- Whales have resumed energetic accumulation, as the ten,000+ BTC cluster is displaying the strongest shopping for pattern in latest months.

- Spot outflows lower to $29.8 million, easing stress as Bitcoin stabilizes above the vital $90,000 assist zone.

- BTC faces a tough higher EMA between $93,000 and $105,000 as consumers look to recapture the short-term pattern.

Bitcoin value at present is buying and selling round $91,450 after staying within the $90,000 zone for 3 consecutive periods. This restoration comes as spot runoff slows sharply, whale pods return to accumulation, and stress eases on a market that has absorbed a 35% correction from its October peak. Patrons try to stabilize momentum, however overhead resistance continues to be limiting restoration.

Whales re-enter as distribution tendencies reverse

After months of regular gross sales, massive holders are lastly coming again. Glassnode’s cumulative pattern rating exhibits that corporations holding 10,000 BTC or extra have changed into robust web consumers, posting a rating of 0.8. This shift is notable as these similar holders drove a distribution cycle that compressed costs all through the second half of this 12 months.

The medium-sized cohort holding 1,000 to 10,000 BTC additionally turned optimistic for the primary time since September. Energetic accumulation of the 100-1,000 BTC group continues, with retail holders at the moment displaying the strongest shopping for pattern since July. The mix of all main cohorts shopping for on the similar time has traditionally coincided with the formation of cyclical bottoms.

The market’s newfound confidence coincides with the US Spot Bitcoin ETF’s $82,000 price foundation. Buyers seem to view the $80,000 area as honest worth, and the early restoration of $90,000 confirms that consumers consider the danger of capitulation has diminished.

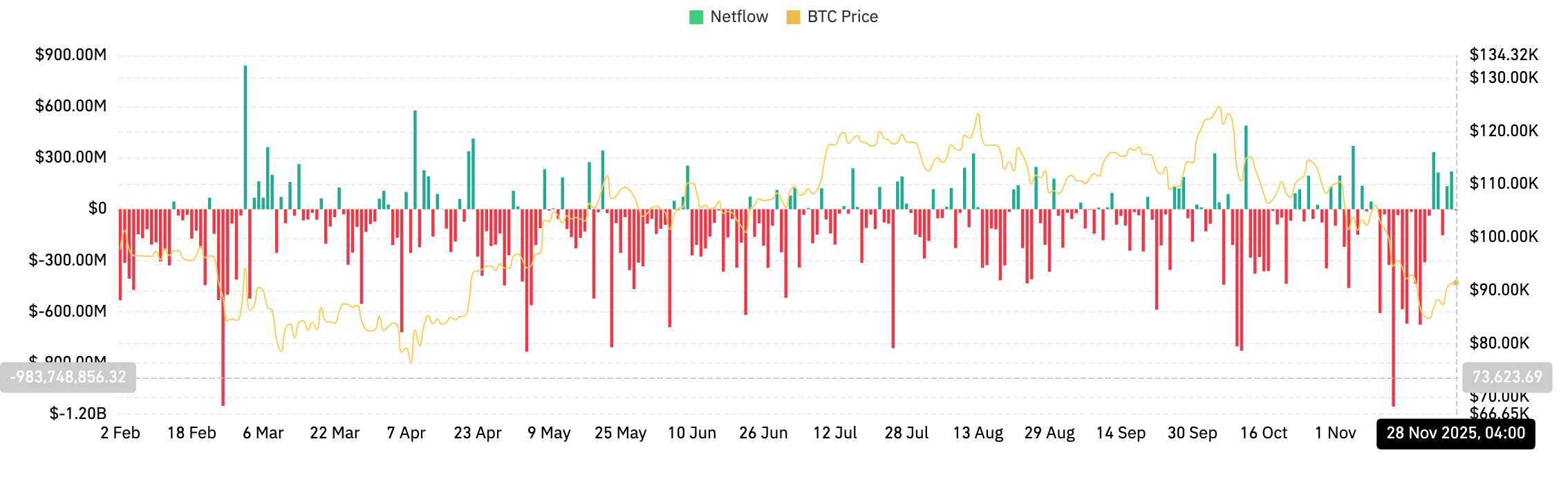

Spot outflows gradual as market stabilizes

Spot flows have been one of many strongest bearish forces over the previous month. Outflows dominated nearly each session, with day by day repeat print volumes exceeding $200 million. The newest studying, $29.83 million, suggests sellers are pulling again, although inflows have but to return.

As soon as spot outflows ease and accumulation accelerates, costs usually start to kind a base. This dynamic is manifested within the short-term construction. Bitcoin is tightening inside a slim ascending channel on the 30-minute chart, with VWAP assist at $91,026 holding persistently. A collection of intraday candlestick lows exhibits early indicators of stabilization.

The RSI on the intraday chart is close to 56, reflecting bettering momentum with out going too far. Though the value continues to fluctuate throughout the Bollinger Bands, the decrease band acts as assist reasonably than a breakdown set off.

Patrons face important resistance at key EMAs

The day by day chart exhibits an even bigger problem. BTC continues to be beneath the 20-day, 50-day, 100-day, and 200-day EMA. This cluster sits between $93,224 and $105,380 and has a excessive ceiling that may require important quantity to interrupt.

The latest rally started on the 0.236 Fibonacci retracement at $86,833. Patrons are at the moment focusing on the 0.382 stage at $90,747, which Bitcoin has regained. The subsequent take a look at lies on the 0.5 retracement at $93,911, adopted by the important thing 0.618 stage at $97,074. These ranges are roughly in step with the downtrend line that led to the correction from highs above $130,000.

Momentum indicators are displaying early enchancment. The BBP histogram recorded a optimistic bar for the primary time in a number of periods, indicating that the draw back exhaustion is easing. Costs additionally proceed to maneuver away from the long-term purple uptrend line that supported the restoration earlier this 12 months.

The instant goal for consumers is a decisive break above the 20-day EMA at $93,224. A detailed above that stage would pave the way in which for deeper Fibonacci ranges and alter sentiment in a significant manner.

outlook. Will Bitcoin go up?

The pattern is dependent upon whether or not the client can recoup the overhead of the EMA cluster.

- Bullish case: Momentum turns optimistic as soon as the value closes above $93,224 and begins transferring in direction of $97,074, adopted by $101,571. That may verify the buildup pattern and sign a broader restoration.

- Bearish case: Shedding $90,000 exposes $88,500 after which $86,800, turning the rebound into a brief response.

If Bitcoin regains the 20-day EMA with growing quantity, the trail to an entire pattern reset will start. If the value falls beneath $90,000, momentum will shift again to sellers and restoration will likely be delayed.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.