- Santiment’s new index exhibits Bitcoin and Ethereum whales are promoting concurrently retail, and the compelled sell-off is just not over.

- Ethereum stays under $3,300 and under the 50-week SMA, leaving the door open for additional declines earlier than it recovers.

- XRP nonetheless seems to be like a clear rebound play, however merchants are hoping for a flash to $1.90 earlier than chasing a return to $3 territory.

The newest Santiment dashboard exhibits what merchants do not need to see on the finish of a decline. Bitcoin wallets holding between 10 BTC and 10,000 BTC are lowering their publicity concurrently smaller holders. Which means the yield stress remains to be persevering with and has not ended.

The concern and market weak point noticed in Bitcoin (BTC) is spilling over into the broader altcoin market, excluding privacy-focused altcoins.

Because the October 11 cryptocurrency crash, retail addresses have been offloaded and bigger wallets at the moment are becoming a member of them, making a unidirectional movement that sometimes delays a full rebound. It will preserve the broader altcoin market tied to Bitcoin’s underlying development till bigger consumers return.

Ethereum value stays weak under key weekly ranges

Ethereum has not adopted swimsuit with small reduction pops elsewhere. Costs are under the 50-week easy transferring common, indicating that spot demand remains to be skinny in comparison with 2024 and early 2025.

On the 1-hour timeframe, the ETH/USD pair is forming a possible double prime, coupled with a bearish divergence within the Relative Power Index (RSI). The ETH/USD pair has additionally damaged under its latest logarithmic uptrend, suggesting extra ache is forward.

Corruption knowledge confirms ETH whales and small holders stay in decline

Santiment’s new Ethereum index exhibits the identical two-sided decline. Wallets between 100 ETH and 100,000 ETH have been sending cash again to exchanges, and the smallest wallets under 0.01 ETH have been lowering their publicity since July 2025.

If each strains are leaning collectively, historical past exhibits that the market wants extra time to reset earlier than forming a sturdy backside. This additional pushes out the “excellent” accumulation window for ETH and high-beta alternate options.

Associated: XRP value prediction for November 12, 2025: XRP value seems to be to proceed bullish as market exercise surges

XRP Nonetheless Seems Prefer to Rally Initially, however Wants a $1.90 Flush

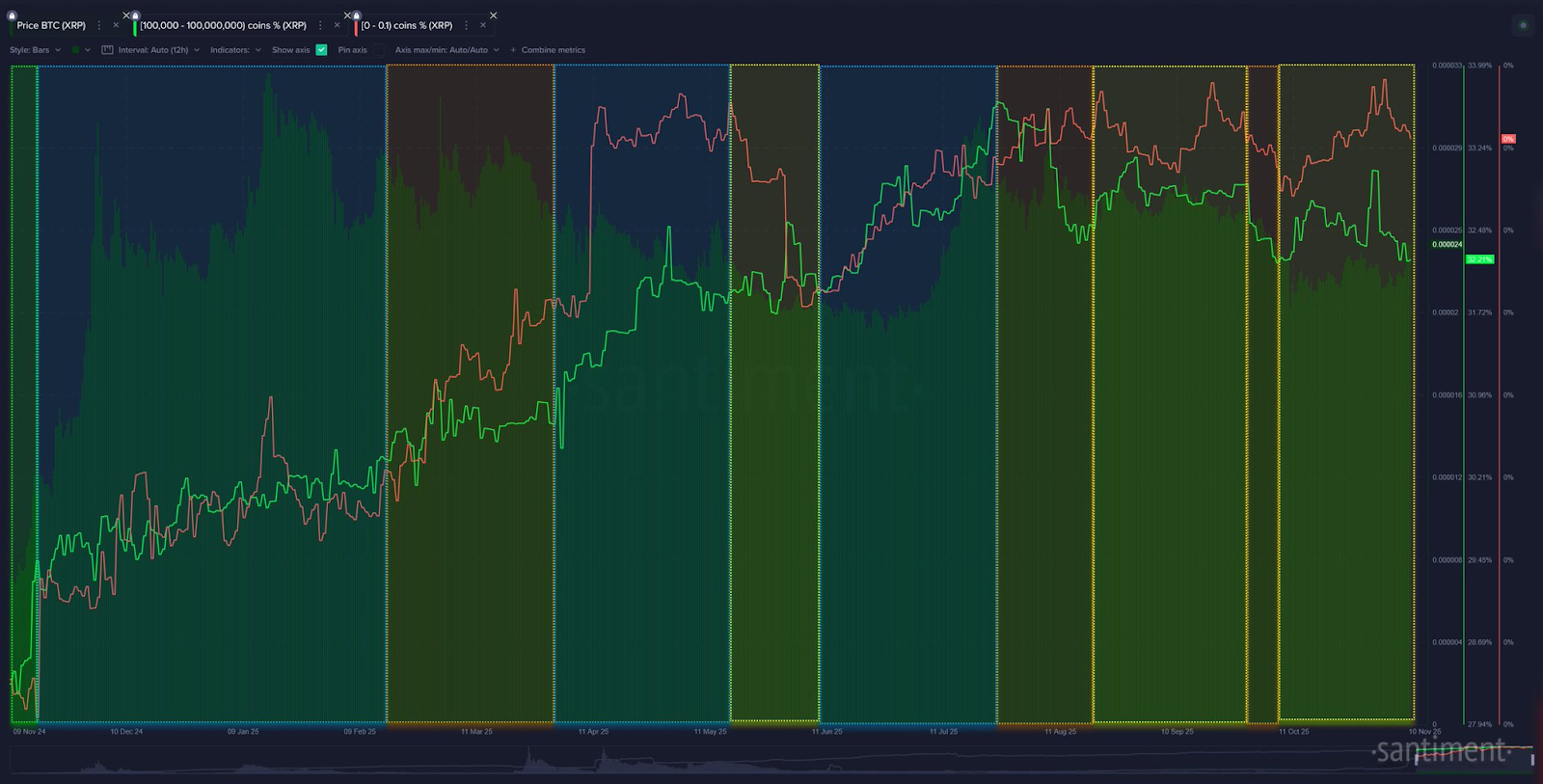

XRP is an outlier on this configuration. Santiment stated this week signifies XRP has entered a medium-term correction as beforehand aggressive XRP accumulation slowed and each whales and retail contracted.

Analysts monitoring the XRP vary nonetheless need to reconfirm the $1.90 value as this stage is essentially the most dependable start line for this cycle. A clear retest there, mixed with an anticipated spot XRP ETF itemizing as soon as Washington reopens and the Fed resumes offering liquidity, is the setup merchants are trying ahead to.

Associated: Analyst says XRP might “soften face” in 4-6 weeks, “Mark my phrases”

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.