- Bitcoin has struggled under key EMAs, indicating that sellers preserve management throughout key time frames.

- Regardless of bearish market stress, excessive futures open curiosity exhibits optimism amongst cautious merchants.

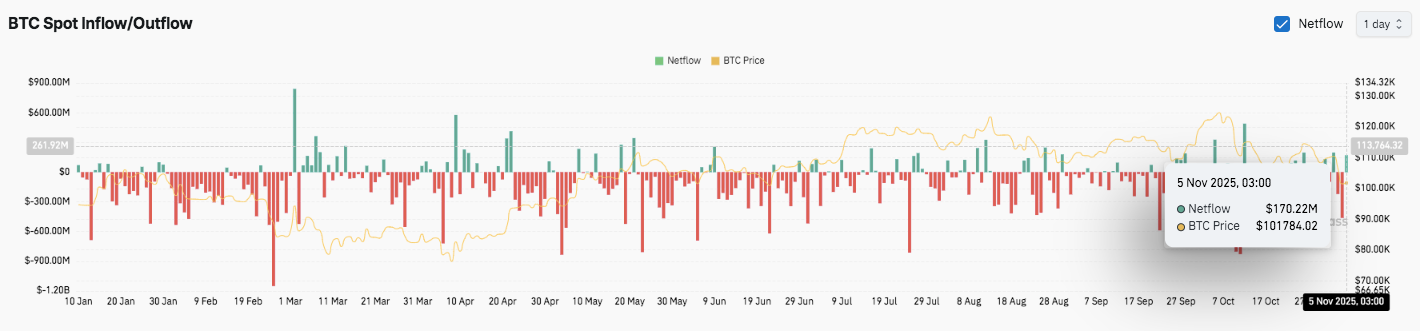

- The current influx of $170 million suggests early accumulation after BTC’s sharp correction in October.

Bitcoin (BTC) is buying and selling round $101,839 after retreating from the $102,000 degree, reflecting the market’s persistent bearish sentiment. Regardless of occasional pullbacks, the broader construction suggests sellers preserve management throughout key time frames. The asset’s 4-hour chart reveals continued weak point under key transferring averages, indicating restricted restoration momentum.

Market construction displaying continued stress

Bitcoin continues to be under the 20, 50, 100, and 200 exponential transferring averages, confirming that the downtrend is dominant. The supertrend indicator reinforces this bias, displaying that current restoration makes an attempt have failed close to the resistance zone. Costs are presently buying and selling simply above the important thing help band of $101,000 to $100,000, an space the place consumers have traditionally stepped in to stop additional declines.

Moreover, merchants are retaining an in depth eye on the Fibonacci retracement zone from the $126,383 excessive to the $103,634 low. The 38.2% degree close to $110,324 represents the primary main resistance, adopted by a 50% retracement at $115,008, which coincides with the 100-EMA.

These overlapping resistances create a technical ceiling that have to be cleared for bullish momentum to reemerge. Additional upside boundaries seem round $117,692 and $121,514.

Derivatives market displays threat urge for food

Bitcoin futures open curiosity stays remarkably excessive regardless of current volatility. As of November 5, 2025, the index is $67.36 billion and the spot value is hovering round $101,428.

This persistence suggests merchants are sustaining vital publicity and factors to cautious optimism within the derivatives market. The regular enhance in open curiosity since September signifies continued participation from each retail and institutional buyers.

Nonetheless, elevated leverage ranges elevate issues about potential liquidation cascades. A pointy decline under the $100,000 psychological ground may set off aggressive long-term liquidations and amplify volatility. Subsequently, sustaining value stability past this zone stays important for short-term sentiment restoration.

New accumulation of influx alerts

Current influx information exhibits early indicators of investor re-engagement. After weeks of dominant outflows, round November 5, the trade recorded internet inflows of roughly $170 million.

This sample suggests a possible buildup of bargains following a pointy correction from October’s highs. Continued outflows early within the quarter signaled warning as merchants moved belongings off exchanges amid uncertainty.

Technical outlook for Bitcoin value

As Bitcoin trades round $101,800, key ranges stay strictly outlined. Upside resistance lies at $105,000, $107,800, and $110,324, with a possible breakout extending to $115,008 and $117,692. These resistance ranges coincide with the 100-EMA and Fibonacci retracement, forming an vital provide cluster.

On the draw back, help lies at $101,000 and the psychological $100,000 degree, adopted by deeper cushions round $98,000 and $96,500. The 4-hour chart exhibits value motion under all main EMAs, indicating sustained bearish stress. The Supertrend indicator continues to flash promote alerts, highlighting that brief positions nonetheless dominate the market.

The general construction means that Bitcoin is consolidating inside a tightening vary after a pointy correction. A decisive break above $107,800 would sign the primary signal of a pattern reversal, whereas a lack of $100,000 may speed up draw back momentum.

Will Bitcoin regain momentum?

Bitcoin’s value trajectory will depend upon whether or not the bulls can defend the help at $100,000 and transfer above the $107,000-$110,000 resistance cluster. Sustained inflows and robust open curiosity of over $67 billion recommend investor confidence, however excessive leverage makes the market susceptible to volatility.

If shopping for stress will increase across the present zone, Bitcoin may get better in the direction of $115,000 and even $121,000 within the coming periods. Nonetheless, in the event you fail to retain $100,000, you might incur additional losses in the direction of $96,500. For now, BTC is at a pivotal stage, the place stability above key help ranges will decide whether or not a brand new bull market can kind.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.