Bitcoin’s surge above $50,000 sparked a broad market rally, propelling a variety of massive different digital property akin to Ethereum (ETH), Solana (SOL), and others to important beneficial properties.

Based on information from crypto slate, Ethereum rose 7% to $2,661, whereas SOL surged 8% to $114. Among the many prime 10 digital property, Avalanche's AVAX surged 6% to $41, Cardano's ADA rose 3.74% to $0.5574, whereas BNB Coin (BNB) and Ripple's XRP rose extra modestly. skilled a rise of lower than 3% every.

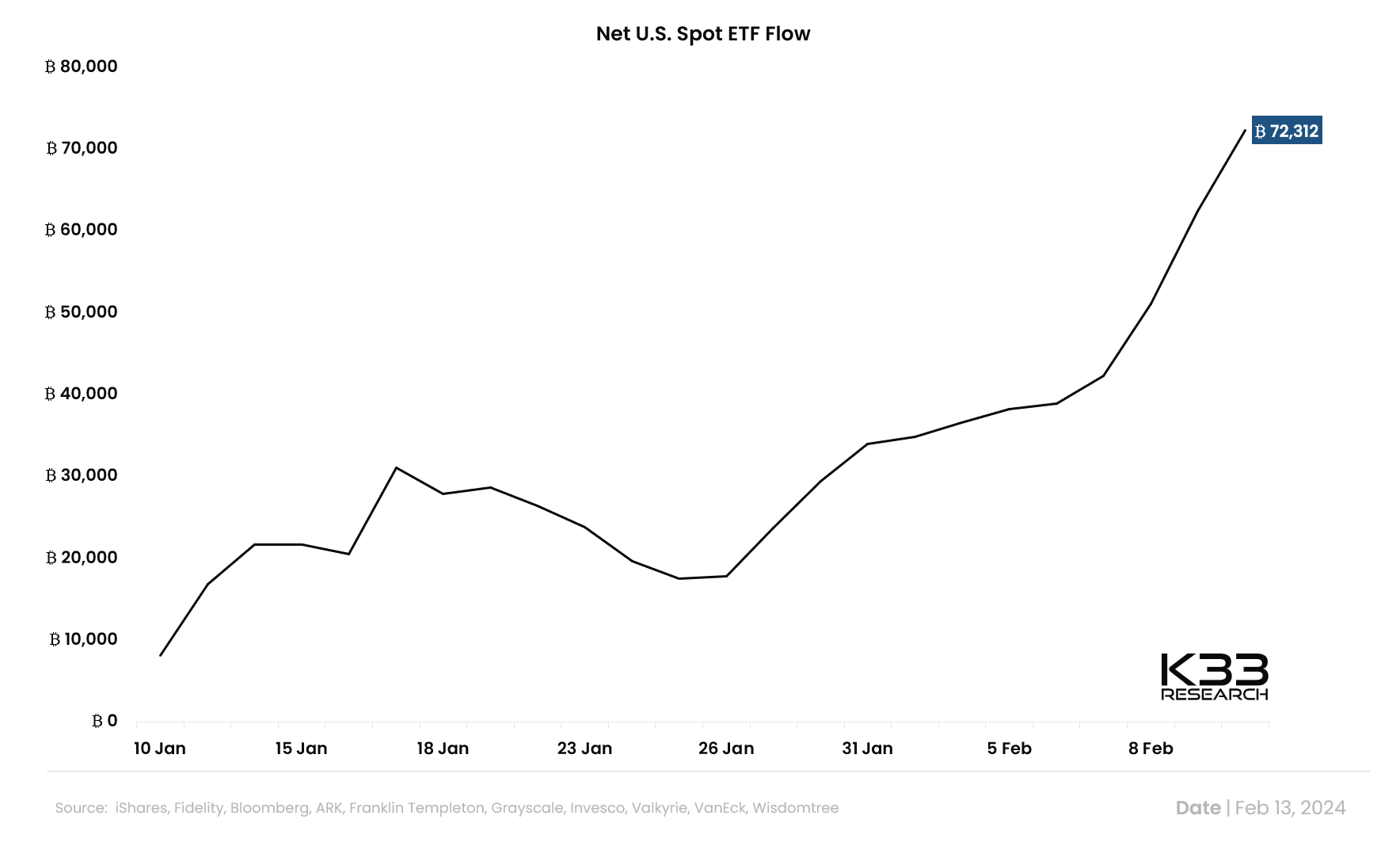

Market analysts attribute this bullish pattern to the excitement surrounding the U.S. multi-spot Bitcoin exchange-traded fund (ETF). Vettle Runde, senior analyst at K33 Analysis, famous that inflows into these ETFs stay sturdy even after greater than a month since their launch.

“We noticed web inflows of 9,870 BTC yesterday, bringing the US Spot ETF’s web inflows since launch to 72,312 BTC. The brand new 9 presently maintain 228,000 BTC,” Lunde added.

On at the present time, BTC worth crossed the $50,000 threshold for the primary time since late 2021. As of this writing, the worth of the highest cryptocurrency rose 4.2% to $50,146, extending a robust run of 16% over the previous week.

$184 million in liquidation

The widespread rally within the crypto market has resulted in large-scale liquidations totaling greater than $184 million from greater than 56,000 merchants, in accordance with information from Coinglass.

Quick merchants, or speculators, who wager on costs rising misplaced $134 million, whereas lengthy merchants, who wager on costs rising, misplaced about $50 million.

Amongst all property, Bitcoin topped the liquidations chart with a complete lack of $69.8 million. Bitcoin quick merchants misplaced $55.04 million, whereas lengthy merchants misplaced $14.76 million. Ethereum adopted intently, contributing $39.85 million to total liquidations.

Different property akin to Solana, LINK, and ORDI additionally skilled liquidations of $10.14 million, $5.93 million, and $4.81 million, respectively.

Binance had the very best liquidation share of all exchanges at 43.13%, totaling $79.42 million. Different platforms akin to OKX and ByBit recorded liquidations of $58.29 million and $18.73 million, respectively.

Notably, essentially the most important liquidation order occurred in opposition to LINKUSD on Bitmex, with an quantity of $3.14 million.

(Tag translation) Bitcoin

Comments are closed.