- Bitcoin worth at the moment is hovering round $91,450 after shedding its multi-month trendline and falling in the direction of the $90,500 assist zone.

- The every day EMA turned fully bearish as sustained spot outflow reached $125.46 million on November nineteenth.

- Bitwise CIO Matt Hougan says “the underside is in,” however the worth development is unsure as sellers are eyeing $88,000 subsequent.

Bitcoin worth has failed to stick to the multi-month trendline that has underpinned each rally since early 2024, buying and selling round $91,450 at the moment. This breakdown firmly shifted short-term momentum to the sellers as spot outflows accelerated and the every day EMA become overhead resistance.

Weekly development line break suggests deepening strain

The weekly chart reveals that Bitcoin has snapped a long-term uptrend line that it has held for over a yr. The candle ended decisively beneath this line, which beforehand served because the spine of the rally from $60,000 to $130,000. After a double high of $130,000 in August, momentum has weakened and the worth has now rolled over towards the midpoint of a broader ascending wedge.

The RSI on the weekly chart is close to 38, the bottom stage because the mid-2023 retracement. This displays a transparent transition to the corrective part. OBV has additionally began to reverse, which doesn’t verify a reversal, however quite signifies much less quantity participation throughout the decline.

Associated: Cardano Worth Prediction: ADA Extends Downtrend as Foreign money Outflows Lengthen

The following main weekly stage is at $88,000, adopted by a deeper liquidity zone between $80,000 and $76,500. These areas coincide with earlier breakout assist from 2024 and signify an important structural flooring for consumers.

Day by day EMA turns bearish as promoting will increase

The every day chart is below rising strain. Bitcoin is buying and selling beneath all the EMA stack of $100,039, $105,858, $108,658, and $107,012. Presently, every EMA has turned downward, forming a bearish cluster that has rejected any restoration makes an attempt since early November.

The Supertrend indicator turned pink at $103,900 and stays bearish. Any try at a rebound from $95,000 to $98,000 rapidly disappeared, displaying how aggressively sellers are leaning upwards.

The character of the market modified when it fell beneath $92,000. Worth is presently testing minor assist at $90,500, indicating a threat of widening in the direction of $88,000 if flows don’t enhance. There isn’t a development reversal sign on the every day chart till Bitcoin reclaims a minimum of the 20 EMA of $100,039.

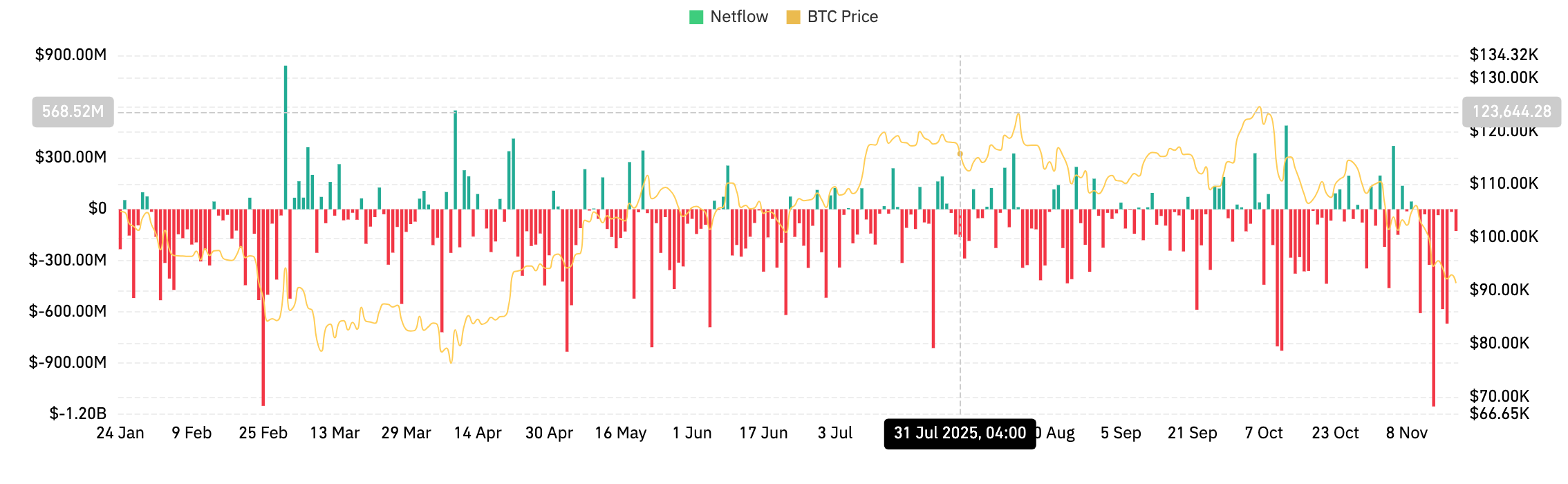

Spot outflows intensify as merchants withdraw capital

There was one other $125.46 million in web outflows on Nov. 19, in keeping with Coinglass knowledge. This sample has been constant for a number of weeks. The chart is dominated by pink marks, with only a few steady inflows from October to November.

Associated: XRP worth prediction: ETF hype fades as sellers steer worth in the direction of channel assist

This outflow construction displays the weak point seen throughout the mid-2021 and mid-2022 corrections, the place persistent pink bars have been a harbinger of a deeper worth retracement. Market members proceed to empty liquidity from exchanges as an alternative of hoarding the shortfall.

Sentiment goals to stabilize as monetary establishments converse out

A notable improvement got here from Bitwise CIO Matt Hogan. “The underside is in,” he stated dwell on CNBC, describing present valuations as “a generational alternative.” Such feedback usually affect short-term sentiment, particularly when the market is close to key technical ranges.

Nevertheless, worth traits nonetheless replicate warning. The market has not responded to the CIO’s assertion with sustained shopping for, and intraday construction stays heavy.

Associated: Ethereum Worth Prediction: ETH faces strain as outflows enhance and channel downtrend deepens

Sentiment might stabilize as monetary establishments start to place themselves extra clearly in the direction of the top of the yr. At this level, the story is outweighing the move.

outlook. Will Bitcoin go up?

Bitcoin is testing main assist after breaking out of a serious trendline. The following transfer will rely upon whether or not the worth can maintain $88,000 and whether or not flows begin to enhance.

- A powerful case. A detailed above $100,000 is required to regain momentum. A break above $103,900 will reverse the supertrend and permit Bitcoin to problem $108,658 after which $112,000. Upside stays restricted until the EMA cluster recovers.

- bearish case. A every day shut beneath $90,500 would expose $88,000. The $88,000 loss interprets right into a broader correction from $80,000 to $76,500, the place the following main liquidity zone is situated.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.