- Bitcoin falls under its annual development line, loses its 20/50/100-day EMA, and short-term momentum shifts to sellers.

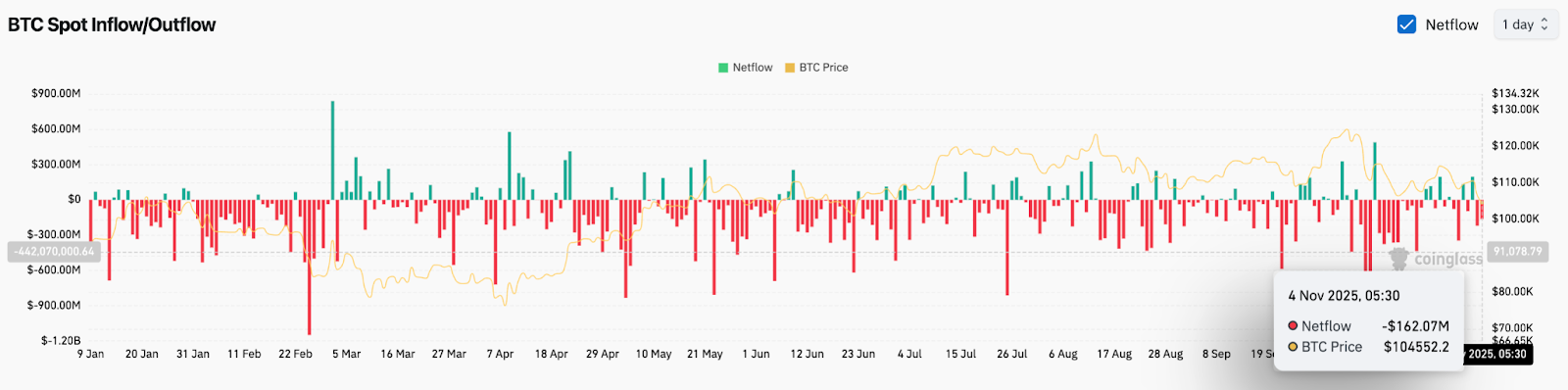

- International trade outflows amounted to $162 million, indicating a decline in demand and indicating that consumers usually are not actively collaborating.

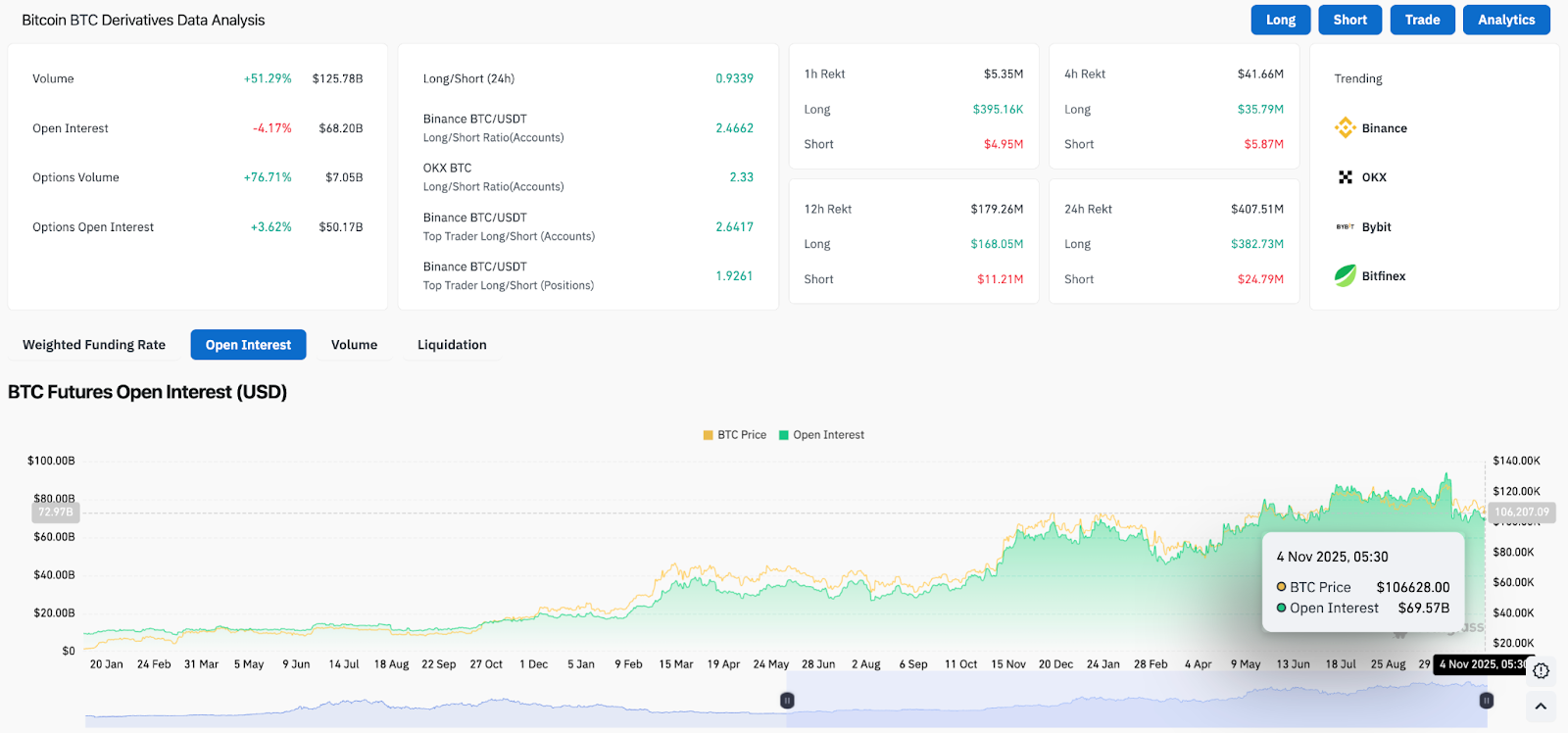

- Derivatives markets unwinded, with $382 million in long-term liquidations and open curiosity down greater than 4%.

Bitcoin value immediately is buying and selling round $104,480, under the uptrend line that supported the complete 2025 uptrend. This chart exhibits a break in value from a year-long symmetrical construction, a change that spotlights the psychological assist zone round $100,000. Momentum waned as leveraged positions have been unwound, and consumers have been much less keen to intervene.

EMA reverses to resistance and value checks long-term development line

The value development of Bitcoin did not get better the 20-day EMA and 50-day EMA close to $112,000, and turned downward. Each transferring averages reject costs in consecutive periods, indicating that sellers are controlling short-term momentum. The 100-day EMA close to $110,250 is at the moment a ceiling fairly than a assist.

The uptrend line from April, the identical one which has cushioned all the large declines this yr, has now been damaged. Promoting stress elevated when the worth fell under the share value. The 200-day EMA close to $108,355 is the final main technical barrier earlier than Bitcoin faces a transparent path in the direction of $102,000 and $100,000. A cluster of ranges between $108,000 and $110,000 will decide whether or not this breakdown ends in a whole development change.

If the worth closes under $100,000, the following robust demand zone will probably be round $96,500. If the worth rises once more above $112,000, the failed breakdown turns into a bear entice and units the stage for a rebound in the direction of $116,000 and $124,000.

Spot outflows point out a decline in demand

Spot movement knowledge confirms danger discount. Coinglass recorded an outflow of $162.07 million on November 4, spurring a weeks-long purple bar development. Sustained outflows point out traders are transferring cash out of exchanges, and are sometimes an indication of much less urge for food for energetic buying and selling and accumulation.

The on-balance sheet quantity line has been flat since August. There was no spike in accumulation throughout this pullback. With out robust inflows, rallies change into unconvincing and shortly disappear. That is why all restoration makes an attempt close to the EMA cluster are going through difficulties.

Derivatives markets present unwinding of lengthy positions

Futures markets are in step with the weak point seen in spot flows. Open curiosity decreased by 4.17% to $68.2 billion, indicating that merchants are closing positions fairly than including new leverage. Lengthy-term liquidations totaled $382.73 million prior to now 12 hours, confirming that pressured promoting contributed to the latest decline.

Futures and choices market quantity jumped to $125.78 billion and $7.05 billion, indicating hedging fairly than accumulation. Funding charges stay impartial throughout main exchanges. Merchants are defensive, not aggressive.

outlook. Will Bitcoin go up?

The following 72 hours have been decisive for Bitcoin. Patrons ought to keep the $102,000 to $100,000 zone to keep up a broader construction. A definitive shut above the EMA cluster round $112,000 would point out power and pave the way in which for a goal above $116,000. If spot inflows return to optimistic ranges, demand is returning, confirming that the latest breakdown was nothing greater than a shakeout.

Failure to defend $100,000 would invite momentum promoting and expose deeper assist close to $96,500, indicating a shift from a pullback to a correction. For now, Bitcoin’s long-term development stays bullish, however short-term momentum favors sellers. A detailed above $112,000 would restore purchaser management, however continued rejection at that degree places Bitcoin value liable to additional decline immediately.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.