- Bitcoin has corrected 20% from its all-time excessive and is at present testing the essential $98,200 to $100,000 help zone.

- On-chain information reveals file accumulation and indicators of a “native backside” as leveraged merchants are worn out.

- This bullish concept depends on the anticipated macro help from the US Federal Reserve (Fed) by quantitative easing (QE).

Bitcoin (BTC) is testing dealer sentiment after a five-week correction. The flagship cryptocurrency has fallen about 20% from its latest excessive, primarily resulting from a wave of liquidations by lengthy merchants.

Key medium-term targets for Bitcoin worth

BTC Bull Case: Necessary Help Check

Bitcoin worth has retested key help ranges and recovered over the previous few days. After falling beneath $100,000 for the primary time since June of this 12 months earlier this week, BTC worth could kind a reversal sample.

On the each day and weekly time frames, the BTC/USD pair retested the essential pattern line, which acted as a resistance degree in 2024, however was a help degree in 2025. Due to this fact, BTC worth is poised to rebound in direction of a brand new all-time excessive (ATH) within the quick time period.

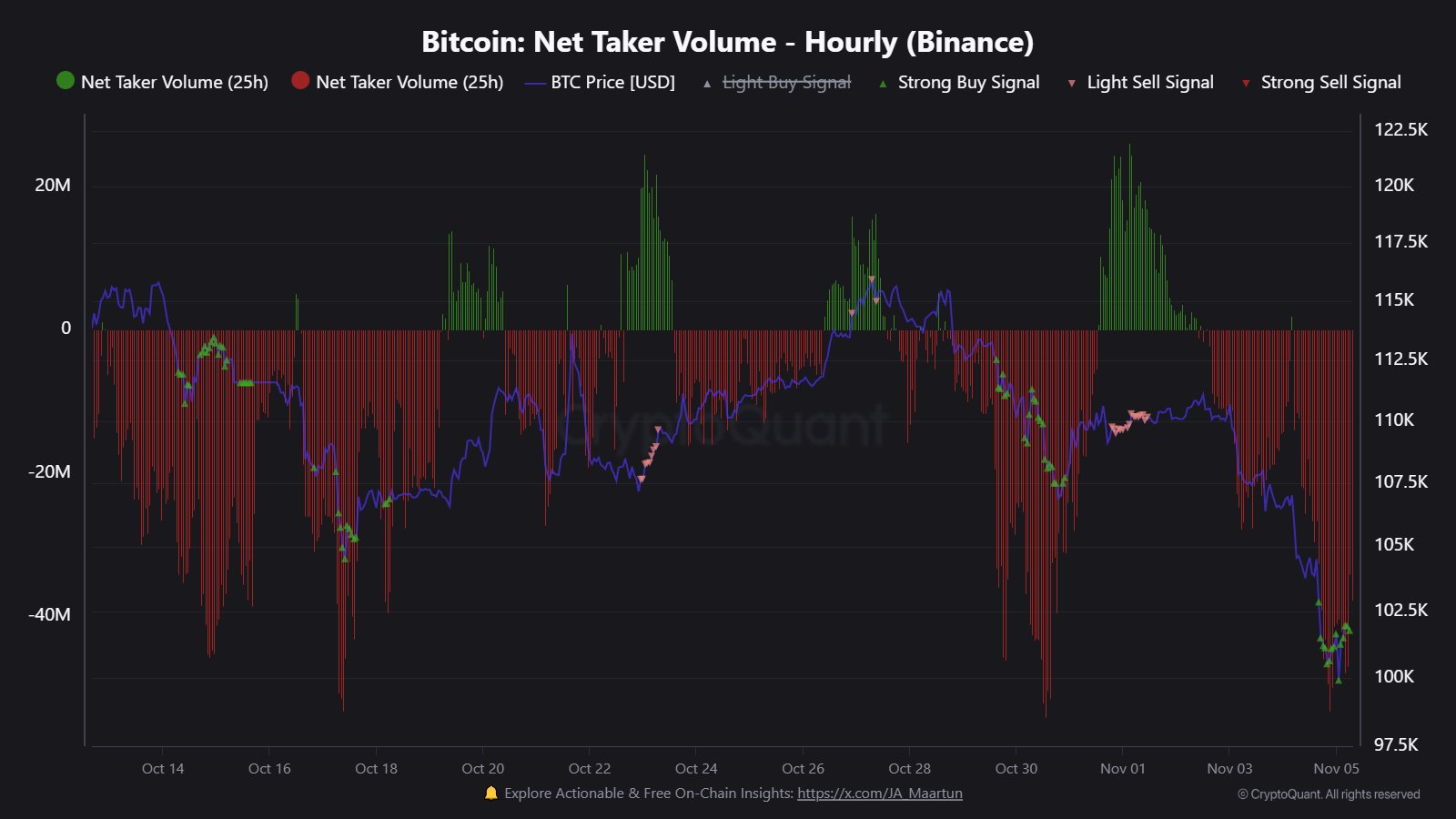

Notably, BTC worth might want to recuperate the 200-day easy shifting common (SMA) to substantiate a rally above $130 within the coming weeks. The Bitcoin bullish thesis is supported by CryptoQuant’s internet taker quantity, which simply reached -53 million, with deep damaging characters indicating aggressive promoting forward of the native backside.

BTC bear case: $98.2,000 must be held

Nonetheless, slowing inflows into Bitcoin, as seen in Spot BTC Change Traded Funds (ETFs) and Digital Asset Treasuries (DATs), may put stress on the bullish momentum within the medium time period. Based on Axel Kivar of Widespread Market Charts, a very powerful factor is to forestall the BTC/USD pair from falling beneath the help degree close to $98,200.

Moreover, Kibal identified that if the flagship coin falls beneath $98,000 within the coming weeks, the medium-term goal of $141,000 can be invalidated.

Why is the bullish concept of BTC supported?

Fed cuts rates of interest forward of anticipated quantitative easing

The bullish concept for Bitcoin is strengthened by the Fed’s ongoing financial coverage adjustments. Notably, the Fed has already begun chopping charges twice in 2025, and Kalsi merchants count on extra cuts to return within the coming months.

Bitcoin liquidity is predicted to enhance within the coming weeks because the Federal Reserve begins quantitative easing (QE) in response to a rise in international cash provide. Moreover, gold costs have doubtlessly hit a ceiling and institutional capital rotation is underway.

Spot demand recovers after collection of enormous liquidations of leveraged merchants

Medium-term bullish sentiment for BTC worth is strengthened by the resurgence of spot demand following the latest crypto deleveraging.

cryptoquant Additionally seen:

“In lower than two months, the month-to-month common has greater than doubled, rising from 130,000 BTC to 262,000 BTC, indicating that this pattern is accelerating.”

Based on CryptoQuant market information evaluation, addresses accumulating Bitcoin have reached file ranges.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.