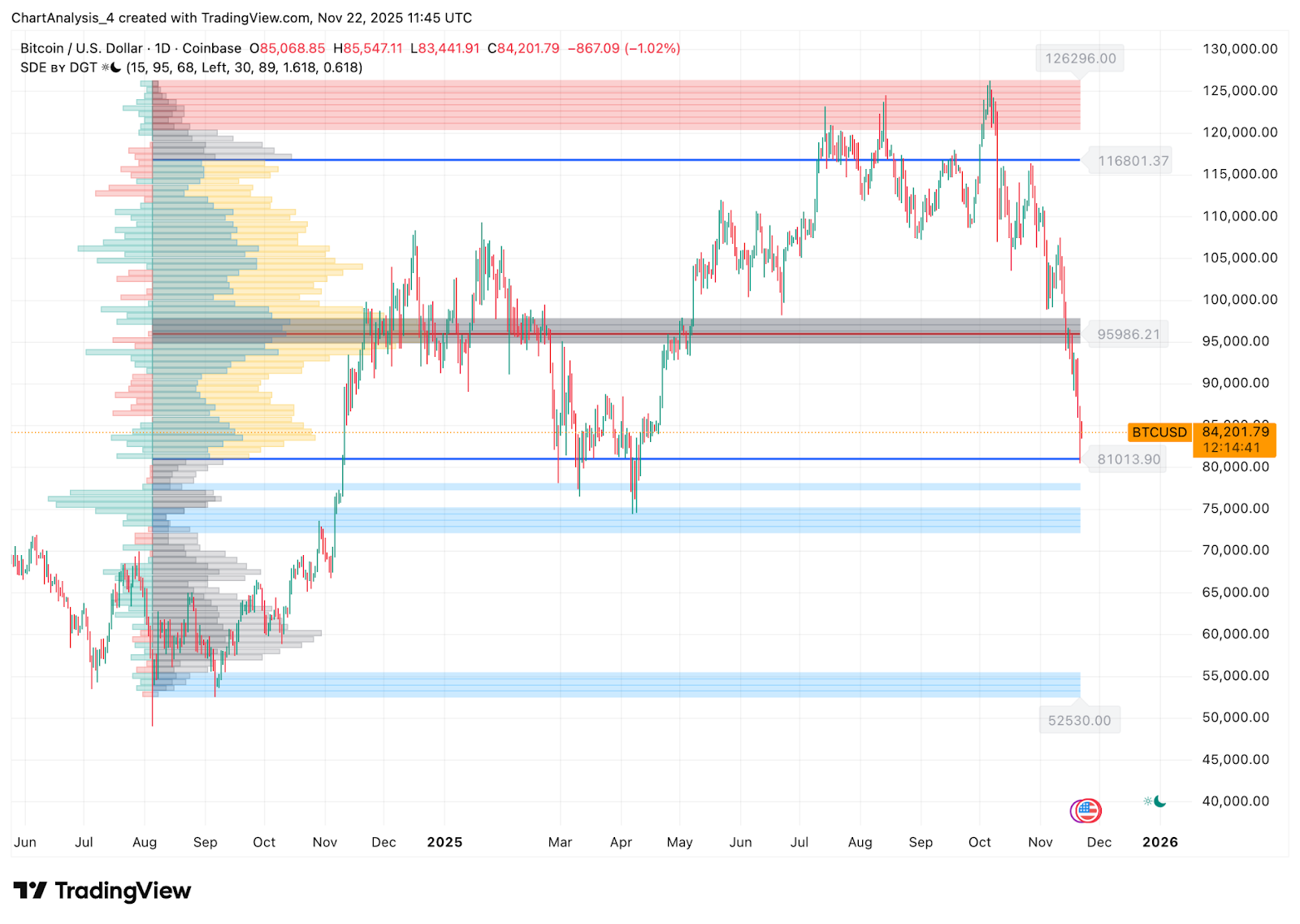

- Bitcoin is buying and selling round $84,200 after shedding the assist cluster at 95,900 and retesting the long-term pattern line.

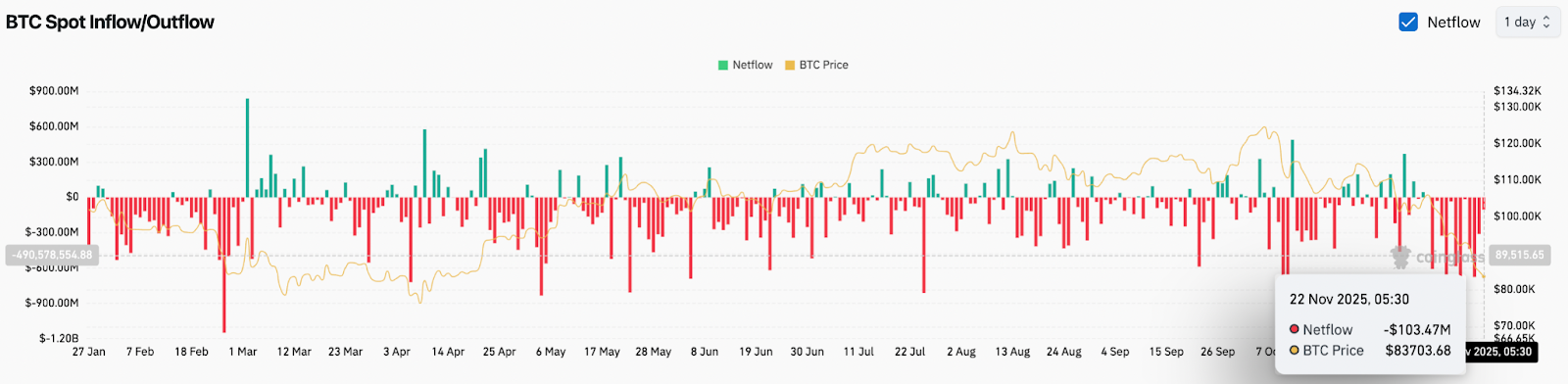

- Spot outflows elevated by $103 million, extending the interval of enormous deficits that worn out any rebound by one month.

- BTC is at present above the important thing demand zone of $81,000 because the slope of the EMA decreases and intraday construction favors continuation over reversal.

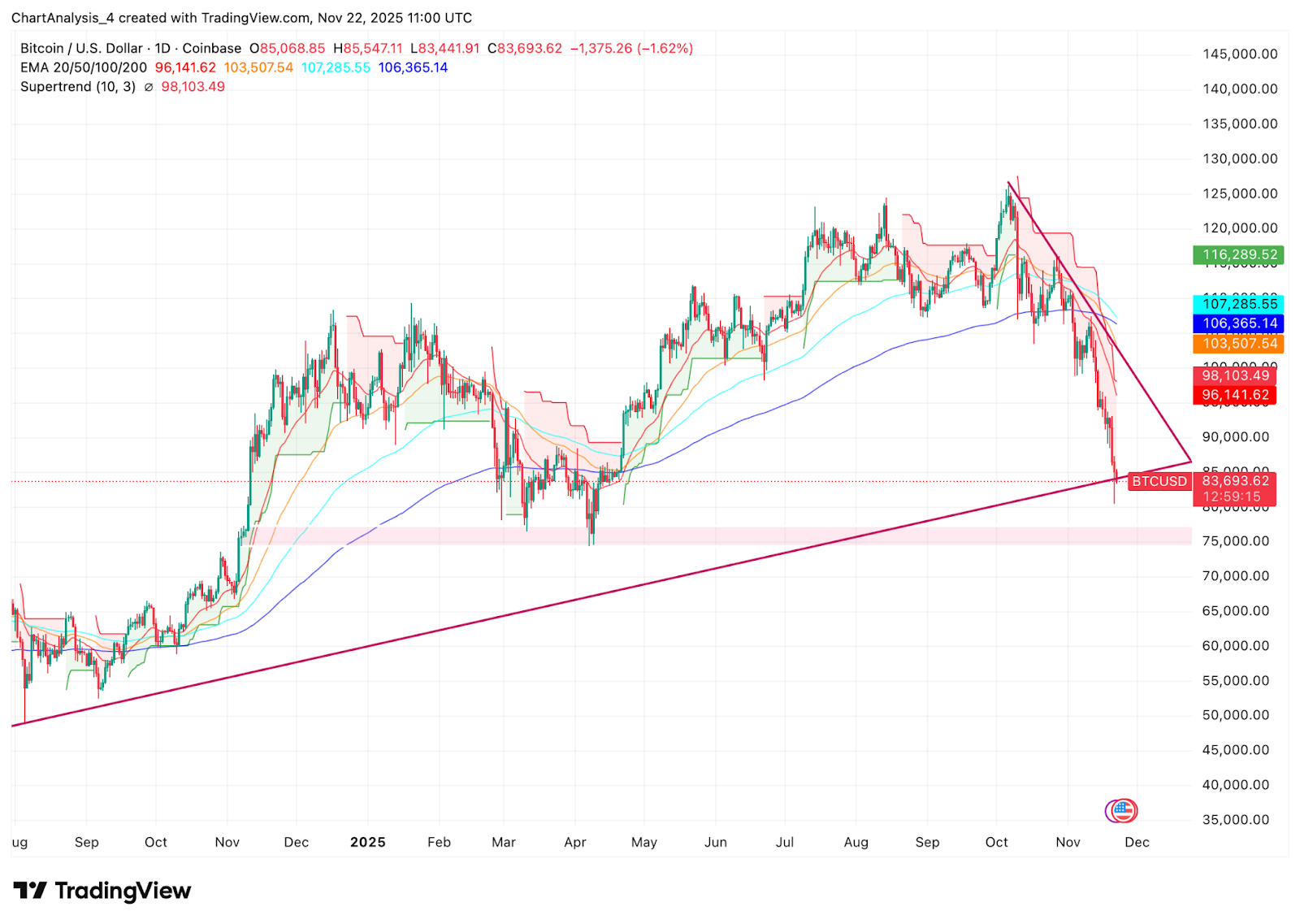

Bitcoin is buying and selling round $84,200 after breaking beneath the $95,900 assist cluster that has held for many of this yr. The rejection at $116,800 triggered a pointy rotation of lengthy positions, with sellers pushing the worth straight into the market-defining long-term pattern line.

Spot outflows improve as danger urge for food weakens

Based on CoinGlass information, round $103 million left the change on November twenty second, one other day of mass outflows.

This led to a month of sustained crimson flows, together with a number of classes with internet exits in extra of $200 million. Liquidity is flowing out of the ecosystem slightly than flowing into it, and this modification explains why every bounce try rapidly disappears.

A break within the pattern line is a sign of short-term weak point.

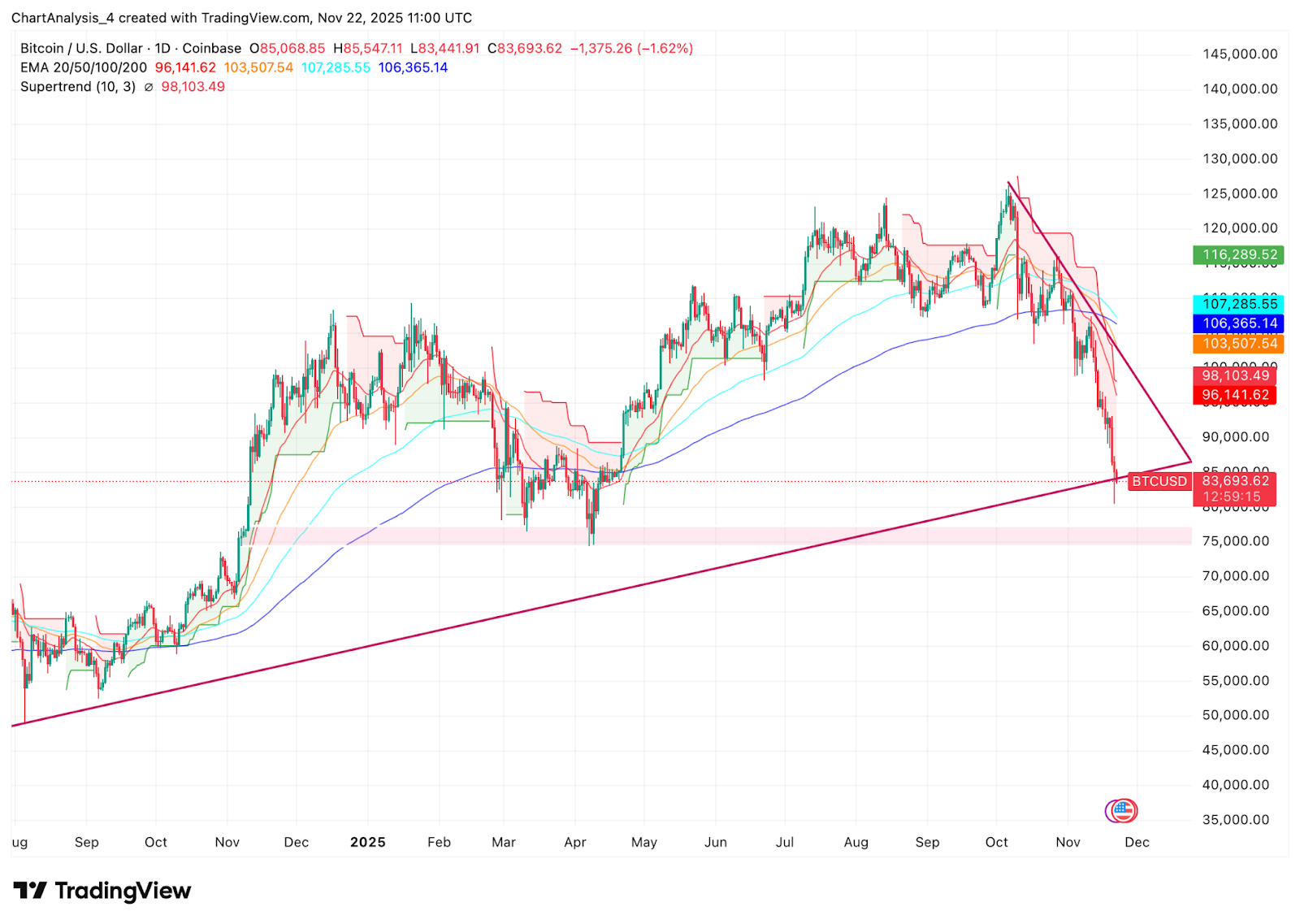

The every day chart reveals a transparent rejection sample. Bitcoin failed to interrupt above $116,800 and flipped violently. Worth then misplaced the 20-day, 50-day, 100-day, and 200-day EMAs in fast succession. All 4 EMAs are downward sloping and are appearing as stacked resistance zones.

The supertrend turned bearish round $98,100 and continued to maneuver beneath the worth. This flip marked the start of the present leg down. A break within the ascending diagonal has eliminated the final structural assist earlier than the present check of the long-term base.

Quantity profile ranges additionally improve the identical scenario. Bitcoin misplaced its excessive participation zone round $95,900, which had served as a key management level for nearly eight months. The subsequent vital layer of liquidity is round $81,000, adopted by a broader accumulation belt between $76,000 and $72,000. Under that zone, there seems to be a good deeper pocket round $52,500, however that may solely have an effect if the present correction part turns right into a full macro reversal.

For now, the pattern stays bearish so long as the worth stays beneath the resistance band round $96,000 to $103,000.

Sellers keep management of intraday construction

Regardless of short-term stabilization makes an attempt, the intraday construction stays weak. The 30-minute chart reveals Bitcoin coiling inside a tightened symmetrical triangle after plummeting from the $87,000 space.

The parabolic SAR dot is above worth on most consolidations, confirming sustained draw back strain. All makes an attempt to rally in direction of $85,000 have been rejected earlier than reaching the highest of the triangle, indicating that consumers will not be robust sufficient to pressure a breakout.

The RSI is hovering round 48.86, suggesting indecision, however the general pattern stays bearish. Momentum stays unchanged and restoration makes an attempt are likely to decrease the highs with every push.

A breakdown beneath $83,800 confirms the continuation of the present draw back and divulges the $82,500 to $81,000 demand zone. A breakout above $85,000 can be the primary signal of energy, however a follow-through above $85,600 can be required to invalidate the sample. Till that occurs, sellers stay in management and consolidation favors continuation over reversal.

Will Bitcoin go up?

Bitcoin is at present on a long-term pattern line and its subsequent transfer will rely fully on how consumers react between $83,000 and $81,000.

- Bullish case: Bitcoin must regain $89,500 and shut above the 20-day EMA. The continued breakout above $96,000 signifies that consumers are regaining momentum within the pattern. Above $103,500, the construction will transfer again towards the $116,800 resistance.

- Bearish case: If the day’s closing worth falls beneath $81,000, we are able to verify that the long-term base has fully collapsed. This reveals a deeper zone between $76,000 and $72,000, and failure to maintain this vary will pave the way in which for a $52,500 liquidity pocket.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.