- Bitcoin soars above $95,000 as US inflation expectations decline, triggering $603 million in short-term liquidations and wiping out 122,000 merchants.

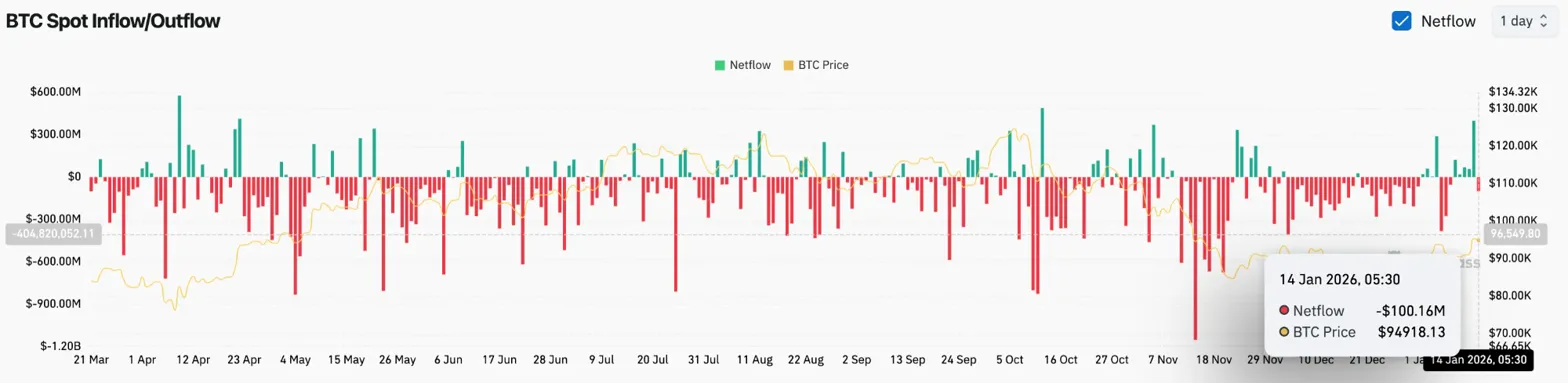

- Spot outflows reached $100.16 million on January 14, displaying distribution regardless of a 4% rise as worth examined the 100-day EMA resistance.

- The highest of the triangle is nearing $95,314 as political tensions over the Fed subpoenas and a weaker greenback make non-sovereign belongings extra engaging.

Bitcoin costs soared to $95,385 right this moment after weaker-than-expected US inflation information reignited demand for the scarce asset and triggered a large quick squeeze throughout the crypto derivatives market. The 4% rise took BTC above $95,000 for the primary time in per week, however spot outflows of $100.16 million point out that sellers are utilizing their leverage to exit positions.

Inflation shock causes short-term liquidation of $603 million

An surprising downward revision to US inflation information has strengthened expectations that the Federal Reserve will proceed to chop rates of interest in 2026. Decrease inflation has eased strain on bond yields, enhancing liquidity situations which have traditionally favored cryptocurrencies and threat belongings.

This transfer was accompanied by a major unwinding within the futures market. Greater than $688 million in crypto derivatives positions have been liquidated in 24 hours, of which quick gross sales accounted for roughly $603 million. The worth rally accelerated, led by the $12.9 million ETHUSDT liquidation on Binance, which worn out almost 122,000 merchants.

The liquidation skew highlights how aggressively merchants took positions on the draw back within the run-up to inflation, and the way shortly that story unraveled. Ether outperformed Bitcoin, rising greater than 7% to round $3,330, whereas main tokens corresponding to Solana, Cardano, and XRP rose as a lot as 9%.

Political tensions added gasoline. Earlier this week, stories that the U.S. Division of Justice had issued a grand jury subpoena in opposition to the Federal Reserve spooked markets, sending the greenback weaker and rising the attraction of belongings seen as insulated from central financial institution dangers.

$100 million outflow reveals distribution regardless of rise

Internet outflows on January 14 have been $101.6 million, in line with alternate stream information, with vast distribution as Bitcoin assessments the $95,000 to $96,000 resistance zone. When giant outflows happen throughout a rally somewhat than a correction, it normally signifies that holders are transferring their tokens to exchanges to promote somewhat than withdrawing them to chilly storage.

Associated: Ethereum Value Prediction: ETH Extends Breakout as Bulls Retake Quick-Time period Management

The outflows are in sharp distinction to the bullish worth motion, making a divergence that means members are benefiting from inflation-driven positive factors to exit positions somewhat than chasing momentum. Conventional risk-on indicators supported the transfer, with Asian shares rising to file highs, silver exceeding $90 an oz. for the primary time, and gold hovering close to file highs.

The strikes recommend buyers are in search of publicity to belongings that profit from easing monetary situations and foreign money volatility. Nonetheless, spot outflows point out that Bitcoin holders stay cautious regardless of enhancing macro settings.

Triangle Apex assessments 100-day EMA resistance

The day by day chart reveals Bitcoin testing the apex of a symmetrical triangle that has compressed volatility since early January. Value is difficult the 100-day EMA at $95,955, which caps the upside and offers important resistance all through the draw back.

The primary technical ranges are:

- 20-day EMA: $91,167

- 50-day EMA: $91,803

- 100-day EMA: $95,955

- 200-day EMA: $99,569

- Supertrend: $88,032

BTC is buying and selling above the 20-day and 50-day EMAs, however the 100-day EMA is dealing with speedy resistance. A clear break above $96,000 together with quantity would flip this degree into help, paving the way in which for the 200-day EMA at $99,569. A lack of $94,500 would invalidate the breakout and expose the decrease sure of the triangle close to $91,000.

Associated: Solana Value Prediction: $5.54 million spot inflows help uptrend line as open curiosity…

The uptrend line that has supported costs because the December lows is slightly below present ranges round $93,000-$94,000. This trendline has been performing as a purchase zone by means of consolidation, and a check of the present triangular resistance whereas sustaining trendline help creates a coiled setup.

Quick-term integration in parabolic SAR

The 30-minute timeframe reveals Bitcoin consolidating slightly below the parabolic SAR of $95,314 after an preliminary surge above $95,000. RSI is 51.85, impartial after cooling down from an overbought rally.

Value is testing the resistance created by each the SAR and the convergence of the 100-day EMA. A detailed above $96,000 will flip bullish on each indicators and make sure a triangle breakout. Failure to maintain $95,000 would sign the tip of rising inflation and profit-taking overwhelming new demand.

The apex of the triangle is approaching and normally requires decision inside a couple of days. The mix of enhancing macro situations, quick squeeze momentum, and technical compression create the potential for explosive strikes in both path.

Outlook: Will Bitcoin Rise?

Inflation stats and quick squeeze create bullish catalysts, however $100 million outflows mood confidence. If BTC crosses $96,000 with quantity and retakes the 100-day EMA, the triangle might be bullishly resolved. In that case, the preliminary goal is $99,569 on the 200-day EMA, with additional upside reaching $102,000 if momentum builds.

If the worth falls by $94,500 and breaks out of the uptrend line, this rise might be an exit liquidity acquire. This places the 50-day EMA at $91,803, revealing a deeper correction and supertrend help in the direction of $88,000 if the selloff accelerates.

A breakout is confirmed when the worth breaks above $96,000. For those who lose $94,500, the transfer is void.

Associated: Sprint Value Predictions for 2026: Evolving Sensible Contracts and the Battle of Privateness Proliferation July 2027 EU Ban

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.