- Bitcoin holds help at $109,000, displaying resilience amid continued market volatility.

- A rise in open curiosity suggests rising confidence and bullish positioning amongst institutional buyers.

- Robust inflows in October point out the potential of renewed accumulation and restoration momentum.

Bitcoin continued to consolidate close to $110,000 on Friday, displaying resilience regardless of continued volatility within the broader crypto market. The digital asset stays in a correction part inside a big bullish construction, as merchants think about whether or not current capital inflows and elevated open curiosity might be the beginning of a brand new uptrend.

Purchaser Defends $109,000 Assist

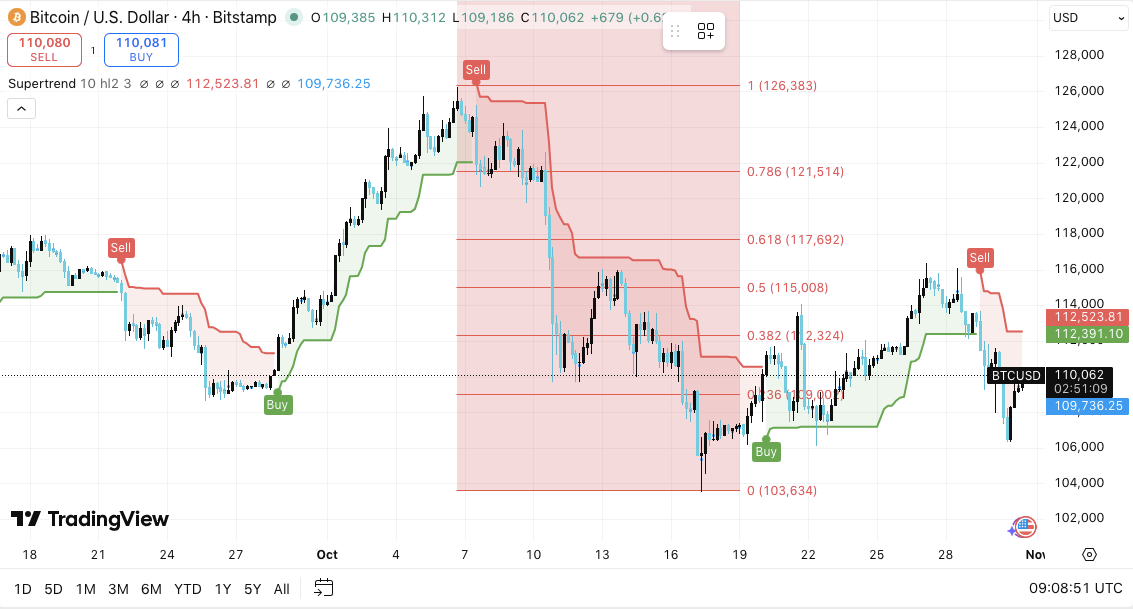

Bitcoin’s 4-hour chart reveals worth motion stabilizing above the $109,000 help space, which coincides with the decrease band of the supertrend. Sustaining this zone stays essential to keep up short-term construction. A fall beneath this might result in additional losses in the direction of $106,000, a degree that has traditionally served as a robust demand base.

Resistance stays outlined round $112,500, the 0.382 Fibonacci retracement degree. In consequence, this zone continues to restrict upside momentum. A sustained breakout above $112,500 may set off a transfer in the direction of $115,000 and $117,690, equivalent to the 0.5 and 0.618 Fibonacci zones. If patrons are capable of regain these ranges, Bitcoin may intention for a broader reversal in the direction of $121,500, a key space that marks the higher certain of the present correction.

Associated: Solana Value Prediction: Bears intention for main help ranges as momentum weakens

Futures Knowledge Alerts Institutional Positioning

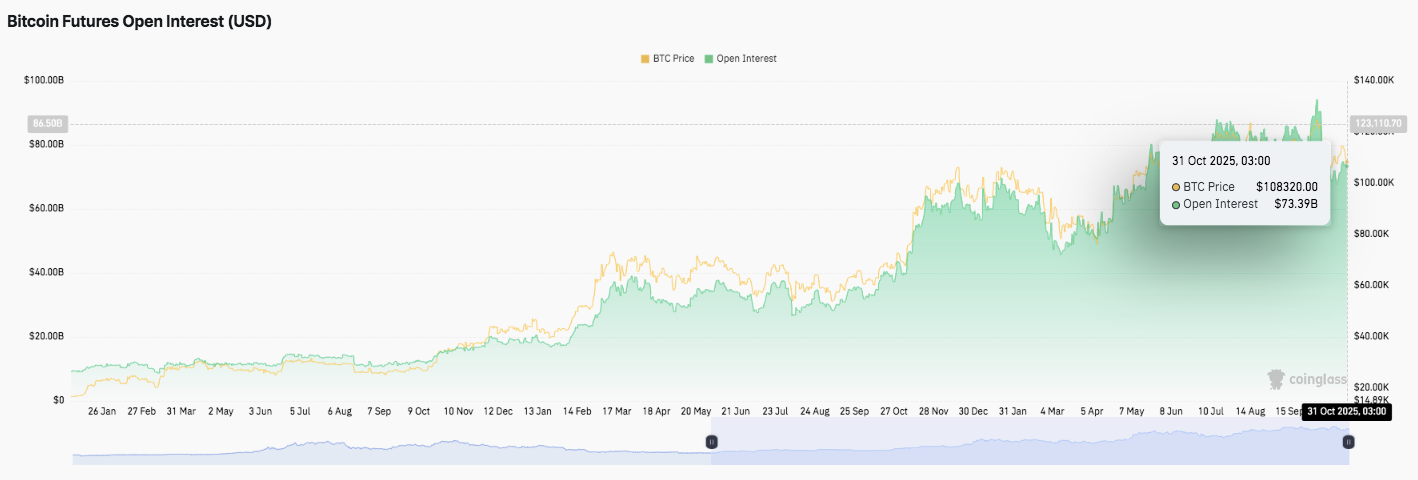

Open curiosity in Bitcoin futures elevated quickly all through 2025, reaching $73.39 billion by October thirty first. This determine represents a rise of greater than thrice since January.

This constant enlargement signifies elevated institutional participation and heightened derivatives exercise. Moreover, this rally has continued regardless of repeated corrections in spot costs, indicating that speculative urge for food stays robust.

The information means that merchants are bracing for bigger directional strikes forward, particularly after the current market retrace. Open curiosity has consolidated close to year-to-date highs, which analysts interpret as an indication of renewed confidence and positioning forward of a possible spike in volatility.

Overseas change flows present new accumulation

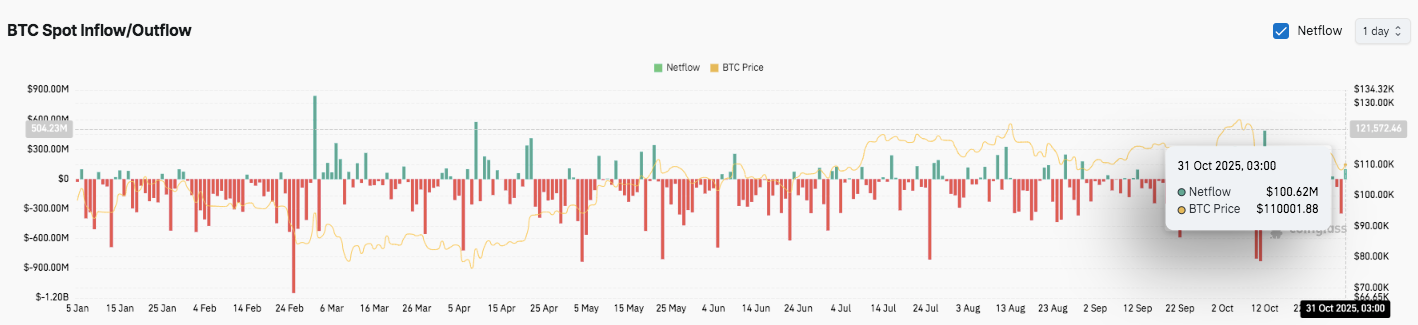

Bitcoin on-chain knowledge additionally reveals adjustments in sentiment within the spot market. Forex inflows and outflows have fluctuated broadly via 2025, with giant outflows occurring from February to June in response to weak costs. Nonetheless, October recorded internet inflows of $100.62 million, suggesting contemporary cash is accumulating amongst buyers.

Associated: Chainlink worth prediction: $3.6 million influx and Ondo buying and selling increase confidence

Moreover, the return of constructive internet movement means that merchants are re-entering positions after earlier profit-taking cycles. Sustained inflows at present ranges could subsequently replicate institutional accumulation previous to a broader restoration part.

Technical outlook for Bitcoin worth

Key ranges stay clearly outlined for November.

- Upside ranges: $112,500, $115,000, and $117,690 are the instant hurdles. A break above these zones would align with the 0.786 Fibonacci retracement degree and will lengthen the rally in the direction of $121,514.

- Draw back Ranges: $109,700 acts as instant help, adopted by $106,000 and $103,600 as deeper demand zones. A sustained decline beneath $109,000 may result in broader draw back stress.

- Higher Resistance: $112,500 stays the important thing degree for a reversal in the direction of a medium-term bullish restoration.

Technical settings point out that Bitcoin is consolidating inside a correction construction after the decline from $126,383. A transfer inside this vary displays a compression inside a broader uptrend and will see elevated volatility in both route.

Will Bitcoin rise additional?

Bitcoin’s near-term route will rely on whether or not patrons can defend $109,000 and get well $112,500. A profitable breakout of the $112,500-$115,000 zone may present new power and pave the best way to $118,000 and even $121,500.

Nonetheless, failure to maintain help close to $109,000 may set off a deeper correction in the direction of $106,000 or $103,000. Nonetheless, elevated open curiosity and constructive forex inflows recommend that accumulation stays robust even beneath present ranges. For now, Bitcoin is buying and selling inside a pivotal zone, and affirmation of a breakout will decide the following massive transfer heading into November.

Associated: Shiba Inu worth prediction: Fed rate of interest cuts and commerce truce paving the best way for a rebound

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.