- Bitcoin stays in a fragile vary as a bearish EMA collides with indicators of sluggish accumulation.

- Tightening volatility suggests growth, whereas a heavy resistance cluster caps the upside.

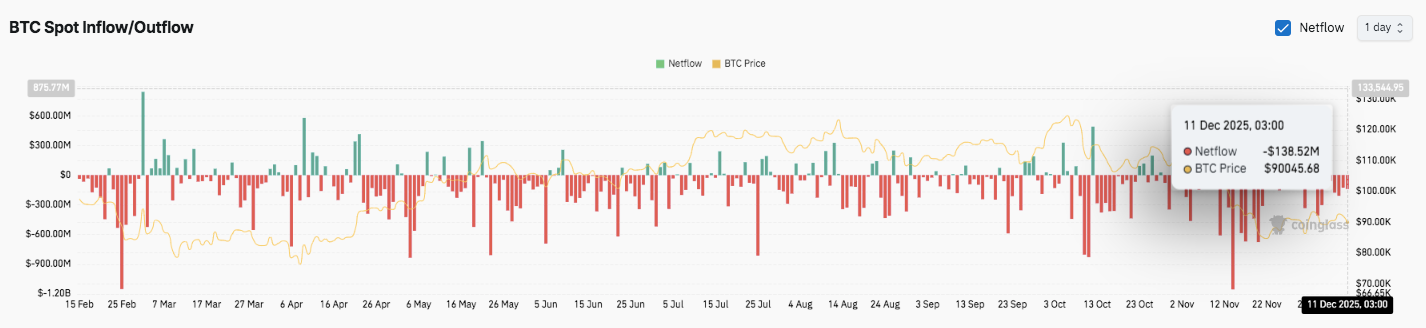

- In blended flows, leverage is rising however spot demand is weak, limiting robust momentum.

Bitcoin traded close to $90,050 as buying and selling situations remained fragile after current Federal Reserve selections introduced new uncertainty to danger markets. The coin remained inside a compressed vary on the 4H chart and failed to interrupt out of short-term resistance a number of instances, inflicting hesitation amongst merchants.

Moreover, the broader construction remained bearishly tilted as value continued to commerce beneath the descending 200-EMA. Nevertheless, it has fashioned additional lows in current buying and selling, suggesting gradual accumulation regardless of cautious sentiment. Markets additionally reacted to broader macro components, with rate of interest expectations shifting once more, weighing on urge for food for speculative property.

Key ranges form short-term path

Bitcoin confronted robust resistance at $91,296, with repeated rejections highlighting the energy of the sellers. Moreover, provide stays excessive between $92,630 and $93,795, with the EMA cluster aligning with the higher Donchian band. A clear transition by way of this zone would point out an enchancment in near-term momentum.

Associated: NIGHT Value Prediction 2025-2030

Furthermore, merchants continued to trace the $94,251 Fibonacci degree because the bullish shift might strengthen if the worth closes above the $94,251 Fibonacci degree. Increased targets close to $98,491 and $102,730 stay related provided that demand returns strongly.

Help remained concentrated at $89,006 and the $88,419-$89,419 vary. Consumers defended the sector throughout earlier pullbacks.

Nevertheless, beneath that, the worth might head in the direction of the broader $85,000 space the place November’s low quantity node was situated. Market situations stay tight as volatility narrows, suggesting an expansionary section is constructing.

Futures and spot flows present blended tone

Open curiosity continued to extend all year long, reaching $58.81 billion on December eleventh. This quantity reveals constant progress in leverage. The height of greater than $70 billion earlier this 12 months displays better optimism. Nevertheless, current volatility has diminished positioning as merchants diminished publicity whereas ready for readability.

Spot movement advised a unique story. Most classes had been dominated by outflows, with robust promoting. Internet outflows of greater than $300 million occurred in a matter of days. Inflows look like small and rare, indicating that purchaser confidence is weakening. The most recent readings confirmed that $138 million was misplaced whereas Bitcoin hovered round $90,000.

Associated: Cardano Value Prediction: Consumers lose pattern help as a consequence of capital outflows…

Macro stress limits climb makes an attempt

The Fed reduce charges by 25 foundation factors however signaled a cautious path into 2026. Because of this, the market priced within the extent of rate of interest cuts, placing stress on danger sentiment. Bitcoin briefly fell beneath $90,000 as Oracle’s weak monetary outcomes added stress. Because of this, momentum remained sluggish as merchants saved a watch on key resistance ranges for indicators of restoration.

Technical outlook for Bitcoin value

As Bitcoin strikes by way of December’s tightening vary, key ranges stay clearly outlined.

- Prime degree: The primary rapid hurdle is $91,296, adopted by a provide group between $92,630 and $93,795. A breakout above this band might prolong to $94,251 and $98,491.

- Lower cost degree: $89,006 acts as the main intraday help, adopted by the Donchian low band zone from $88,419 to $89,419. A deeper breach would expose a wider $85,000 structural shelf.

- Higher restrict of resistance: $94,251 (Fib 0.382) stays the vital degree that should flip into medium-term bullish momentum. If this may be cleared up, clear adjustments out there construction will develop into obvious.

Technical situations counsel that Bitcoin is compressing inside a slender vary beneath the 200-EMA, and contraction in volatility usually precedes growth in a stronger path. This sample displays greater bass that meets static resistance, forming a breakout setup that may resolve abruptly in both path.

Will Bitcoin rise additional?

Bitcoin’s subsequent transfer will rely on whether or not patrons can defend $89,006 lengthy sufficient to set off a retest of the $92,630-$93,795 cluster. Moreover, stronger inflows and sustained open curiosity might speed up the push to $94,251, whereas a bullish breakout might liberate targets at $98,491 and $102,730.

Nevertheless, if it fails to carry $89,006, it dangers reverting again to the $88,400 space. A breakdown would weaken the construction and reopen the trail to broader help at $85,000.

For now, BTC stays within the vital zone. Volatility compression, macro uncertainty and blended flows form the short-term story. Merchants are ready for affirmation of both a whole break of resistance or a definitive lack of help earlier than the following massive transfer unfolds.

Associated: Solana Value Prediction: SOL maintains corrective construction…

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.