- Bitcoin’s 15.31% rebound to the $60,000 vary has brought on the Greed and Concern Index to maneuver from excessive worry to impartial.

- Rising inflows into Bitcoin ETFs and enormous purchases by MicroStrategy are buoying market sentiment.

- Ethereum choices buying and selling has surged, with over 20,000 contracts focusing on $3,000 by December.

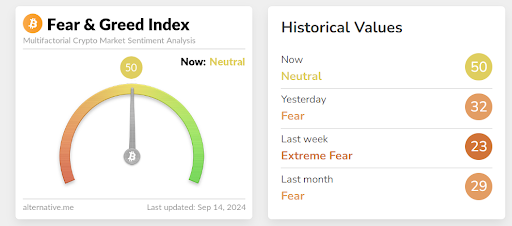

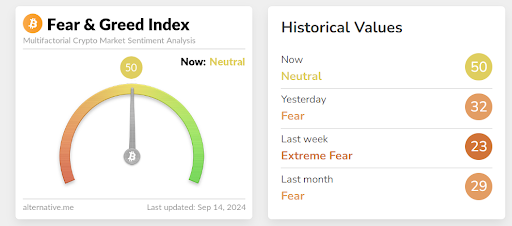

In a stunning improvement, the cryptocurrency market’s Greed and Concern Index has shifted to a impartial place, away from the extraordinary worry beforehand skilled. Latest knowledge exhibits that the Concern Index is now at 50, up from yesterday’s fearful 32 and final week’s excessive fearful 23.

The change got here after Bitcoin rebounded above the $60,000 worth level early at this time, hitting a one-day excessive of $60,656. The final time Bitcoin hit the $60,000 mark was three weeks in the past on August 28. Throughout that interval, Bitcoin's worth fell to a low of $52,598 on September 6, contributing to the intense sentiment of worry available in the market over the previous few weeks.

Primarily, Bitcoin has recovered 15.31% since that drop, contributing to improved market sentiment. On the time of writing, Bitcoin is trying to defend this newly recaptured threshold and is hovering across the $60,000 mark.

Bitcoin's restoration has had a minor affect on the altcoin market, with a number of of the highest 10 altcoins, together with Solana, posting modest positive factors of round 3% previously 24 hours. Notably, a number of important occasions this week have influenced the crypto market restoration, together with constructive inflows into spot Bitcoin exchange-traded funds (ETFs).

Additionally learn: Is Bitcoin's Inactive Provide Index Predicting a Lull Earlier than the Subsequent Rise?

Latest market developments shaping the restoration

- Constructive inflows into Bitcoin ETF: The U.S. Bitcoin spot ETF market noticed internet inflows of $263.2 million on Friday, reversing internet outflows from the earlier week.

- Grayscale Bitcoin Belief (GBTC) Inflows: The Grayscale Bitcoin Belief, which had beforehand seen heavy outflows, noticed an influx of $6.7 million on Friday.

- MicroStrategy's key acquisitions: Bitcoin bull MicroStrategy revealed that it has added 18,300 BTC price over $1.1 billion, bringing its whole holdings to 244.8k BTC.

- Ethereum Choices Surge: Curiosity in Ethereum choices has elevated, with over 20,000 contracts bought by Dec. 27 with a goal of $3,000 ranges, signaling rising optimism for ETH.

- Political developments: One other sizzling matter this week was the talk between Donald Trump and Kamala Harris. Though cryptocurrency was not talked about through the debate, Harris's rising profile was clear, and the most recent polls give her simply over a 50% likelihood of changing into the primary feminine president.

- Impression of inflation knowledge: Inflation knowledge this week confirmed the Client Value Index (CPI) got here in at 2.5% in August, consistent with expectations, elevating the possibilities of a 25 foundation level price minimize to 85%.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent any sort of monetary recommendation or counsel. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.