- Regardless of continued ETF outflows, BTC continues to defend its $84,000 to $85,000 demand zone.

- Costs stay constrained beneath the 20-day and 50-day EMAs, preserving the structural correction.

- Company accumulation offers long-term assist, however weak spot flows hinder breakout makes an attempt.

Bitcoin worth at this time is buying and selling close to $87,400, hovering above short-term assist as patrons try to stabilize the worth inside a growing upward base. The market stays caught between defensive spot flows and strong structural demand, with costs remaining compressed in direction of a remaining deal in 2025.

ETF outflows proceed, placing strain on spot demand

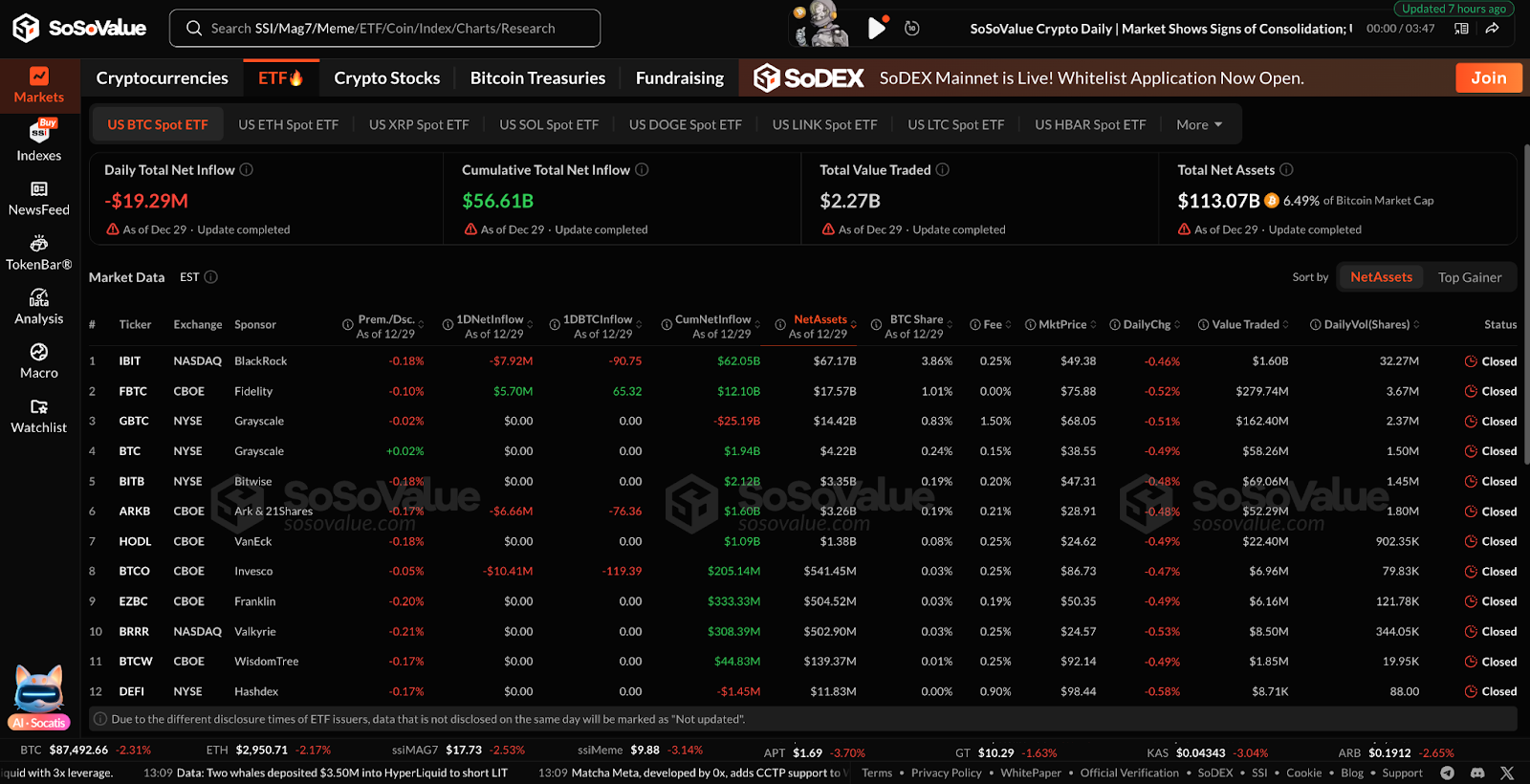

The US Spot Bitcoin ETF recorded internet outflows of $19.3 million on December twenty ninth, and institutional traders turned cautious of their positions. The entire transaction worth was $2.27 billion, reflecting robust exercise, however with restricted confidence on the client aspect.

BlackRock’s IBIT led redemptions with $7.9 million in each day outflows, whereas Constancy’s FBTC was the one massive fund to file small inflows. Though cumulative internet inflows stay robust at $56.6 billion, short-term traits point out that funds are lowering exposures relatively than aggressively including at present ranges.

Keep construction that exceeds main demand zones

On the each day chart, Bitcoin continues to carry the rising assist pattern line drawn from the mid-November lows. Costs have repeatedly rebounded from the $84,000 to $85,000 demand zone, indicating patrons’ willingness to guard worth.

Associated: Midnight Value Prediction: NIGHT Stays Bullish Construction As Cardano Imaginative and prescient Expands

Nevertheless, the restoration stays subdued below the EMA cluster. The 20-day EMA close to $88,200 and the 50-day EMA close to $91,900 each supply overhead resistance. The 100-day EMA close to $97,500 and the 200-day EMA close to $100,800 outline a wider ceiling that the bulls have to regain to vary pattern management.

The construction stays corrective relatively than pattern resuming till worth closes above the 20-day EMA on follow-through.

Brief-term charts mirror compression

Decrease time frames emphasize elevated compression. On the three-hour chart, Bitcoin is buying and selling close to the center of the Bollinger Bands, displaying the steadiness after the November selloff. Volatility is reducing, which frequently portends directional enlargement.

The higher Bollinger band close to $89,300 continues to disclaim any upside, whereas the decrease band close to $86,300 offers short-term assist. This narrowing of the vary exhibits indecision, with neither group capable of power a decisive breakthrough.

Chaikin cash flows stay barely detrimental, confirming that capital inflows haven’t but returned to a significant stage. With out new spot demand, any makes an attempt at upside danger fading away as resistance approaches.

Company accumulation offers structural assist

One stabilizing issue comes from company accumulation. Technique revealed final week that it bought 1,229 BTC for $108.8 million, rising its whole holdings to 672,497 BTC. The corporate is at the moment accumulating Bitcoin over 41 weeks in 2025, making it probably the most aggressive shopping for 12 months in historical past.

Regardless of this, the market’s response has been sluggish. Technique shares ended the 12 months down about 47%, highlighting the rising disconnect between company accumulation and inventory market confidence. Lengthy-term demand stays, however has not but led to sustained upward strain on spot Bitcoin.

This dynamic reinforces the concept accumulation alone is just not sufficient. Supportive flows and improved technical acceptance are nonetheless required for costs to rise.

Outlook: Will Bitcoin Rise?

Bitcoin is consolidating with out collapsing, however the upside continues to be being held again by weak spot flows.

- Bullish case: The worth holds above $86,000 and regains $91,900 on robust quantity. This transfer brings momentum again to $97,500 and reopens the trail to $100,000.

- Bearish case: A detailed of the day beneath $84,000 will break the rising assist and ensure a deeper correction in direction of $80,000.

Associated: Dogecoin Value Prediction: Downward Channel Tight for DOGE Beneath $0.14

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.