- Bitcoin costs surged 5.6% to hit a three-week excessive of $61,100 on Tuesday morning.

- Altcoins equivalent to Celestia, Immutable X, and Close to recorded double-digit will increase.

- Crypto shares rose modestly forward of the Fed's anticipated rate of interest minimize announcement.

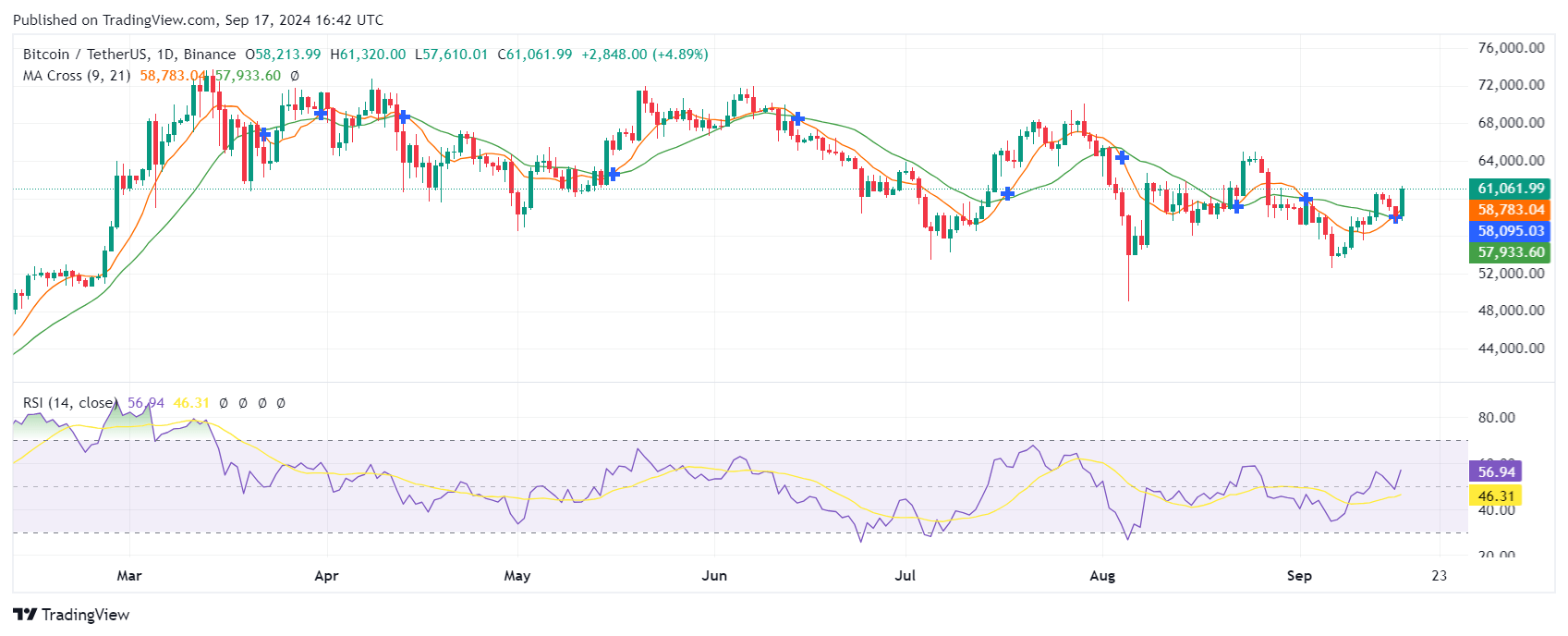

Bitcoin costs surged to their highest in three weeks, sparking features throughout the cryptocurrency sector and associated shares. Costs rose 5.6% to $61,100 by 11:55 a.m. ET earlier than falling again to round $61,000.

The surge marks a pointy reversal from a quiet begin to the week and indicators renewed curiosity within the digital asset.

Altcoin and Bitcoin Costs Soar Forward of Fed Price Lower

Except for Bitcoin, different main cryptocurrencies additionally noticed vital features, with Ethereum (ETH) rising 4.2% to $2.38K.

Notably, some altcoins outperformed bigger tokens, for instance, Celestia (TIA) elevated by 15.7%, Immutable X (IMX) rose by 14.8%, Close to Protocol (NEAR) elevated by 9%, Uniswap (UNI) elevated by 8.9%, and Sui (SUI) elevated by 8.1%.

The rise got here simply earlier than a extremely anticipated determination on rates of interest by the Federal Reserve.

Market analysts are more and more anticipating the central financial institution to chop rates of interest for the primary time in 4 years, with many betting the Fed will undertake a extra accommodative stance with inflation largely beneath management and the labor market exhibiting indicators of cooling.

Falling rates of interest are typically bullish for cryptocurrencies as decrease borrowing prices make conventional financial savings and funding autos much less engaging, which in flip leads traders to show to riskier belongings like cryptocurrencies looking for increased returns.

Cryptocurrency-related shares additionally surged

Cryptocurrency-focused shares have additionally benefited from Bitcoin's rise, although the features have been typically extra modest than these of different digital tokens.

MicroStrategy (MSTR), an organization identified for holding giant quantities of Bitcoin, rose 0.6%.

Cryptocurrency buying and selling platform Coinbase International (COIN) rose 3%, whereas cryptocurrency funding agency Galaxy Digital (OTCPK) rose 5.4%.

Within the crypto mining sector, Riot Platforms (RIOT) elevated 2.4%, Mara Holdings (MARA) elevated 1.9%, and Hive Digital Applied sciences (HIVE) elevated 4.3%. Bit Digital (BTBT) was the most important gainer with a 13% improve, adopted by Hut8 (HUT) and CleanSpark (CLSK) which rose 6.6% and three.1%, respectively.

Because the broader inventory market comes beneath shopping for strain forward of a significant Federal Reserve determination, the cryptocurrency sector continues to experience a wave of optimism round the opportunity of decrease rates of interest and elevated funding in digital belongings.