- Bitcoin falls under the 200 EMA as consumers defend lows and sellers cap the rally

- Because the return stays shallow, open curiosity stays excessive and volatility danger will increase.

- Sustained spot outflows recommend defensive positioning regardless of strategic long-term optimism

Bitcoin ended December with extreme consolidation and heightened uncertainty, buying and selling round $89,400. After a risky month, worth tendencies have slowed to a slender vary. Consequently, merchants have been centered on whether or not consumers would be capable to regain management or whether or not sellers would lengthen the correction.

The 4-hour chart exhibits Bitcoin transferring sideways with a gentle bearish pattern. Worth remained under the 200-period EMA on a downtrend, persevering with to restrict any upside makes an attempt. Nevertheless, secure demand close to decrease ranges prevented a pointy collapse.

Technical construction Sign compression

On the 4-hour timeframe, Bitcoin continued to maneuver in a corrective moderately than an impulsive method. Sellers repeatedly defended the $91,500-$92,000 zone, rising provide stress. Nevertheless, consumers continued to defend the lows within the $85,800 to $86,000 vary. Subsequently, this construction displays stability moderately than pattern decision.

The short-term EMA was considerably compressed, suggesting a decline in momentum. Such compression is usually preceded by volatility enlargement. Moreover, the supertrend indicator remained bearish, limiting upside follow-through throughout the rebound.

The primary resistance degree centered round $90,800, adopted by a heavier provide band between $91,600 and $92,000. A decisive pullout above this space might drive momentum in the direction of $94,600. Conversely, a lack of $87,000 might expose the $85,000 to $84,000 space.

Watch out with derivatives and spot flows

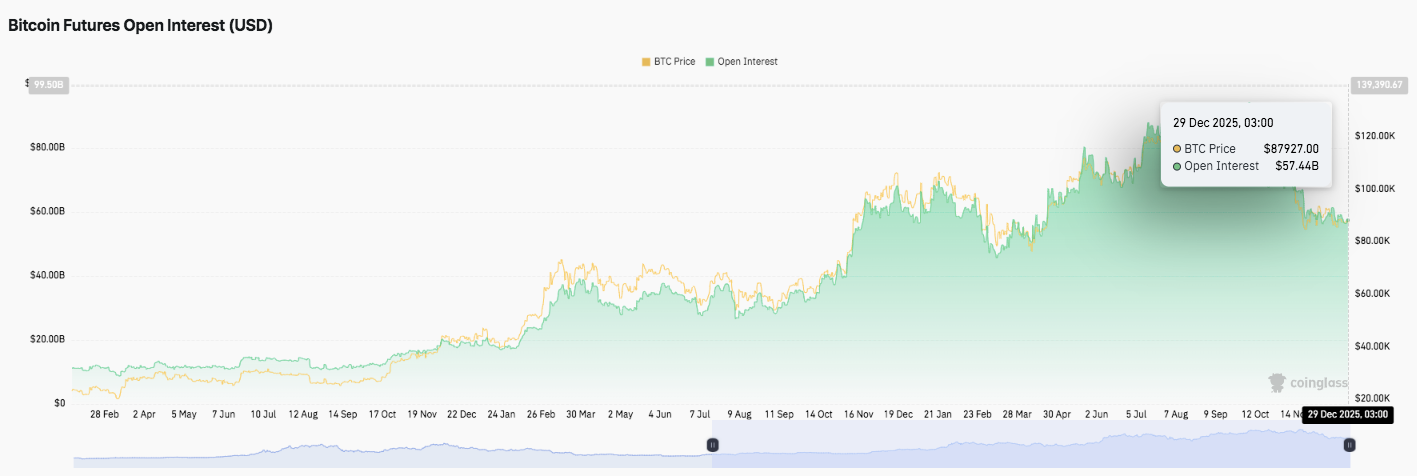

Bitcoin futures information has revealed a steady improve in open curiosity in latest weeks. Open curiosity rose as costs rose, reflecting new leveraged participation. Importantly, the decline in open curiosity remained shallow even throughout consolidation.

Associated: Cardano Worth Prediction: ADA Makes an attempt Base as Consumers Shield Low of Vary

Consequently, merchants largely maintained their publicity by way of the correction. Nevertheless, the latest leveling off at round $57 billion suggests a rising sense of warning. Such pauses usually seem earlier than volatility spikes, particularly when positioning is crowded.

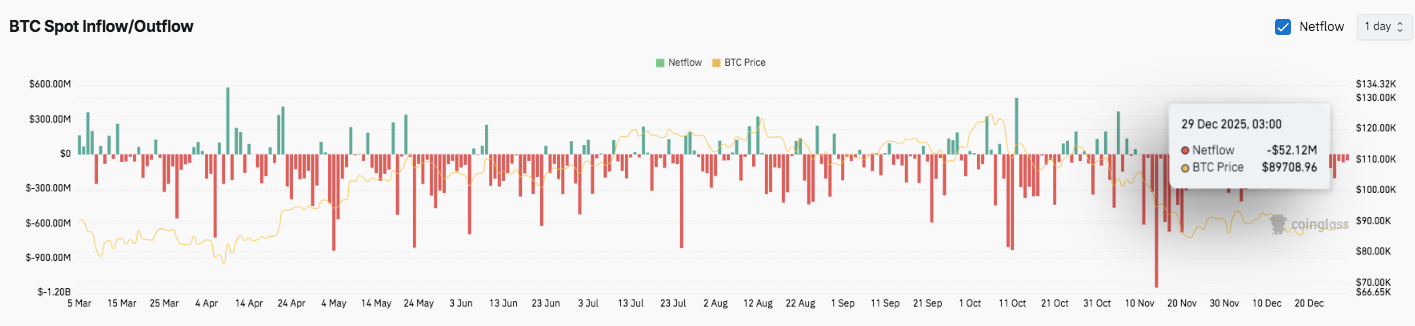

Spot circulate information strengthened the market’s defensive stance. Outflows have constantly exceeded inflows, indicating prudent capital habits. Moreover, the surge in massive outflows coincided with a decline in native costs. This sample highlighted the liquidity flowing out of the alternate throughout draw back worth actions.

Though there was a short-term burst of inflows, it steered tactical buy-in moderately than sustained accumulation. In late December, internet inflows remained destructive, together with notable outflows close to $89,700.

Saylor Sign provides strategic context

Michael Saylor’s latest “again to orange” message added one other layer to market sentiment. Observers related the indicators with previous strategic accumulation phases. Nevertheless, the acquisition was by no means confirmed after this publish.

The technique not too long ago paused shopping for following earlier accumulation indicators, suggesting a disciplined pacing. Nonetheless, traders usually view Strategic’s actions as faith-based moderately than speculative. Consequently, whereas short-term indicators prompted warning, expectations for future shopping for supported long-term confidence.

Technical outlook for Bitcoin worth

Bitcoin trades inside a 4-hour vary, so the important thing ranges stay well-defined.

Upside ranges embrace $90,500 and $91,600, the place earlier rejections stay concentrated as quick hurdles. A decisive break above $92,000 would strengthen the bullish momentum and will begin a transfer in the direction of $94,600 after which in the direction of the prolonged degree of $103,300.

Associated: Zcash Worth Prediction: Zcash Consolidates After Rejection As Merchants Be Alert…

On the draw back, $88,800 serves as the primary line of intraday help. Beneath that, the $87,600 to $87,000 zone stays an necessary structural and Fibonacci help space.

Failure to take care of this vary will expose the $86,000 demand zone that has stored costs low all through December. A lack of $86,000 would weaken the broader construction and shift focus to $83,900.

The highest of resistance lies close to the falling 200 EMA at $91,600. This degree stays an necessary barrier to reversing enhancing medium-term tendencies. Technically, Bitcoin continues to compress under this transferring common, reflecting a decline in directional confidence.

The larger image suggests worth compression inside a correction vary moderately than an impulsive pattern. This construction usually happens earlier than volatility expands when worth breaks out of a spread. Subsequently, checking route stays necessary.

Will Bitcoin rise additional or roll over?

Bitcoin’s near-term outlook depends upon whether or not consumers can maintain onto the $87,000 help zone lengthy sufficient to problem the $91,600-$92,000 resistance cluster. If the power above resistance persists, it’s going to push in the direction of $94,600. Nevertheless, if the worth isn’t maintained at $87,000, there’s a danger that downward stress will speed up under $85,000.

For now, Bitcoin stays in an important technical zone. Compression, rising derivatives positioning, and cautious spot flows recommend a decisive transfer is on the horizon. The following leg will rely upon affirmation from worth construction, quantity, and follow-through above key resistance.

Associated: Shiba Inu worth prediction: SHIB stabilizes near-term lows as provide indicators enhance

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.