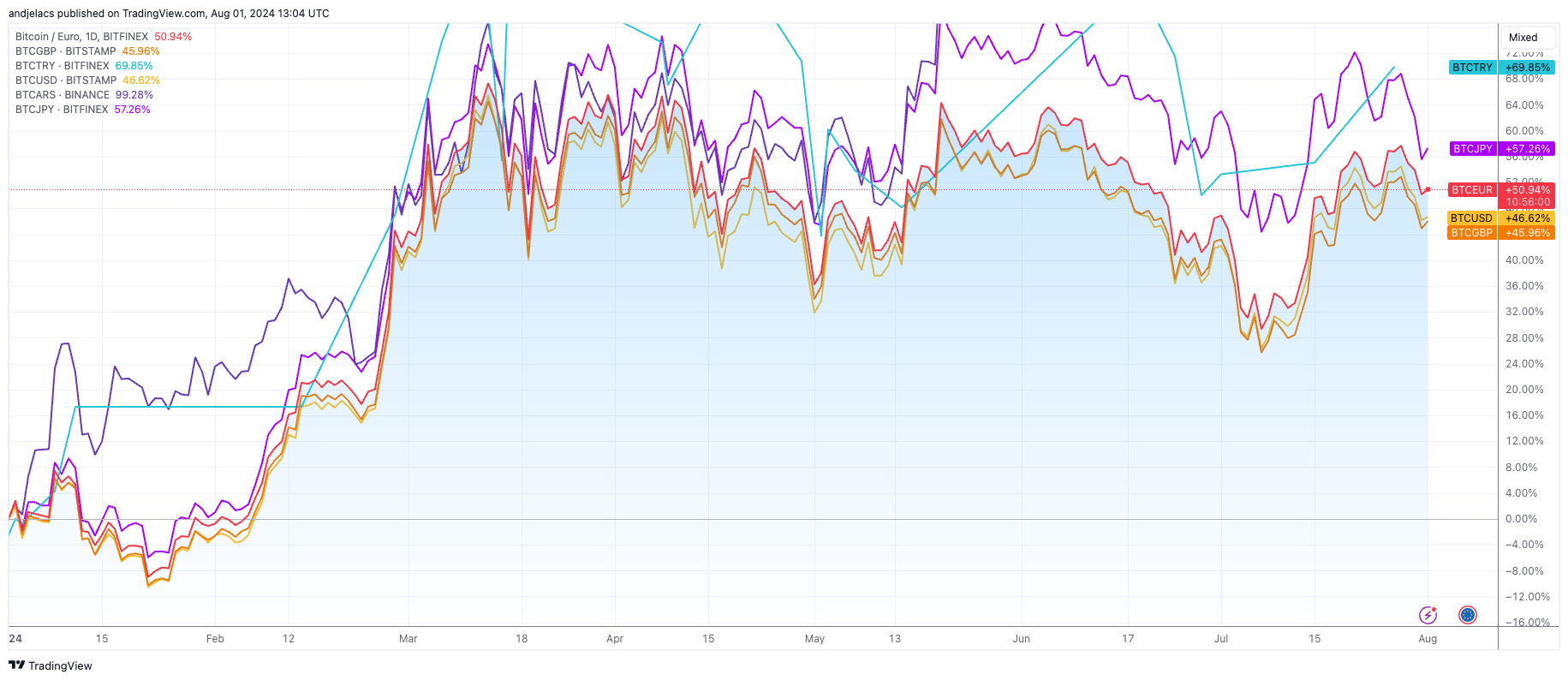

Analyzing Bitcoin vs. fiat buying and selling pairs on centralized exchanges usually reveals efficiency variations which are invisible when specializing in international or common costs. We present how liquidity, geopolitical and financial considerations, and market sentiment have an effect on efficiency.

Trying on the year-to-date (YTD) efficiency of the most important fiat foreign money pairs, we see that BTCARS has recorded a staggering improve of 98.27%, BTCTRY has risen 69.85%, BTCJPY has risen 55.01%, BTCEUR has risen 49.85%, BTCUSD has risen 45.62% and BTCGBP has risen 45.07%.

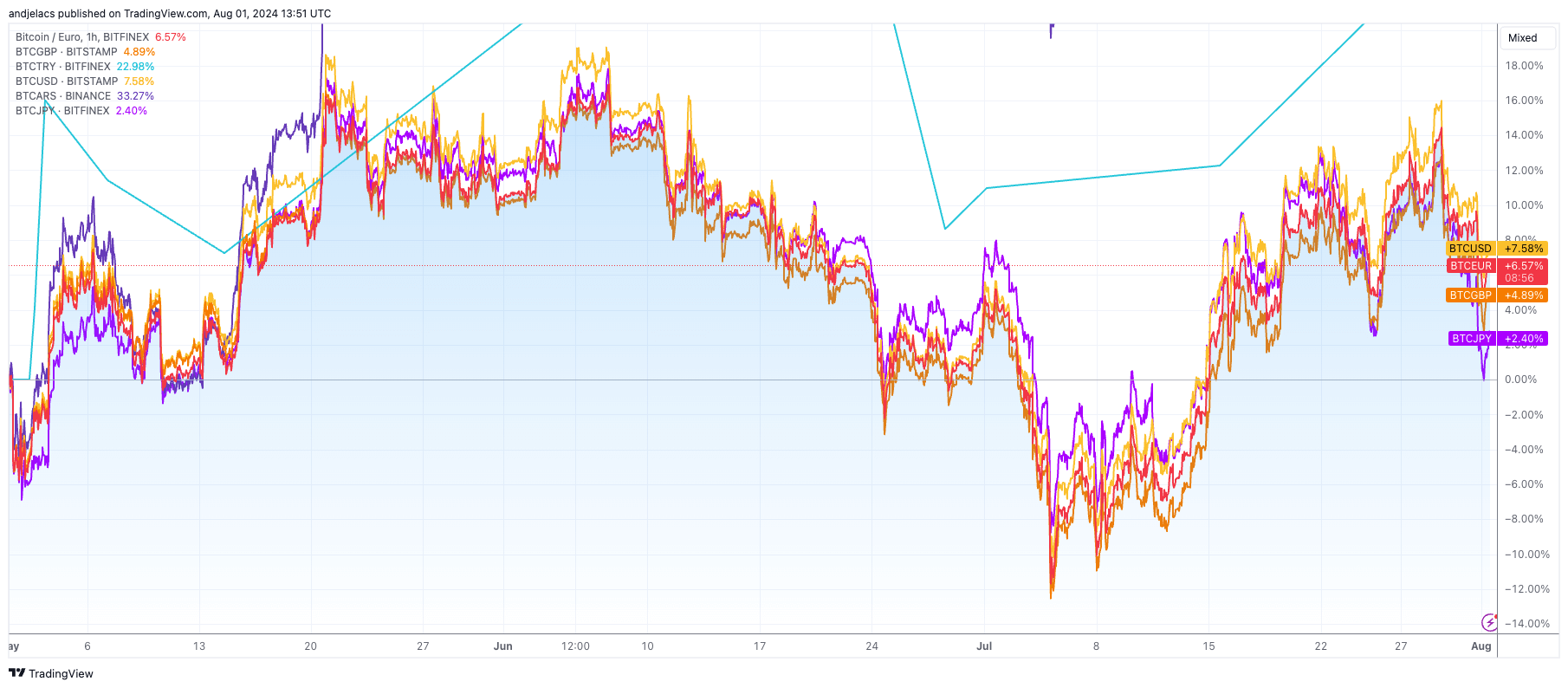

In distinction, by way of three-month efficiency, BTCARS has come out on high with a 19.64% improve, whereas BTCEUR, BTCUSD, BTCGBP, BTCJPY, and BTCTRY have all recorded unfavourable returns starting from -1.16% to -6.50%.

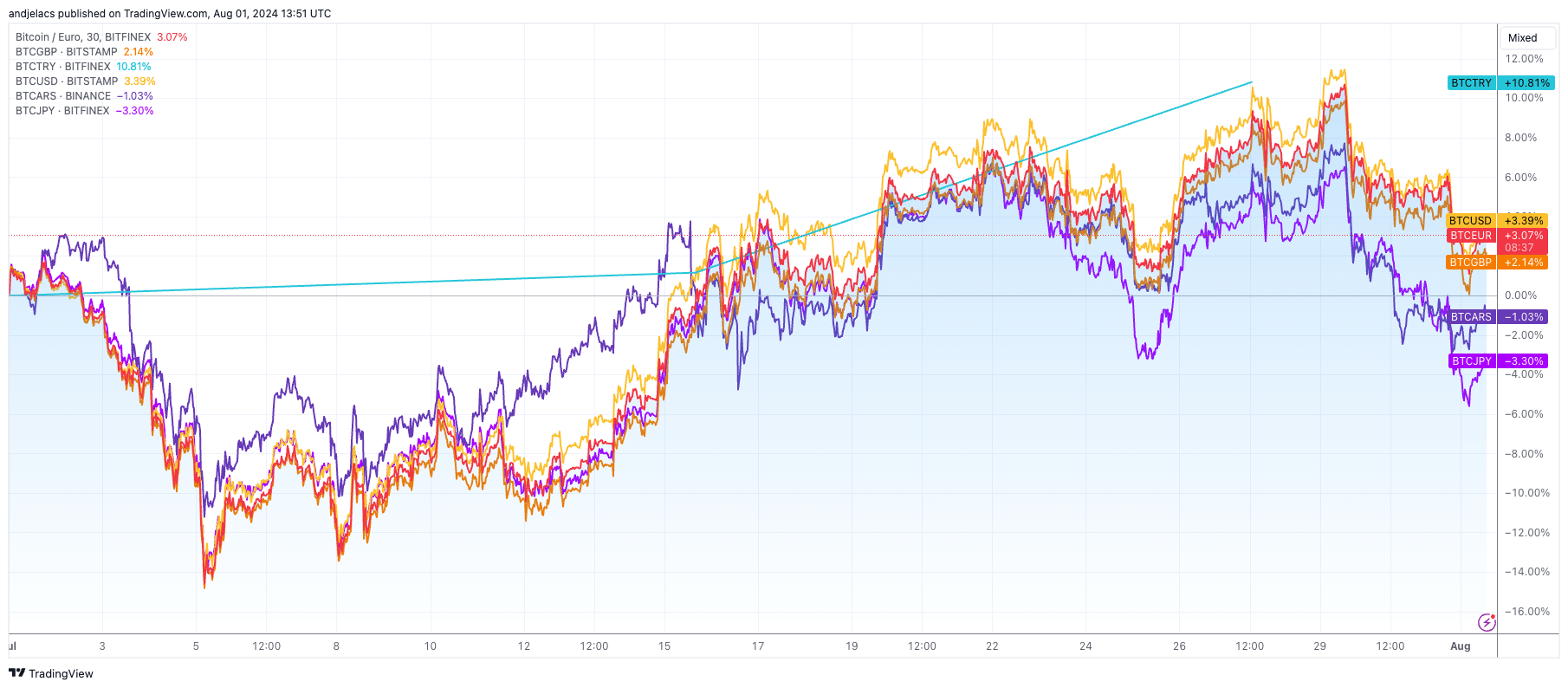

Efficiency over the month was blended, with BTCTRY up 10.81%, BTCUSD up 2.97%, BTCEUR up 2.72%, and BTCGBP up 2.03%, whereas BTCARS and BTCJPY have been down -0.85% and -3.89%, respectively.

Bitcoin's exceptional efficiency towards the Argentine peso, particularly thus far this 12 months, may be attributed to the nation's extreme inflation. Inflation charges exceed 100% yearly and the sharp depreciation of the Argentine peso have led buyers to hunt refuge in Bitcoin.

The transfer is in keeping with a historic development of residents in international locations hit by hyperinflation or financial instability turning to cryptocurrencies as a hedge towards the depreciation of their nationwide currencies. Inflation has slowed because of the financial and political insurance policies of Argentina's new President, Javier Milley, however demand for Bitcoin stays sturdy.

Equally, BTCTRY's sturdy efficiency thus far this 12 months is because of financial challenges in Turkey, which is stricken by excessive inflation, with current reviews placing inflation at over 75%. The decline of the Turkish Lira has led to elevated adoption of Bitcoin amongst Turkish buyers seeking to defend their belongings.

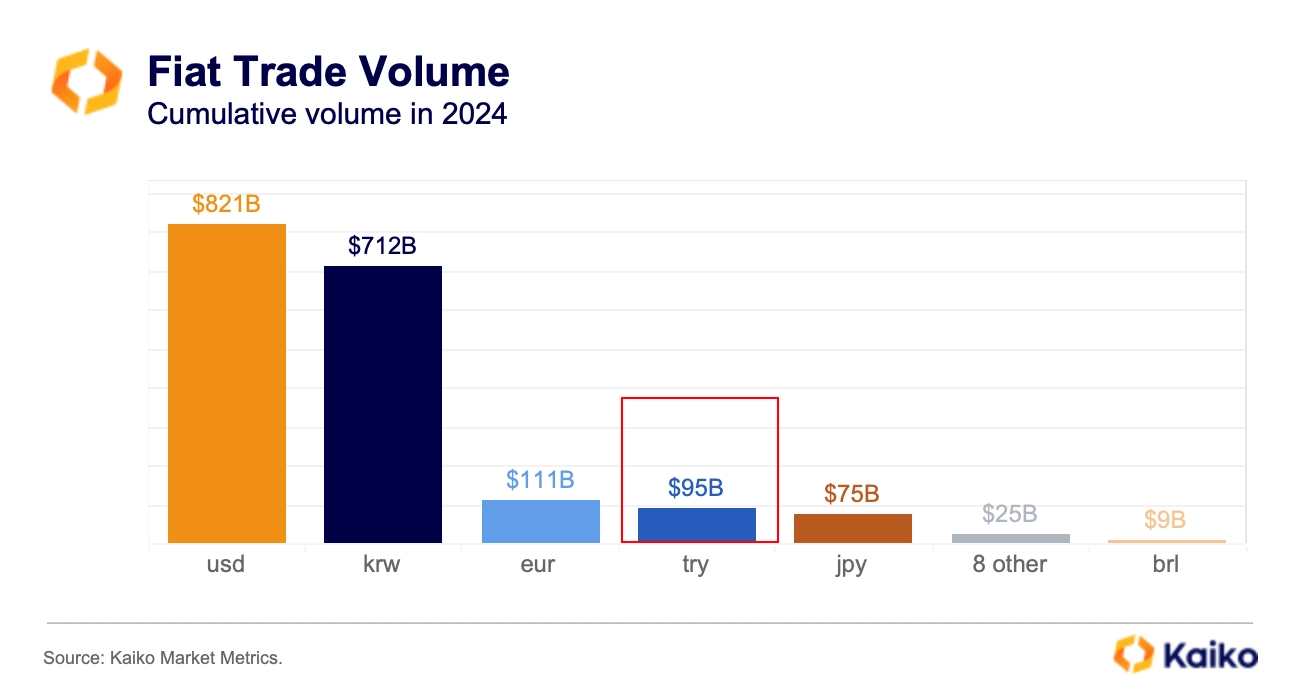

This development is additional supported by the truth that Turkey boasts one of many highest cryptocurrency adoption charges on this planet: In line with knowledge from Kaiko, Turkish lira buying and selling quantity exceeded $10 billion for the eighth consecutive month, with cumulative lira buying and selling quantity throughout seven exchanges reaching $95 billion.

The weakening of the yen towards the greenback because of the dovish stance of the Financial institution of Japan has impacted the BTCJPY pair. Japan's intervention within the foreign money market to stabilize the yen has additionally contributed to fluctuations in Bitcoin's worth towards the yen. The unfavourable 3-month and 1-month performances point out the short-term volatility and impression of those interventions.

The muted features within the euro, US greenback and British pound thus far this 12 months and their blended short-term efficiency can probably be attributed to the comparatively steady financial situations and robust monetary infrastructures within the eurozone, US and UK.

The current energy of the US Greenback has impacted the BTCUSD pair, inflicting it to underperform within the brief time period. The Euro and Pound appear to be beneath barely extra stress from financial points and central financial institution insurance policies, inflicting them to outperform in comparison with the Greenback.

Liquidity additionally performs a key position within the efficiency of fiat buying and selling pairs. Extremely liquid markets reminiscent of BTCUSD and BTCEUR are likely to have decrease volatility and extra steady costs. It is because larger liquidity permits bigger trades to be executed with out considerably affecting the market worth.

Conversely, much less liquid pairs reminiscent of BTCARS are extra inclined to bigger worth fluctuations and volatility. This excessive volatility can translate into massive advantages during times of excessive demand, as seen within the YTD efficiency of BTCARS vs BTCTRY.

The publish Bitcoin’s Fiat Pair Efficiency Highlights Financial and Political Challenges appeared first on currencyjournals.