beneficial properties.

Bitcoin (BTC) has struggled to regain momentum after pulling again from October highs and is buying and selling round $101,358. Value stays underneath promoting strain and stays beneath the key exponential shifting averages (20, 50, 100, 200-EMA). This setup signifies continued short-term weak spot regardless of the non permanent rebound seen earlier within the week.

Value integration and know-how degree

Bitcoin continues to carry regular within the $99,000 to $105,000 vary, displaying restricted volatility after the current selloff. Speedy assist lies at $98,953, a key degree the place patrons have beforehand intervened to gradual losses. Under this, if momentum picks up, the worth might fall in the direction of $97,500 and even $95,000.

On the upside, resistance seems close to $103,177, which coincides with the 50-EMA, adopted by the 23.6% Fibonacci retracement at $105,399. A return to those ranges would strengthen purchaser confidence and sign a near-term reversal.

Medium-term resistance lies close to $109,386, the place Bitcoin confronted repeated rejections in late October. Above that, a broader resistance zone from $112,609 to $115,832 offers a 50% to 61.8% retracement vary, an space that would outline the medium-term path.

Futures and market participation

Open curiosity in Bitcoin futures has skyrocketed all through 2025, suggesting elevated investor participation. After a number of months of vary buying and selling early this yr, open curiosity started to rise sharply in late March.

By November 7, that quantity had reached $68.82 billion, one of many highest ranges of the yr, reflecting elevated leveraged exercise. This enlargement usually signifies intensified speculative positioning upfront of huge value actions.

Moreover, the rise in open curiosity coincides with Bitcoin stabilizing above the $100,000 threshold. This means that merchants are anticipating short-term volatility, probably pushed by macroeconomic cues and institutional accumulation.

Trade price flows and investor psychology

Trade movement information reveals a shift in the direction of long-term holding conduct. All through 2025, Bitcoin has constantly flown from exchanges, suggesting that buyers most well-liked storage over short-term gross sales. Occasional spikes in inflows, corresponding to in March and Might, mirrored short-term profit-taking fairly than sustained distributions.

Just lately, internet inflows reached $46.05 million as BTC hovered round $101,156. This means that new buying exercise is going on regardless of market uncertainty. Consequently, the mix of excessive ranges of open curiosity and secure capital inflows suggests a change in institutional positioning previous to a possible enlargement section.

Technical outlook for Bitcoin value

Key ranges stay nicely outlined as Bitcoin trades beneath main shifting averages, suggesting cautious market sentiment heading into mid-November.

- Prime degree: $103,177 and $105,399 function quick hurdles and are in keeping with the 50-EMA and 23.6% Fibonacci retracement zone. A break above these ranges might prolong the rally in the direction of stronger resistance at $109,386 and $112,609.

- Cheaper price degree: The closest assist is at $98,953, adopted by deeper draw back targets at $97,500 and $95,000. A break beneath $98,953 might create additional promoting strain and take a look at the following demand zone.

- Higher restrict of resistance: The 200-EMA close to $110,291 stands as a key threshold for a flip to medium-term bullish momentum.

Technical circumstances present that BTC is consolidating inside a broad vary between $99,000 and $105,000, reflecting a balanced market between patrons and sellers. This construction means that volatility might enhance as soon as the worth exits this vary.

Will Bitcoin regain momentum?

Bitcoin’s near-term outlook will depend on whether or not the bulls can defend the $99,000 assist and break via the $105,000 barrier. A sustained transfer above $109,386 would affirm new power and pave the way in which for $112,000-$115,000. Nonetheless, shedding the $98,953 ground might expose BTC to $95,000, the place a stronger accumulation base might type.

Presently, Bitcoin continues to be within the pivotal zone. Momentum indicators are displaying a decline in promoting strain, however no assured shopping for has emerged. Market members are ready for affirmation from value actions and capital inflows, which is able to decide whether or not the following large transfer is in the direction of restoration or additional draw back.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.