- BTC continues to be restricted beneath $90,000 because the downtrend line and EMA cluster restoration is blocked.

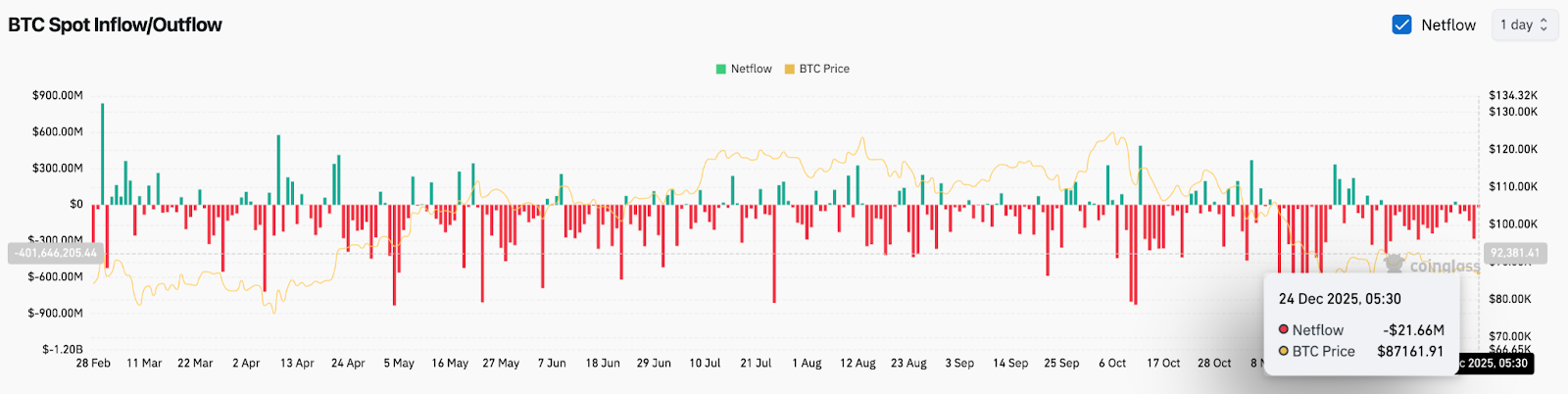

- Spot outflows proceed, with $21.6 million leaving the trade on December twenty fourth.

- Weak momentum and diminished liquidity have stored Bitcoin trapped in a bearish consolidation.

Bitcoin worth right this moment is buying and selling close to $87,000, hovering simply above a fragile short-term assist zone as sellers proceed to dictate construction. The market stays locked beneath the steeply declining pattern line from the October peak, whereas persistent spot outflows restrict any restoration makes an attempt. Bitcoin is approaching a brand new resolution level on December twenty fifth as volatility compresses and momentum weakens.

Construction turns into heavier attributable to pattern line breakdown

On the day by day chart, Bitcoin continues to be in a correction part after shedding the uptrend line that supported its rise to October highs above $126,000. This break decisively modified the character of the market. Since then, the worth has recorded decrease highs and decrease lows, with every rally failing beneath dynamic resistance.

The downtrend line is at present intersecting close to the $90,000 to $92,000 space. All makes an attempt to reclaim the area have stalled, reinforcing bearish bias. Bitcoin can also be buying and selling effectively beneath the key EMA cluster. The 20-day EMA is close to $88,800, the 50-day EMA is close to $93,000, and the 100-day EMA is close to $98,700. The 200-day EMA close to $101,700 continues to be effectively above the worth, highlighting how far the market has strayed from its earlier pattern.

Associated: Ethereum Worth Prediction: ETH trades sideways throughout resistance…

The supertrend stays firmly within the crimson on the day by day timeframe, confirming that sellers preserve directional management. The broader construction will stay corrective till the worth closes above the EMA for not less than 50 days.

Quick-term charts present weak follow-through

The two-hour chart confirms the dearth of conviction. The worth continues to swing between $86,000 and $89,000, with the parabolic SAR dot largely remaining above the worth. The short-term rebound has been met with promoting close to $88,500 to $89,000, respectively.

Directional indicators additionally point out that momentum is weakening. DMI readings point out that the energy of the pattern is weakening and that patrons usually are not clearly within the ascendant. That is according to the bigger image of consolidation inside a bearish framework quite than accumulation forward of a breakout.

Upward strain on costs continues attributable to spot outflows

Circulate knowledge continues to validate the chart construction. Bitcoin spot internet flows stay adverse, indicating that liquidity is flowing out of exchanges quite than flowing into them.

Associated: Pi Community Worth Prediction: Consumers maintain $0.2 as market waits for route change

Internet outflows on Dec. 24 confirmed a further $21.6 million in outflows, a sample that continued via many of the fourth quarter.

A narrative that emphasizes feelings in direction of the top of the yr

Past the charts, Bitcoin’s year-end weak spot displays structural pressures quite than an absence of macro assist. Analysts on the London Crypto Membership spotlight promoting by long-term holders across the $100,000 degree, which isn’t depending on a secure worth. This provide acted as a mechanical overhang, absorbing bids whilst liquidity circumstances improved.

The assumption in Bitcoin’s four-year cycle has additionally turn into self-defeating. With a halving story extensively anticipated, merchants obtained forward of the transfer, triggering early profit-taking quite than pattern extension. Because of this, the rally rapidly stalled as an alternative of getting worse.

The $19 billion liquidation incident in October left a fair deeper scar. Though costs rebounded, liquidity suppliers seem to have subsequently diminished publicity, thinned the order e book, and restricted follow-through via December. The market has stabilized, however the pattern energy continues to be weak.

Bitcoin will not be a hedge, but in addition capabilities as a danger asset that’s delicate to liquidity. As high-beta buying and selling cooled in late 2025, crypto danger urge for food declined regardless of strong efficiency in gold and equities. This distinction displays positioning quite than a breakdown in principle.

Long term, analysts stay constructive via 2026, pointing to institutional adoption, regulatory developments, and elevated liquidity. For now, provide and positioning proceed to outperform the narrative, protecting strain on costs till the construction improves.

outlook. Will Bitcoin go up?

Bitcoin continues to appropriate, however is in a bearish construction.

- Bullish case: A powerful shut above $93,000 will reverse the pattern line and resume upwards in direction of $98,000 and $101,000.

- Bearish case: Chapter is confirmed with a lack of $85,000, $82,000 is in danger, and the chance will increase to $78,000.

Sellers stay in management till improved flows carry costs again to key resistance ranges, with endurance favoring affirmation over expectations.

Associated: Cardano Worth Prediction: ADA faces strain as builders push for late-night growth

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.