- Bitcoin is buying and selling round $122,000, holding the important thing $118,000 assist whereas stabilizing after a rejection at $124,000.

- On-chain flows present outflows of $39.5 million, indicating gentle accumulation as merchants stability profit-taking and long-term positioning.

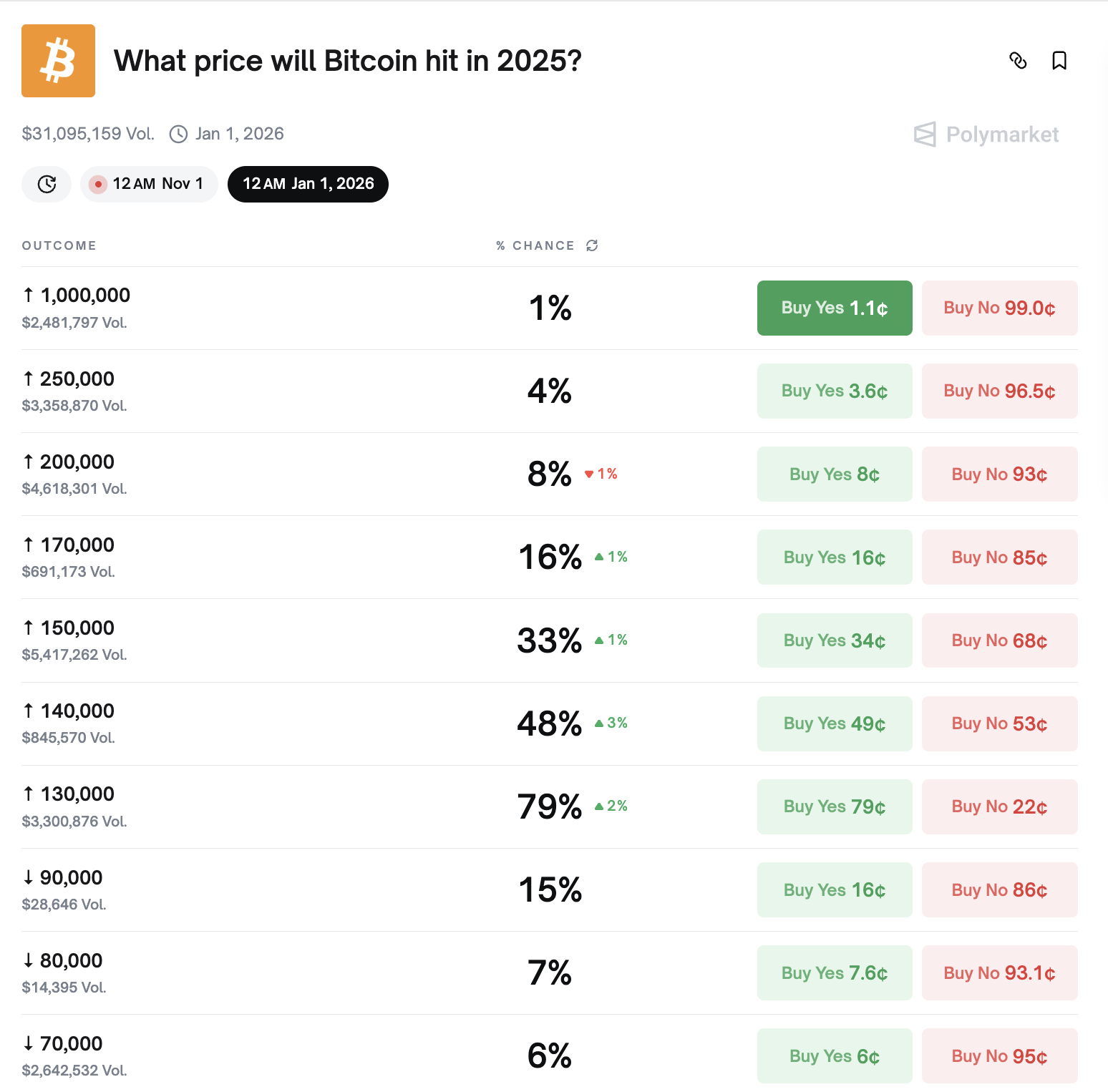

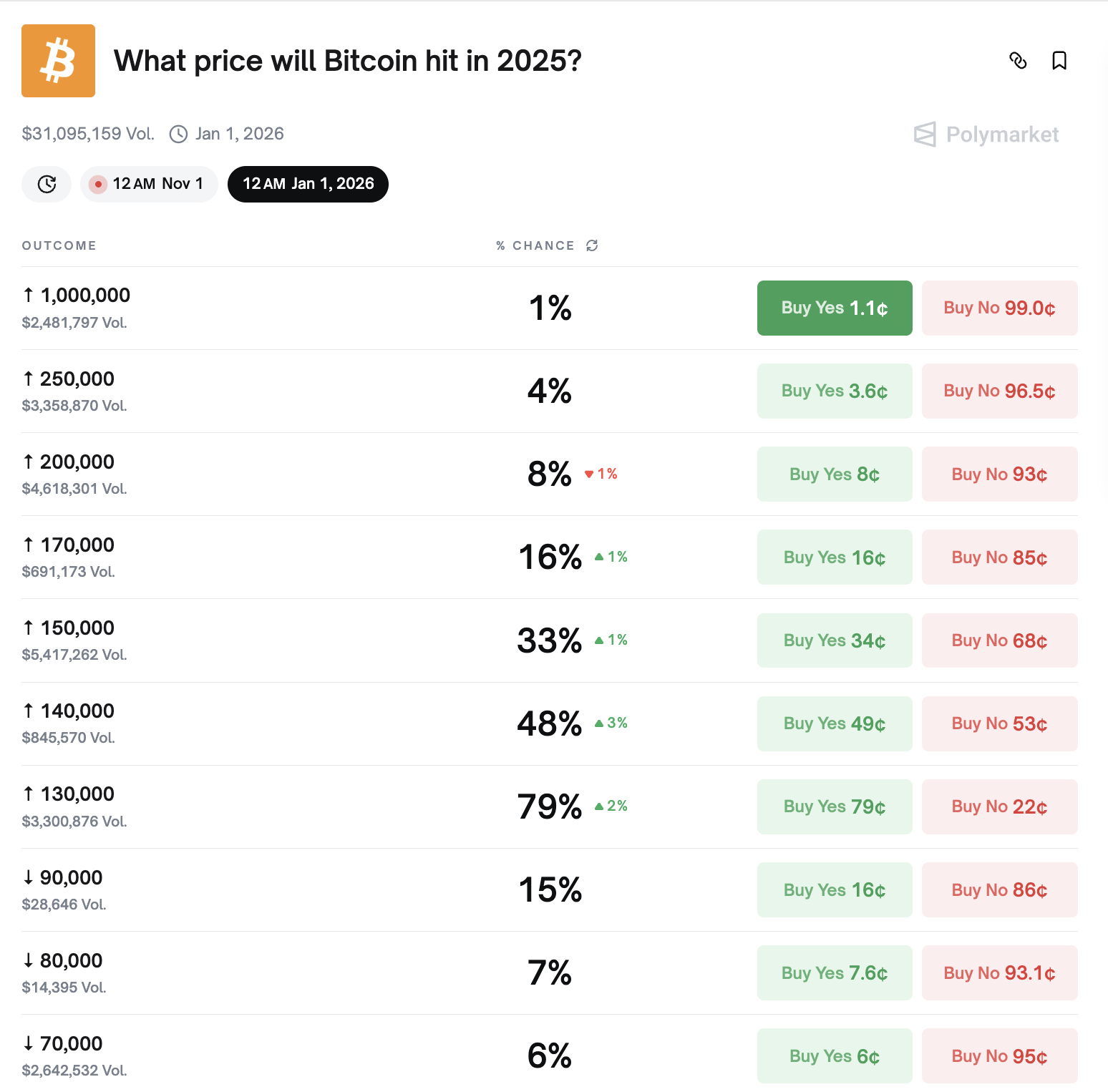

- Market sentiment was boosted by David Marcus’ $1.3 million Bitcoin prediction and Polymarket’s 79% odds of $130,000 this 12 months.

Bitcoin value at the moment was buying and selling round $122,000, falling barely after being rejected on the $124,000 restrict. This transfer follows a pointy rebound from $110,000, with consumers at present defending the $118,000 to $119,000 zone, which is supported by the 20-day EMA.

Bitcoin value checks resistance at $124,000

Bitcoin has failed to interrupt out of the resistance stage close to $124,000 and stays trapped in a consolidation vary. The chart exhibits a broad ascending construction, and the highest of the channel coincides with this ceiling. Help is at $118,587, whereas the subsequent main safety ranges are alongside the 50-day and 100-day EMAs at $116,000 and $113,500.

A break above $124,000 would affirm bullish continuation in direction of $128,000-$130,000. The RSI has cooled from overbought and the MACD line is flattening, suggesting a pause earlier than the subsequent transfer.

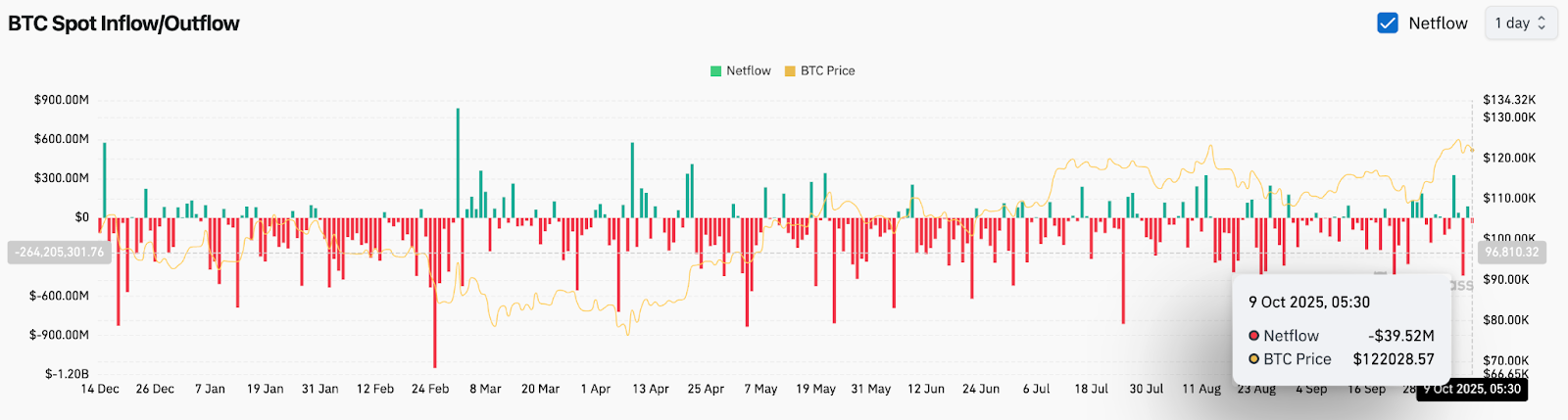

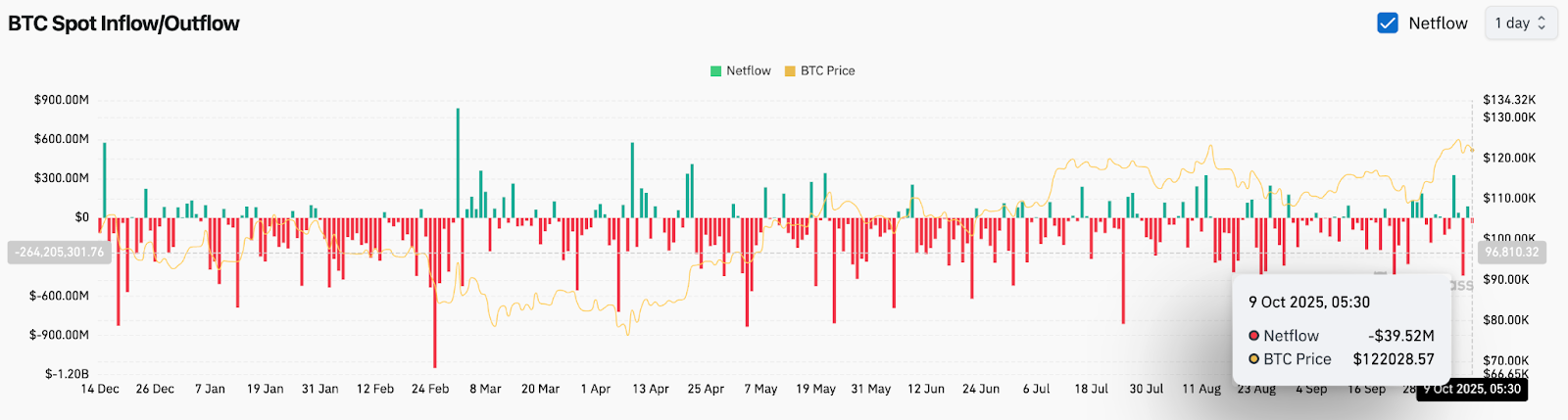

On-chain knowledge exhibits gentle accumulation

Internet outflows on October 9 had been $39.5 million, based on Coinglass knowledge, indicating gentle accumulation after every week of combined exercise. The present tempo is properly under September’s all-time excessive when outflows exceeded $100 million, suggesting short-term merchants are taking income whereas long-term holders proceed to build up.

Associated: PancakeSwap (CAKE) Value Prediction 2025-2030: Can Deflationary Tokenomics Drive Development?

Regardless of the lower in quantity, Bitcoin value pattern has stabilized above the breakout zone. Alternating inflows and outflows mirror a cautious temper out there, however total provide from exchanges helps a bullish view over the medium time period.

Market confidence strengthened by daring predictions

Optimism soared after former PayPal president David Marcus referred to as Bitcoin the “Web of Cash” on Bloomberg and predicted that it may attain $1.3 million. His feedback increase long-term confidence amongst fintech buyers and reinforce the view that institutional adoption continues to be in its infancy.

In the meantime, merchants imagine there’s a 79% probability of Bitcoin reaching $130,000 by the top of the 12 months, a 33% probability of reaching $150,000, and an increase in speculative bets at $170,000, based on Polymarket knowledge. These possibilities mirror the idea that the broad uptrend can be maintained at the same time as costs consolidate.

outlook. Will Bitcoin go up?

The query now could be whether or not consumers can recoup their $124,000 earlier than momentum weakens. In the present day’s Bitcoin value is steady and on-chain knowledge nonetheless favors outflows and long-term accumulation. Sentiment stays optimistic resulting from macro forecasts and commentary from monetary establishments.

Associated: Dogecoin Value Prediction: DOGE stays at $0.25 as CleanCore buys 710 million cash

If consumers maintain to $118,000, Bitcoin may retest $124,000 and break in direction of $130,000. As soon as under $118,000, the main target shifts to $113,000 to $108,000. The market stays structurally bullish and a correction is probably going forward of one other breakout try later this month.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.