- BTC is buying and selling close to $87,050 as patrons defend the $86,000 trendline that helps the long-term construction.

- Spot and ETF outflows have exceeded $270 million in two periods, and the stress continues to mount with every rebound try.

- Worth stays under all main EMAs, leaving Bitcoin trapped between rising long-term assist and a falling channel.

Bitcoin worth at present is buying and selling round $87,050 after defending the $86,000 assist zone for the second session. This rally comes as sellers proceed to place stress available on the market with heavy spot and ETF outflows, forcing patrons to stay to a slender vary whereas the general development stays down.

The worth is under the 20-day EMA of $93,937, the 50-day EMA of $101,716, and the 200-day EMA of $105,813. This correction retains the construction bearish regardless of the latest rebound. This chart exhibits Bitcoin caught between an ascending long-term trendline and a descending short-term channel, making a compressed setup forward of the ultimate buying and selling day of November.

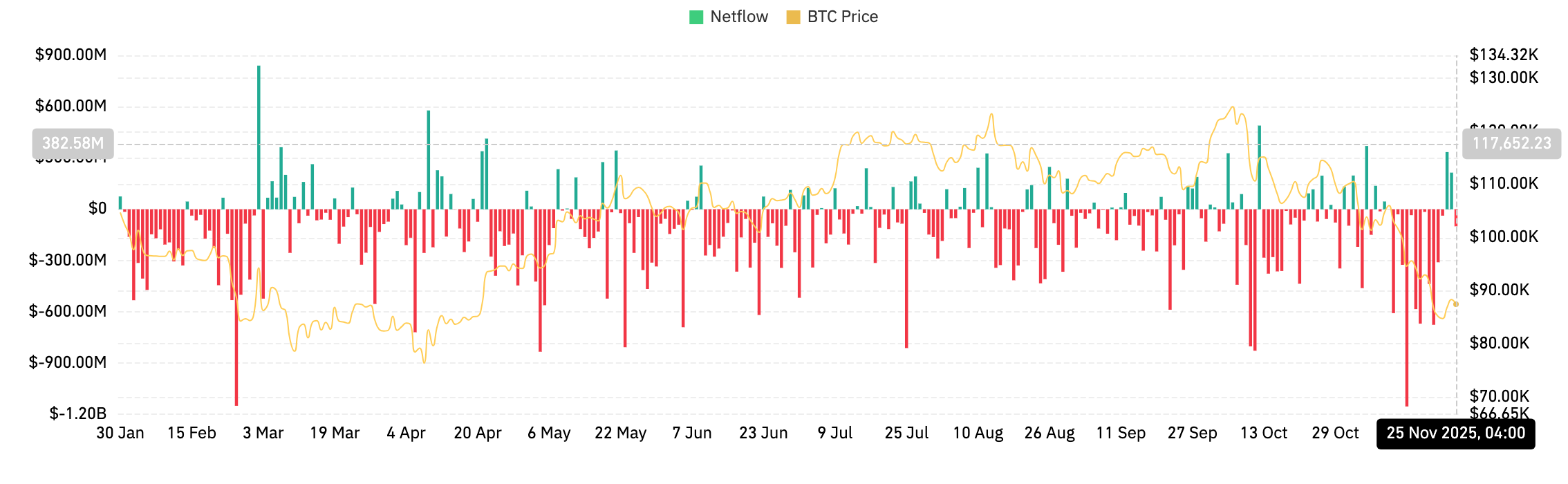

Spot outflows improve as purchaser participation slows

Web outflows on Nov. 25, one of many largest exit days this month, have been $122.39 million, in accordance with Coinglass information. The crimson streak in latest periods displays constant promoting stress because the coin returns to exchanges somewhat than chilly wallets. Merchants proceed to unwind publicity somewhat than add measurement, which removes upward momentum from the tape.

This imbalance within the distribution started to be seen from the start of November. Each try and recuperate above $90,000 has been met with recent outflows, indicating that sentiment stays cautious.

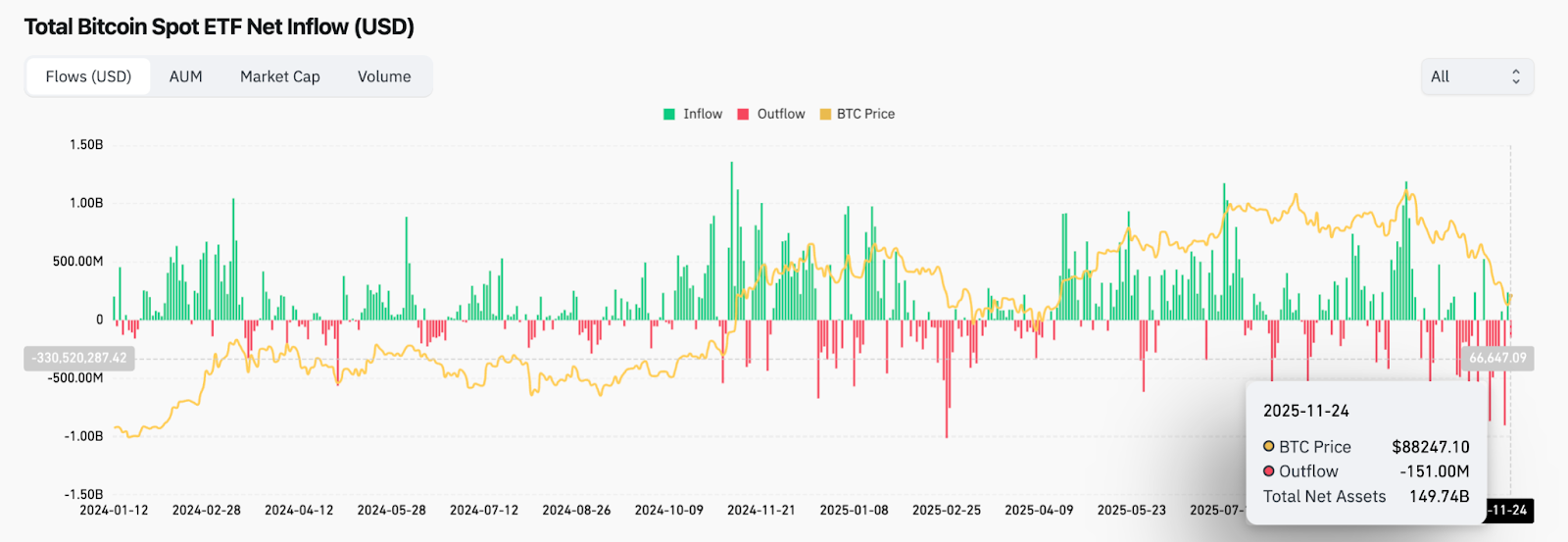

Downward stress will increase resulting from ETF outflows

Bitcoin spot ETF flows add additional stress. On November twenty fourth, the ETF recorded outflows of $151 million. That is according to a broader two-week development of redemptions outpacing inflows and pulling liquidity away from the spot market.

Associated: Ethereum Worth Prediction: ETH struggles with downtrend as BitMine grows to three% provide share

The ETF’s complete internet belongings are practically $149.74 billion, and up to date exits point out the fund is decreasing threat somewhat than including to positions at decrease costs.

Trendline retest defines medium-term construction

On the day by day chart, Bitcoin is buying and selling under the whole EMA cluster. The failure to retake the 20-day EMA at $93,937 retains short-term momentum firmly in place amongst sellers. The supertrend indicator is at $98,103 and stays within the crimson, reinforcing the downtrend.

The long-term uptrend line from early 2023 is presently offering vital assist. Worth not too long ago rebounded from this zone round $86,000. If patrons maintain this line, Bitcoin can maintain the broader uptrend even when short-term momentum stays weak. If the worth breaks under the development line cleanly, the medium-term construction will transfer right into a deeper correction part.

Associated: Solana Worth Prediction: SOL Makes an attempt to Rally as ETF Enlargement Alerts Market Curiosity

Downward resistance from the $124,000 peak continues to cap the rally. Any rejection alongside this line ends in a fall within the highs, indicating that sellers are nonetheless in command of the sample.

Intraday momentum signifies early stabilization

The 30-minute chart supplies a extra detailed view of short-term habits. The worth is buying and selling inside an uptrend channel that began after the sharp decline to the $82,000 space. Channel assist close to $86,500 has held by way of a number of exams, indicating that intraday patrons are energetic at this degree.

VWAP is sitting close to $87,693 and the worth is buying and selling barely under that, indicating delicate draw back stress throughout the present commerce. The SAR dot has reversed above the worth, indicating a brief change that’s unfavorable to patrons. For a stronger restoration, Bitcoin wants to interrupt by way of $88,272 and regain higher channel resistance close to $90,500.

If this channel can maintain the US session, Bitcoin may try additional positive aspects in direction of the $89,500 space. If the worth loses the decrease sure of the channel, the market will doubtless revisit $85,500 and check deeper liquidity pockets.

outlook. Will Bitcoin go up?

Bitcoin is presently sitting above key assist that can decide the following massive swing.

- Bullish case: A detailed above $93,937 adopted by stable quantity to $101,716 would point out patrons regaining management. The decision of the EMA cluster will pave the way in which for $110,000, weakening the downtrend that dominated November.

- Bearish case: A day by day shut under $86,000 will break the long-term development line and expose the $82,000 space. A lack of this degree would scale back liquidity, additional rising stress on $78,500.

As soon as Bitcoin regains its 20-day EMA, momentum will start to stabilize. If the inventory falls by $86,000, the correction part will deepen into December.

Associated: Monad (MON) Worth Prediction 2025, 2026, 2027, 2028-2030

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.