- Balancer misplaced over $116 million throughout v2 swimming pools, resulting in suspension and third DeFi safety menace.

- Bitcoin simply recorded its first pink October since 2018, so merchants are nervous about November’s follow-through.

- Whales, alternate promotions, and excessive beta tokens on BSC and Solana additional destabilize the market tape.

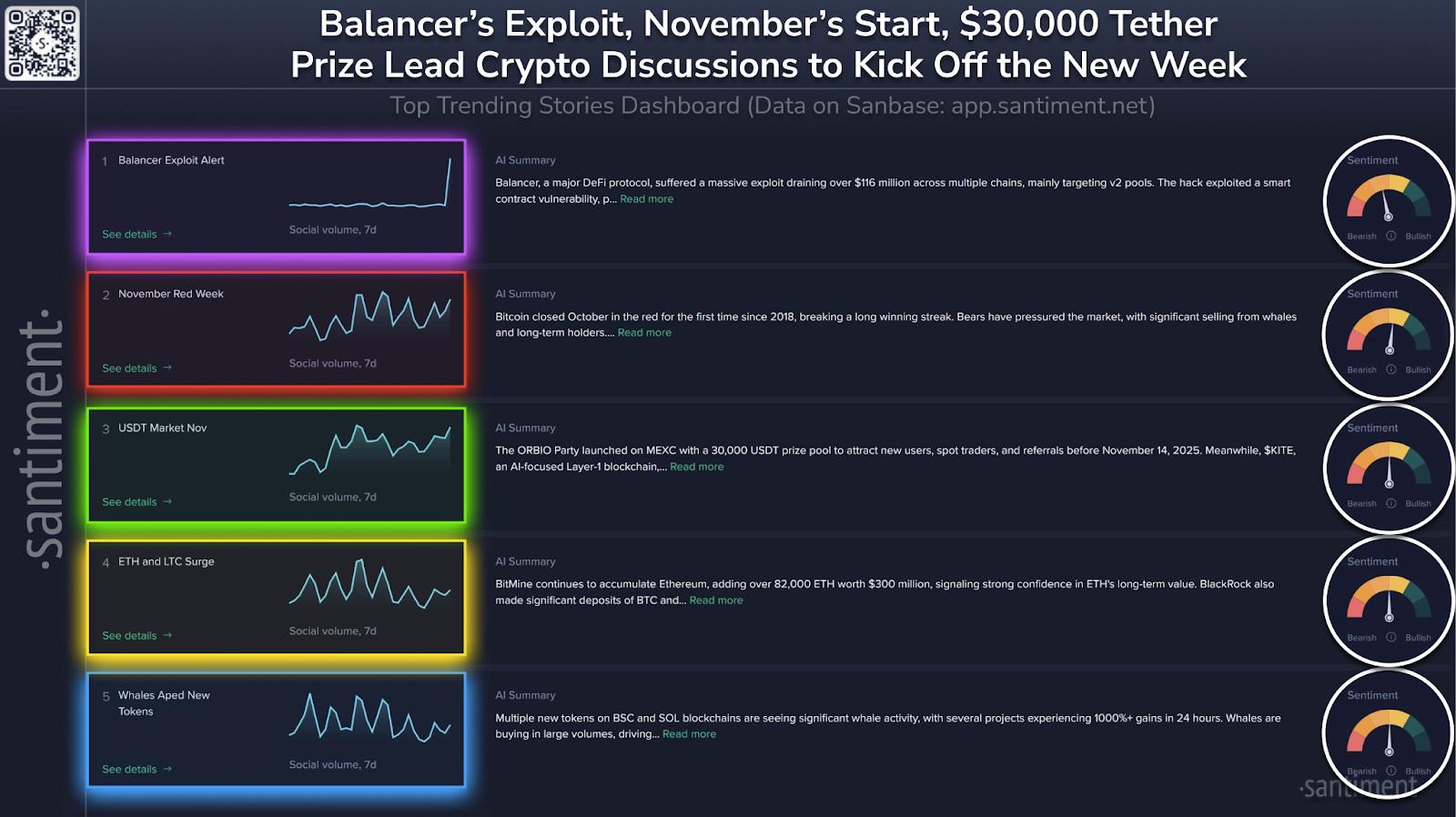

Balancers have change into probably the most mentioned subject throughout crypto boards after the decentralized finance (DeFi) protocol confronted a large exploit that resulted within the lack of over $116 million in belongings. In response to Santiment information, the breach exploited a sensible contract vulnerability and focused Balancer’s v2 pool throughout a number of blockchains.

The platform instantly suspended the affected pool and commenced an investigation. That is the third main safety breach by Balancer. This occasion raises considerations about persistent dangers inside DeFi infrastructure. Customers had been prompted to withdraw their remaining funds and test their token authorization settings.

Bitcoin’s Crimson October causes uncertainty in November

This abuse has additional weakened market sentiment. For instance, Bitcoin simply ended October with a month-to-month decline. That is the primary time since 2018 that October’s closing value has been unfavourable. Santiment’s evaluation says the decline is because of sturdy promoting stress from whales and long-term holders.

Regardless of this weak end, merchants are maintaining a tally of November. This month has seen a historic rise in Bitcoin. Market sentiment stays combined as members weigh this short-term volatility in opposition to historic efficiency.

Associated: Handoff, not headline: BTC threat map as Crimson October handsoff in November

Conflicting indicators: Altcoin rise and whale warnings

MEXC’s ORBIO occasion additionally featured prominently in trending articles with a 30,000 USDT prize marketing campaign geared toward attracting new customers and boosting referral exercise forward of the November 14th deadline.

In the meantime, $KITE, an AI-driven layer 1 blockchain, continues to realize traction after being listed on a number of main exchanges together with MEXC, BTSE, Hotcoin, and Upbit. The venture’s rollout, accompanied by futures buying and selling choices and commission-free promotions, attracted merchants’ curiosity regardless of widespread market weak spot.

Institutional Investor Accumulation and Altcoin Alerts

The information additional exhibits that BitMine has amassed over 82,000 ETH price roughly $300 million, demonstrating institutional-wide confidence in Ethereum’s long-term prospects.

BlackRock deposited each Bitcoin and Ethereum into its Coinbase pockets, reinforcing indicators of continued institutional participation. Litecoin additionally recorded elevated buying and selling quantity and upward value momentum, suggesting a possible technical breakout.

Whale exercise at BSC and Solana

Whale buying and selling surged throughout the Binance Good Chain and Solana networks, with a number of new tokens posting beneficial properties of over 1,000% inside 24 hours. Analysts say the transfer is pushed by speculative buying and selling and social media-driven curiosity in tasks, notably round AI and safety.

Nonetheless, Santiment warned that a few of these tokens pose vital dangers, together with phishing and developer focus, because the market continues to be susceptible because of elevated volatility.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.