- Bitcoin Value holds practically $111,900 in the present day after rejecting it with a $114,000 resistance.

- The $74.3M internet spill highlights cautious investor sentiment regardless of decrease gross sales pressures.

- Institutional demand from ETFs and companies continues to soak up extra bitcoin than miners generate.

Bitcoin costs in the present day are buying and selling practically $111,900 after sliding out of the $114,000 zone earlier this week. Rejections on 20 and 50-EMA clusters, near $113,200, keep an upward try, however speedy help stays at $111,000. Merchants are at the moment specializing in whether or not this integration will flip right into a rebound or deeper retracement dangers will emerge.

Bitcoin costs are combating beneath EMA resistance

The four-hour chart exhibits that Bitcoin was withdrawn downwardly from its mid-September peak. The value at the moment holds a 32.8% Fibonacci retracement at $111,800, per trendline help from the early September rally.

The 20, 50, and 200 EMAs are stacked between $113,186 and near $114,156, creating heavy resistance blocks. Momentum is beneath stress till BTC regains this zone. Parabolic SAR additionally flipped its bearishness and saved its short-term bias down.

If a purchaser defends $111,000, it’s potential to rebound to $114,200 and $117,000. The breakdown beneath $111,000 dangers exposing $109,000 and getting into a deeper demand zone of $107,500.

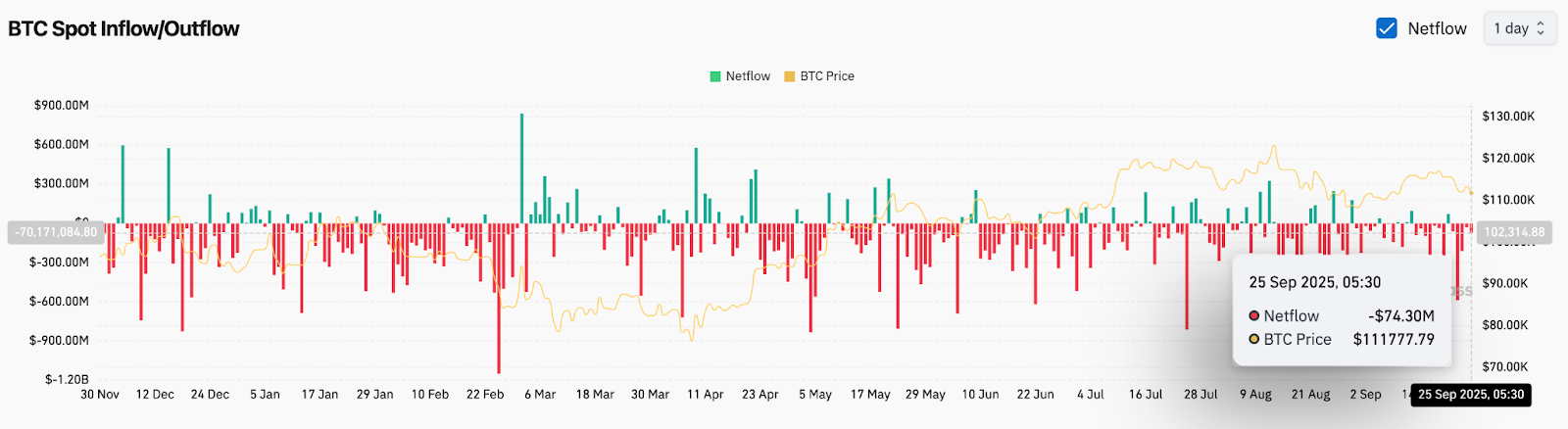

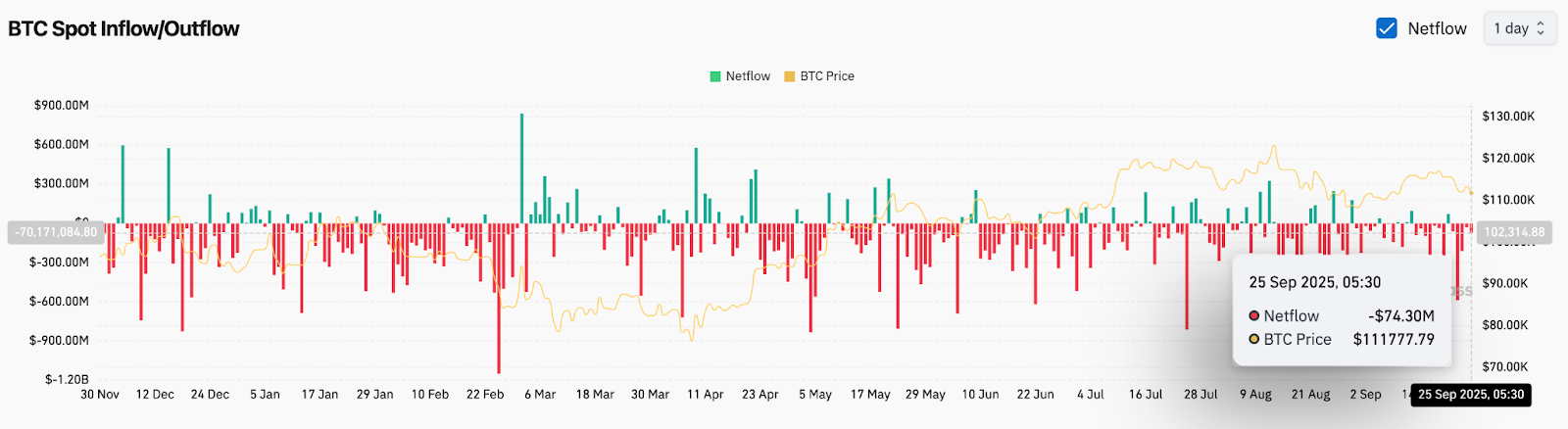

On-chain circulate signifies internet outflow

Spot change circulate information continues to emphasise cautious positioning. On September twenty fifth, Bitcoin recorded a internet outflow of $74.3 million, reflecting buyers’ preferences to keep up the change. This means a decline in gross sales stress, but additionally signifies weak spot demand as accumulation has not but been constant.

Futures positioning stays modest, with an open cooling of curiosity after final week’s $2 billion liquidation occasion. The Flashout is reluctant to drive give up throughout the leveraged lengthy positions and commit new capital till technical readability returns.

For now, on-chain alerts counsel that Bitcoin’s worth motion will stay in vary till a stronger influx reappears.

Institutional and company calls for present tailbone

Regardless of its short-term weak spot, the broader narrative continues to help Bitcoin. Technique government chairman Michael Saylor has repeatedly mentioned that company recruitment and ETF purchases soak up extra bitcoin than they produce daily. Miners generate round 900 BTC per day, however in line with River, firms and ETFs have earned a complete of over 3,000.

This everlasting buy-side imbalance is predicted to create upward stress when macro headwinds turn out to be simpler. Saylor emphasizes that Bitcoin is getting used as a Treasury reserve asset and as a type of digital capital that backs up credit score devices, strengthening its stability sheet and highlighting the enlargement of facility use instances.

The presence of not less than 145 firms holding Bitcoin of their books underscores this shift, offering long-term help even when short-term merchants stay cautious.

Technical outlook for Bitcoin costs

The Bitcoin worth forecast for September twenty sixth factors to a slim vary with detrimental dangers if $111,000 is just not retained. The upward goal stays capped by the EMA resistance till a momentum purchaser intervene.

- Upside Stage: $113,200, $114,200, $117,000.

- Drawback stage: $111,000, $109,000, $107,500.

- Pattern Help: $106,000 for the ultimate line of protection.

Outlook: Will Bitcoin go up?

The speedy query is whether or not the client can maintain a flooring that’s $111,000 lengthy sufficient to make the restoration. Chain outflows counsel a drop in gross sales stress, however inflows are too weak and nonetheless too weak to gas sustained gatherings.

Institutional accumulation and company adoption present a robust tailwind on the finish of the yr, per Cyroler’s view that Bitcoin “strikes up neatly once more” when macros go headwind.

Within the brief time period, in the present day’s Bitcoin costs look weak beneath the EMA cluster, however so long as $109,000 stays intact, the broader bullish construction will likely be retained. The decisive push above $114,200 will restore momentum to $117,000 and resume the street to $120,000.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.