Bitcoin velocity measures how shortly cash are circulating inside the market. It’s calculated by dividing the estimated buying and selling quantity over the previous yr, or the cumulative complete of tokens transferred, by the present Bitcoin provide. Velocity is a key indicator of the extent of financial exercise inside the community. Greater velocity means cash are transferring extra ceaselessly, indicating excessive buying and selling exercise. In distinction, decrease velocity means cash are idle and will replicate a long-term holding mentality.

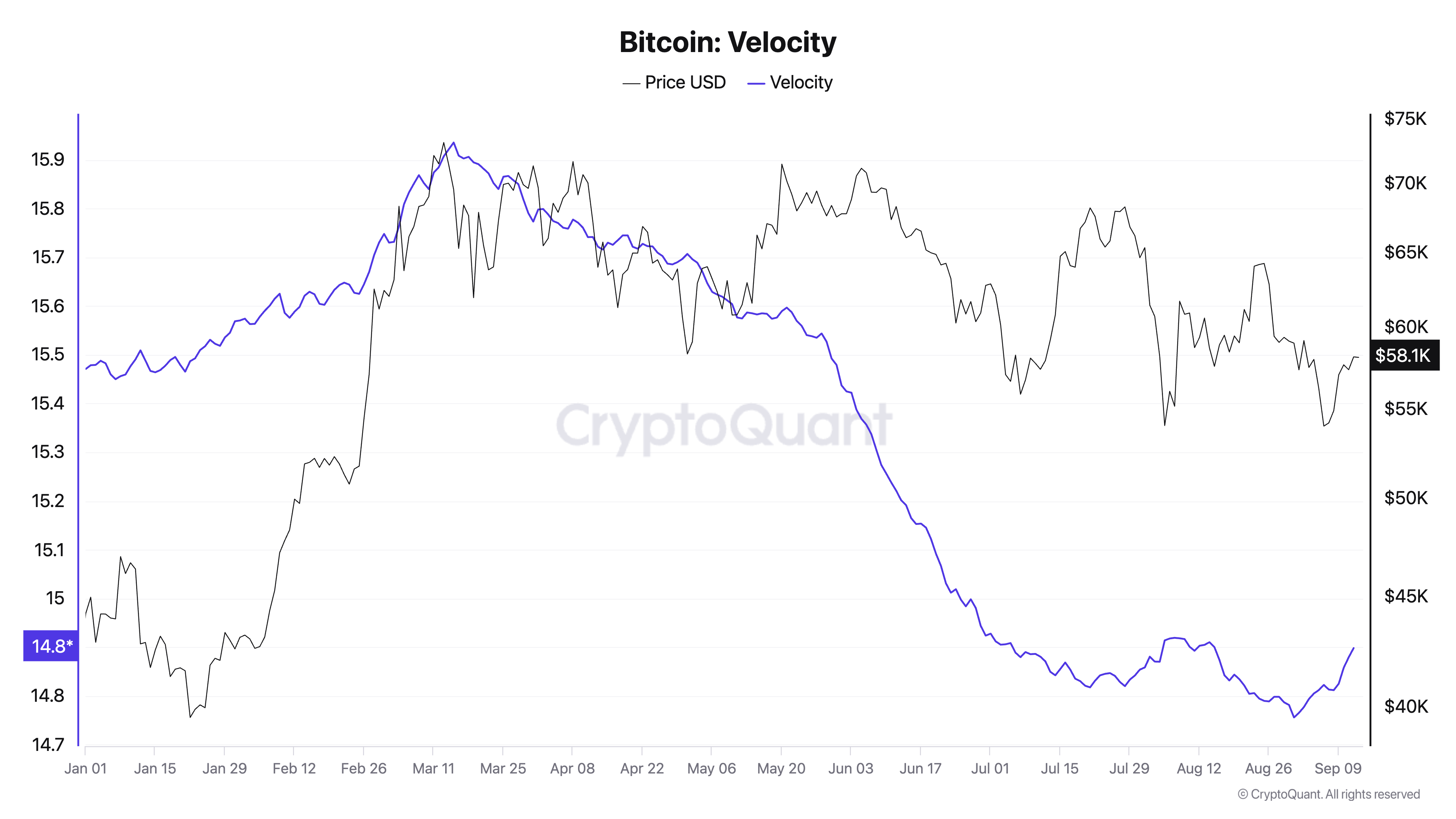

currencyjournals Our evaluation reveals that Bitcoin velocity noticed a notable improve in September. This short-term uptick got here after a chronic interval of decline that started in mid-March. To know the importance of this uptick, we have to have a look at each the current spike and the longer-term downward development in velocity.

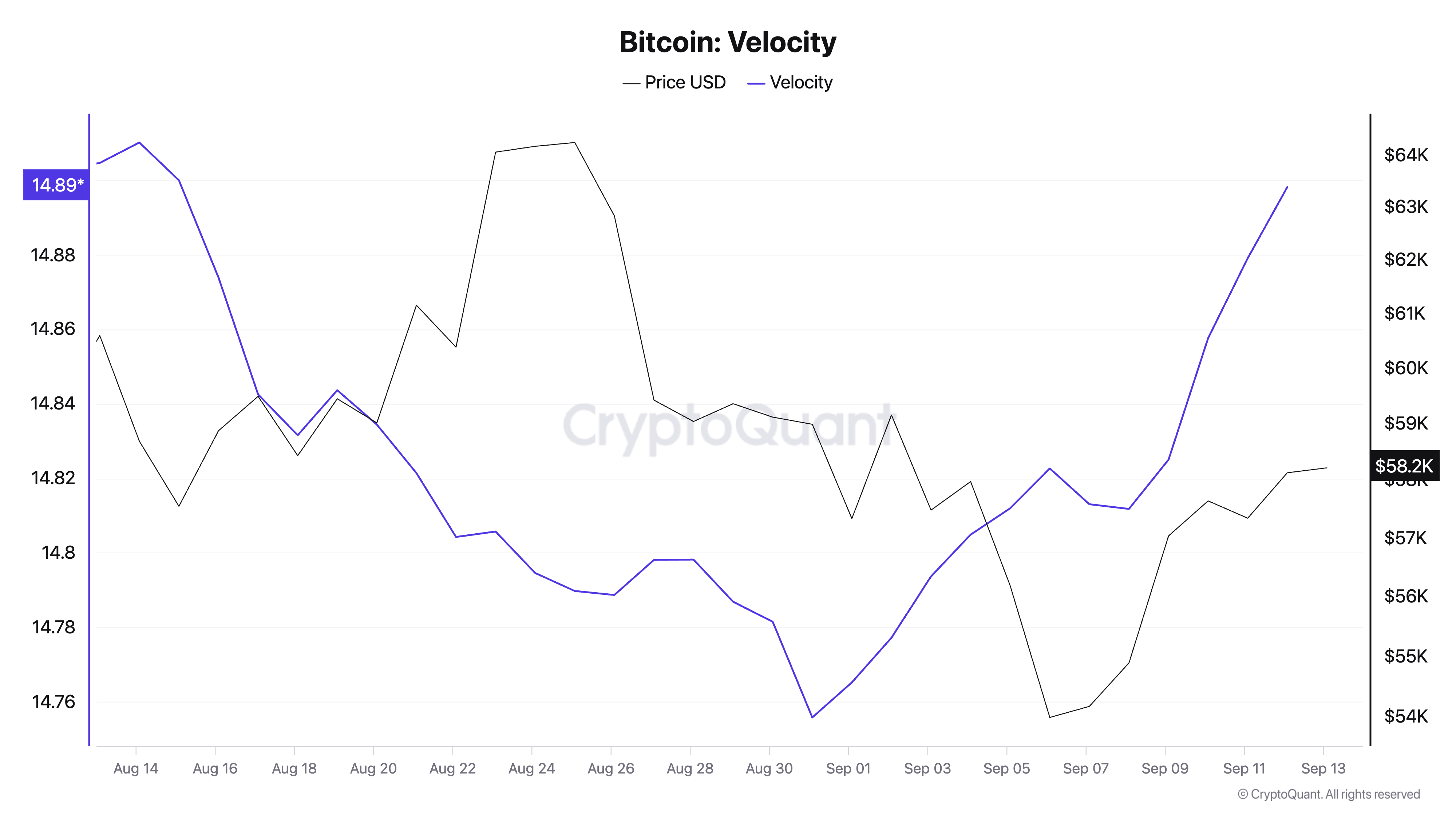

Bitcoin velocity started to rise in late August 2024 after months of regular decline. This short-term improve suggests a brand new wave of market exercise. Whereas the rise isn’t massive in absolute phrases, it does mark a notable improve in Bitcoin velocity for the primary time in a number of months. This means that the market could also be getting ready for extra lively participation after a interval of consolidation.

Spurred by exterior traits and the expectation of additional value actions, merchants have begun to maneuver their holdings once more. This may be as a result of quite a lot of components, nevertheless it often comes right down to volatility. When costs transfer considerably, buying and selling exercise spikes, growing in quantity and velocity, as markets compete to seize earnings or restrict losses from the value motion.

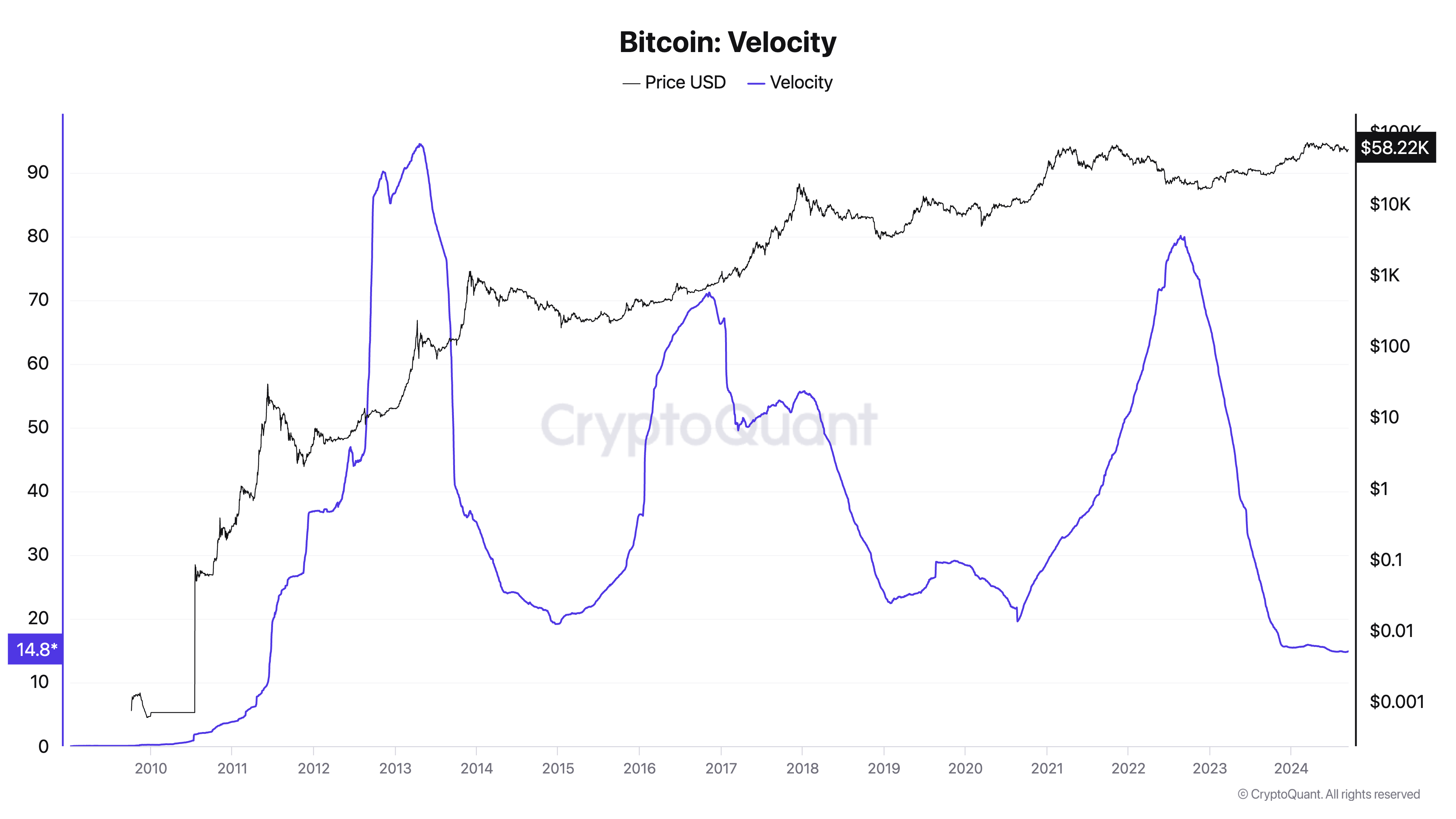

Nevertheless, this short-term spike stands in stark distinction to the general development. Traditionally, Bitcoin velocity has been steadily declining. After peaking throughout the 2013 bull run, velocity dropped considerably. There have been notable spikes in 2017 and 2021 that coincided with Bitcoin's historic bull runs, however velocity has since declined sharply and returned to decrease ranges. This long-term decline displays a serious shift in how Bitcoin is getting used inside the market.

Over time, Bitcoin has come to be perceived as a retailer of worth reasonably than a medium of change. Lengthy-term holders are likely to accumulate Bitcoin in hopes of future value appreciation, lowering the necessity for frequent buying and selling. As adoption by institutional buyers grows, so does the tendency for long-term accumulation.

Giant institutional buyers have a tendency to maneuver Bitcoin in bigger however much less frequent transactions. This habits results in decrease general velocity as establishments are much less curious about buying and selling extra ceaselessly than retail buyers. This grew to become particularly evident in 2024 when institutional demand for spot Bitcoin ETFs surged.

The velocity spike seen since early September is critical within the brief time period given the market, however continues to be tiny in comparison with the general downward development in 2024.

The present improve in velocity means that the market could also be coming into a extra lively part after a protracted interval of consolidation. That is an early indicator of renewed curiosity and speculative exercise, which may sign a bullish outlook.

The general market continues to be dominated by long-term holders, with HODL and institutional involvement contributing to the general slowdown in velocity. Until this current rally is accompanied by sustained value will increase and broader market exercise, it’s unlikely to result in a long-term reversal of the downward velocity development.

The submit Bitcoin Velocity Will increase Considerably for the First Time Since March, Exhibiting a Surge in Transactions appeared first on currencyjournals