- Bitcoin is buying and selling close to $112,450, rebounding after a ten% flash crash worn out greater than $7 billion in positions.

- President Trump’s 100% tariffs on Chinese language items sparked panic promoting and pushed Bitcoin to the essential assist of $110,000.

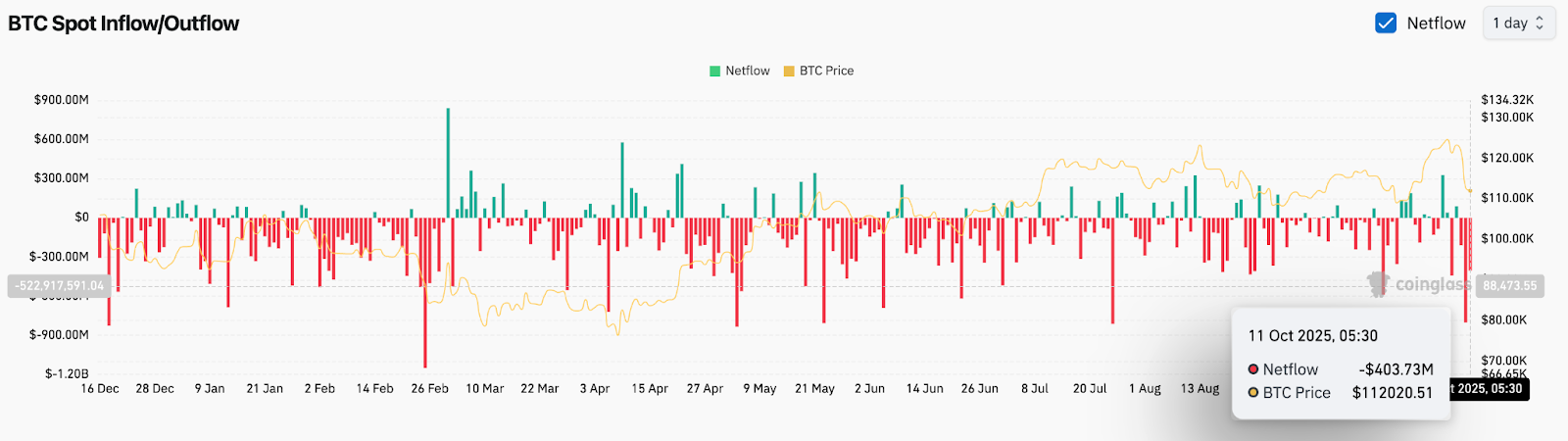

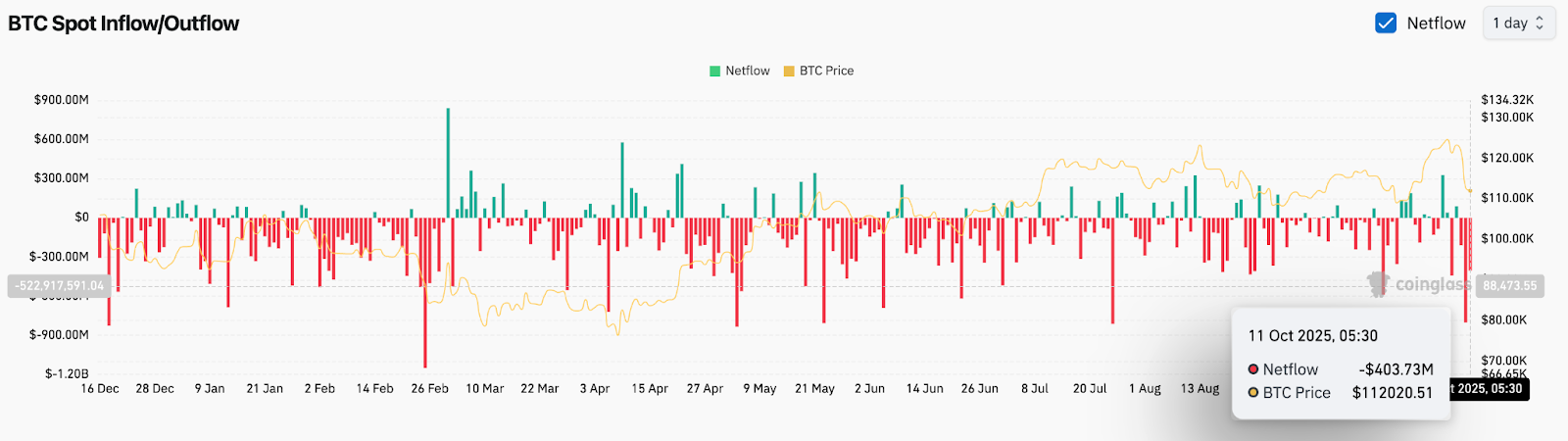

- Forex outflows of greater than $400 million sign accumulation as whales purchase a squeeze regardless of short-term warning.

Bitcoin value is buying and selling round $112,450 in the present day, recovering barely after a extreme 10% flash crash attributable to the flare-up of US-China commerce tensions. The selloff, which worn out greater than $7 billion in leveraged positions, took Bitcoin from the $120,000 zone to $111,100 earlier than consumers intervened. This decline marked one of many greatest intraday declines in 2025 and pushed Bitcoin in the direction of key uptrend line assist.

Bitcoin value faces main technical breakdown

The day by day chart exhibits Bitcoin decisively beneath the 20-day and 50-day exponential shifting averages (EMAs), that are at present performing as short-term resistance close to $115,800 and $117,500. Worth briefly broke by way of the uptrend line that has guided the rally since Might, however closed simply above it and has maintained structural integrity for now.

If BTC fails to get better above $113,500-115,000, momentum might rapidly deteriorate in the direction of the following essential defensive zone, the 200-day EMA close to $107,800. The on-balance quantity (OBV) indicator stays excessive at 1.74 million, indicating that whereas promoting was concentrated, long-term holders haven’t given in but.

President Trump’s tariff shock causes flash crash

Friday’s market selloff adopted U.S. President Donald Trump’s announcement of 100% tariffs on Chinese language items, reigniting fears of a worldwide commerce conflict. Cryptocurrencies immediately plummeted, with Bitcoin dropping greater than $12,000 in a matter of hours.

The announcement got here after the market was already mushy following experiences of latest export restrictions on uncommon earth metals by China. President Trump’s late afternoon submit on Reality Social confirming further tariffs beginning November 1st sparked panic promoting in each spot and derivatives markets.

Analyst Bob Lucas described the occasion as a “coronavirus-level nuke,” evaluating it to the March 2020 crash. Others, like Lumida Wealth’s Ram Ahluwalia, famous that “overbought situations and leverage buildup amplified the decline.”

This transfer highlights Bitcoin’s continued sensitivity to geopolitical shocks, particularly when macro uncertainties collide with positioning limits.

Level-to-dip accumulation of international alternate outflows

In keeping with Coinglass information, there was a internet outflow of $403.7 million on October 11, following the $522.9 million in withdrawals recorded earlier this week. This constant outflow development means that buyers are withdrawing Bitcoin from exchanges regardless of volatility, an indication usually related to accumulation and long-term storage.

Whereas short-term merchants confronted widespread liquidations, on-chain information exhibits that whales and long-term holders had been internet consumers across the $110,000 zone. Traditionally, giant liquidations of this dimension have coincided with localized bottoms, particularly if sustained outflows observe in subsequent classes.

Technical state of affairs turns cautious

From a technical perspective, Bitcoin stays at a essential inflection level. Resistance lies at $115,800 and $117,500 (50-day EMA and 20-day EMA), adopted by $120,000 because the higher rejection zone. On the draw back, the $111,000 to $107,800 space varieties a confluence of horizontal and EMA assist, with deeper demand at $103,000.

The RSI has fallen sharply in the direction of the mid-$40s, confirming the lack of momentum, however not but in oversold territory. The MACD stays in a bearish crossover, elevating the chance that the worth decline will proceed until BTC regains $116,000.

| Bitcoin technical predictions | stage |

| resistance stage | $115,800, $117,500, $120,000 |

| assist stage | $111,000, $107,800, $103,000 |

| Essential EMA cluster | 20EMA $117,493 – 50EMA $115,792 |

| bias in momentum | Bearish beneath $115,000 |

| Studying OBV | 1.74 million individuals (impartial to accumulation stage) |

Outlook: Will Bitcoin Rise?

Bitcoin’s subsequent transfer will rely upon whether or not consumers can stabilize the worth motion above the $111,000 assist and reestablish power across the $115,000 zone. The present restoration is modest and market sentiment stays cautious after large-scale liquidations and macro-driven uncertainty.

Nevertheless, on-chain information displaying sustained outflows and resilient OBV suggests that giant buyers proceed to build up. If Bitcoin regains $117,500, a rescue rally towards $120,000 might rapidly unfold.

Till then, merchants ought to keep watch over $111,000 as an essential pivot. A break beneath this stage might expose you to $107,800 and even $103,000. For now, Bitcoin stays underneath stress, however stays structurally intact in its long-term uptrend and stays well-positioned for a restoration as soon as macro situations stabilize.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.