- Bitcoin stays capped beneath the prevailing downtrend line, holding a structural correction at decrease highs.

- Spot web flows present solely short-term inflows and don’t present sustained accumulation throughout rebound.

- The EMA resistance between $86,600 and $89,300 continues to reject any try to maneuver larger and keep strain on assist.

Bitcoin costs are buying and selling round $87,000 right this moment, stabilizing after a mid-week selloff that despatched costs to their lowest ranges since early November. Though patrons managed to defend the $85,000 zone, the broader construction stays fragile as Bitcoin continues to commerce beneath the dominant downtrend line and heavy overhead EMA cluster.

Spot circulation doesn’t present sturdy accumulation sign

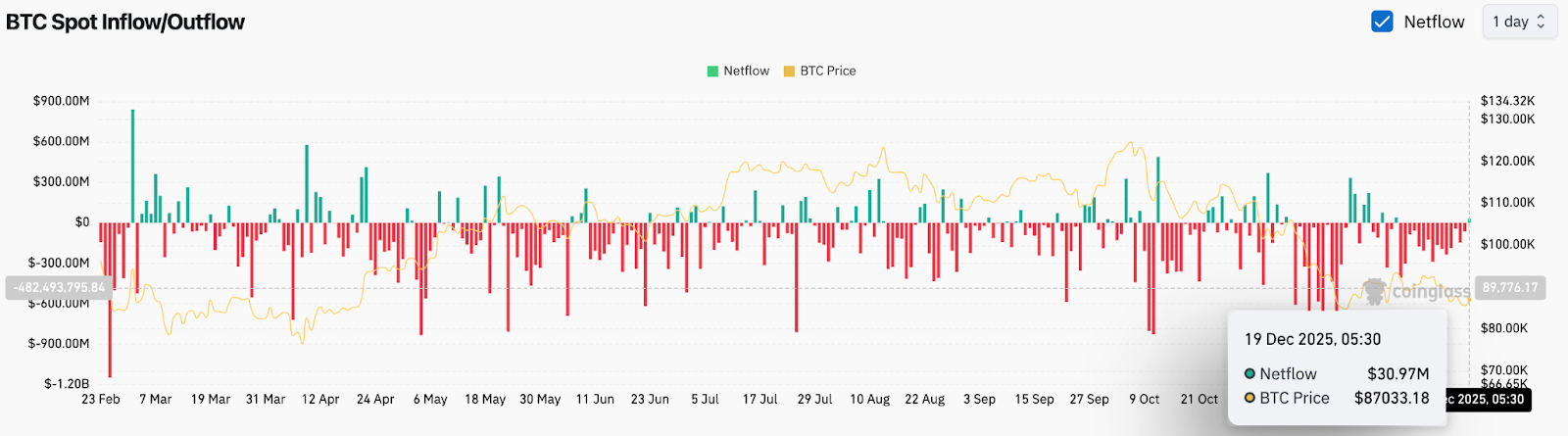

Bitcoin spot circulation knowledge continues to replicate warning moderately than accumulation. Internet inflows on December 19 had been modest at $30.97 million, in step with a short lived rebound towards $87,500. Nevertheless, this determine contrasts with the broader pattern of sustained web outflows seen from November to December.

A number of classes final month recorded each day web outflows of greater than $200 million, highlighting the regular distribution through the rally. At the same time as costs attempt to stabilize, capital is primarily returning to exchanges moderately than chilly storage.

Associated: Dogecoin Value Prediction: Dogecoin faces sustained strain…

This motion is vital. If constructive web flows should not sustained and costs rebound, upward actions are likely to disappear rapidly. The latest rally has adopted that sample, stalling nicely beneath earlier resistance ranges.

Downtrend line continues to outline construction

On the each day time-frame, Bitcoin stays anchored beneath a well-defined downtrend line drawn from the October excessive. All subsequent restoration makes an attempt have failed beneath this degree, reinforcing the extent as a structural ceiling moderately than a short lived barrier.

The supertrend indicator stays bearish, with resistance close to $97,000, nicely above the present value. The parabolic SAR dot additionally stays above the candlestick, indicating that the pattern situations haven’t reversed.

Structurally, the market continues to make new lows. Till this sequence breaks, the rally stays corrective moderately than trending.

Intraday chart highlights EMA resistance

A shorter time-frame reinforces the identical message. On the two-hour chart, Bitcoin is buying and selling beneath the main EMA, which is tightly lined up between $86,600 and $89,300.

This EMA cluster has acted as sturdy resistance all through this week. Every push into this zone creates promoting strain, pushing the worth again to the mid-$80,000s. The repeated failure to get better even the 20 EMA highlights the dearth of follow-through from patrons.

So long as the worth stays trapped beneath this cluster, any makes an attempt to maneuver larger will likely be unconvincing.

The Chaikin Cash Stream determine on the 2-hour chart stays barely unfavorable, hovering just under the zero line. This exhibits that promoting strain has eased from its peak, but in addition confirms that capital inflows should not but dominant.

Macro catalysts can not change threat sentiment

Bitcoin briefly rose after the Financial institution of Japan raised its coverage rate of interest by 25 foundation factors to 0.75%, the best degree in almost 30 years. Though the transfer was extensively anticipated, market response remained muted.

Following this announcement, the Japanese yen depreciated, dropping to 156.03 yen to the greenback, whereas Bitcoin briefly rose from $86,000 to $87,500 earlier than falling again. Issues a few fast unwinding of carry trades by yen funds didn’t materialize.

Associated: Cardano Value Prediction: Political Uncertainty Deepens Draw back…

Though this determination eliminated a serious macro draw back threat, it didn’t set off a brand new risk-on circulation into cryptocurrencies. Japan’s monetary situations stay accommodative in comparison with the US, and the speedy impression on international liquidity is proscribed.

outlook. Will Bitcoin go up?

The market is at an inflection level, however certainty is missing.

- Bullish case: A each day shut above the downtrend line and a return to the $97,000 degree would point out pattern stabilization and open the door for a return to six-digit territory.

- Bearish case: Failure to carry the $84,000 assist zone will affirm that the present pullback is only a pause and never a base, exposing a deeper draw back in direction of the low $80,000 vary.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.