- Bitcoin is buying and selling close to $90,000 as bulls defend assist amid a slim vary and combined alerts.

- Futures open curiosity is rising, indicating that leverage danger is rising whereas spot outflows proceed.

- Institutional accumulation accelerates, including 10,624 BTC, rising long-term confidence.

Bitcoin is buying and selling close to $90,350 as merchants weigh numerous alerts from derivatives exercise, spot flows, and main institutional accumulation. After a number of makes an attempt to regain preliminary resistance ranges, the market is displaying hesitation, however the broader construction suggests momentum is constructing under the floor.

Value construction stays tight as bulls defend assist

Bitcoin continues to commerce between $89,200 and $92,700 throughout a interval of compressed volatility. This vary sits under the cluster of short-term EMAs that capped all current pullbacks.

Along with that, the 0.382 Fibonacci retracement close to $94,379 nonetheless acts as the primary main hurdle. A detailed above this degree would point out stronger momentum. Nonetheless, failure to defend $89,179 might expose the market to a deeper retracement in the direction of the mid-$80,000 zone.

Moreover, the 0.5 and 0.618 Fibonacci ranges stay vital prime targets. These zones are situated at $98,583 and $102,786 and infrequently outline development affirmation factors throughout restoration phases. Merchants be aware that this construction continues to be making an attempt to kind a better low, however affirmation will rely on a stable break above $92,700.

Derivatives positioning expands as spot flows present warning

Open curiosity in Bitcoin futures continues to rise, reflecting rising confidence amongst leveraged merchants. Exercise elevated all year long, topping $60 billion in November, earlier than declining barely to $57.6 billion.

Associated: Terra Traditional (LUNC) Value Prediction: Market Response Intensifies…

Regular growth signifies stronger participation and elevated publicity to directional danger. Nonetheless, the current decline suggests selective profit-taking as the worth has stalled round $90,600.

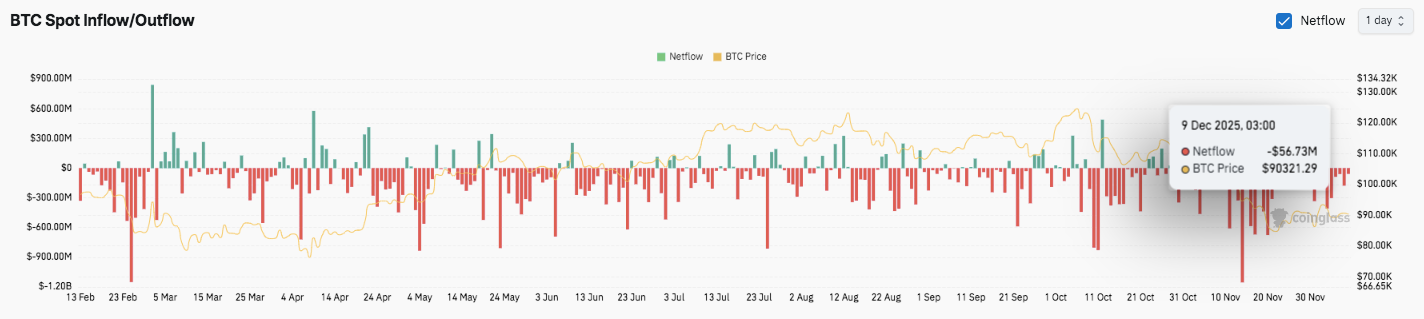

Spot circulate tells a special story. Capital outflows have continued in current months, alarming long-term holders. Outflows reached $56.7 million on December 9, sustaining a bearish development for a number of weeks. Subsequently, buyers proceed to react defensively to every consolidation.

Establishments broaden acquisitions as market waits for breakout

This week, main institutional methods put $963 million into Bitcoin. The corporate added 10,624 BTC at a median worth of practically $90,615.

Because of this, its whole holdings at the moment are 660,624 BTC. This place alerts a long-term perception and strengthens the narrative across the adoption of institutional steadiness sheets. Moreover, this acquisition will assist the growth of the transition to credit-based digital banking fashions.

Technical outlook for Bitcoin worth

Bitcoin is buying and selling inside a tightening vary round $90,000, with key ranges nonetheless clearly outlined.

Upside ranges embody $91,700, $92,700, and the 0.382 fib at $94,379, which represents the primary main hurdle for any restoration try. A breakout above this zone might lengthen in the direction of the 0.5 fib at $98,583 after which the 0.618 fib at $102,786.

Associated: Cardano Value Prediction: Channel Ceiling Rejects Bulls Once more…

The draw back degree begins at $89,179 and serves as instant development assist. Additional assist lies in Bollinger’s mid-band at $88,630. A breakdown under these two ranges reveals a deeper vary in the direction of $80,772, indicating a cycle low and a key invalidity level.

The broader construction exhibits Bitcoin compressing between the $89,200 assist space and the $92,700 EMA cluster. This setup suggests elevated volatility going ahead, just like earlier pre-breakout durations.

A decisive shut above $92,700 would reverse short-term momentum and shift focus to the $94,379-$98,583 resistance band. If Bitcoin fails to get well $92,700, the assist will weaken and the unstable motion is prone to proceed.

Will Bitcoin rise additional?

Bitcoin’s subsequent path will rely on whether or not consumers can construct sufficient momentum to defend the assist at $89,179 and problem the 0.382 Fib at $94,379. If market sentiment stabilizes, greater inflows and better open curiosity might assist the rally. A clear break by means of $94,379 might re-establish the medium-term uptrend and pave the best way for $98,583 and $102,786.

Nonetheless, a break under $89,179 dangers dropping the present accumulation zone, exposing Bitcoin to the mid-$80,000 area. For now, Bitcoin is in a pivotal zone the place futures demand, spot flows, and EMA corrections will decide the subsequent main leg.

Associated: Shiba Inu worth prediction: Sellers defend development line as whale exercise alerts upcoming volatility

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.