- The technique holds 499,096 BTC, at $40.9 billion, with a mean value of $66,357.

- Since November 2024, the technique has added 246,876 BTC and confronted a lack of $300 million.

- The technique accomplished the $2 billion convertible be aware providing in 2025, including 20,356 BTC.

Dominance within the Bitcoin market depends on Michael Saylor’s earlier micro-tactic: technique.

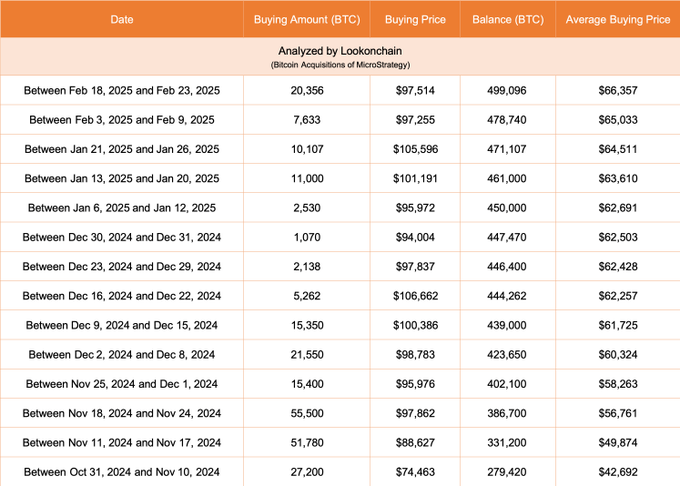

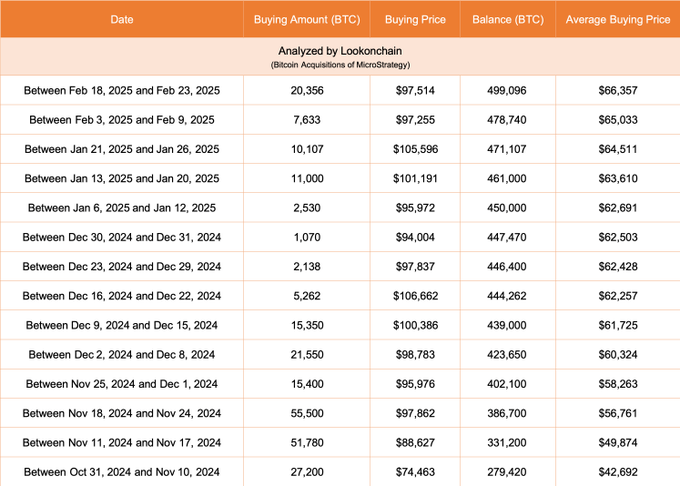

Newest information from Lookonchain reveals that as of February 2025, the corporate had held 499,096 BTC. This Bitcoin Money is valued at roughly $40.9 billion.

Technique Common Bitcoin Purchase-in: $66,357 – Latest Purchases At present Underwater

The common buy value for this reserve is a mean of $66,357 per Bitcoin. Regardless of this general common, the technique is at present dealing with paper losses on the newest acquisition.

This example raises questions on its technique and the longer term outlook for Bitcoin Holding.

Associated: Investor Warning: Tax Guidelines Modifications places Strategic $46 billion Bitcoin Treasury in danger

Since November 2024, $3 billion in paper losses on Bitcoin purchases

Since November 2024, the technique has been actively increasing Bitcoin Holding. The corporate added 246,876 BTC with a mean value of $94,035 per coin. The acquisition prices the corporate $23.2 billion.

Nevertheless, the inherent value volatility of Bitcoin signifies that these newly bought belongings are lowering in worth. It’s at present price $20.2 billion. This lower in worth will end in paper losses of roughly $3 billion.

Peak Purchases Fumble: 55,500 BTC added common of $97,862 per week

Essentially the most intensive purchases occurred between November 18th and November twenty fourth, 2024. This week, the technique acquired 55,500 BTC with a mean value of $97,862 per coin. The transfer has elevated the corporate’s whole Bitcoin reserves to 386,700 BTC.

Regardless of market fluctuations, technique’s unwavering wager on Bitcoin

The strategic acquisition of Bitcoin exhibits its ups and downs. The common value fluctuates over time. Particularly, the corporate’s greatest acquisition occurred between February 18th and twenty third, 2025. Over the previous week, we added 20,356 BTC with a mean value of $97,514.

Regardless of the latest recession in Bitcoin’s market worth, the technique continues to extend its reserves. The corporate’s Bitcoin Holdings continues to be rising. This steady accumulation displays its long-term cryptocurrency technique.

$2 billion in funding will additional enhance Bitcoin acquisitions

Along with its acquisition energy, the technique has accomplished the supply of a $2 billion convertible be aware.

This injection additional strengthens its monetary place. The brand new funding allowed the corporate so as to add 20,356 BTC to its holdings for round $1.99 billion. The acquisition additional strengthened the corporate’s general acquisition in 2025, producing a BTC yield of 6.9% per 12 months.

Associated: MicroStrategy rebrands as “Technique₿” and doubles Bitcoin

As of February 23, 2025, the technique has amassed 499,096 BTC. These holdings had been acquired at round $33.1 billion with a mean value of $66,357 per Bitcoin. Regardless of slowing acquisitions over the previous few weeks, the corporate stays one among Bitcoin’s most necessary company holders.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.