- Bitcoin has surged greater than 9% previously week.

- If September is inexperienced, the fourth quarter can be inexperienced, Lark Davis stated.

- Within the 2020 cycle, Bitcoin turned bullish 161 days after the halving.

Bitcoin has been on an enormous rally since early September, and though there have been some pullbacks alongside the way in which, its dominance within the digital asset market stays unchallenged. The cryptocurrency has bounced again to the $64,000 mark, and short-term features look promising. Analysts are even drawing comparisons to the 2020 bull run.

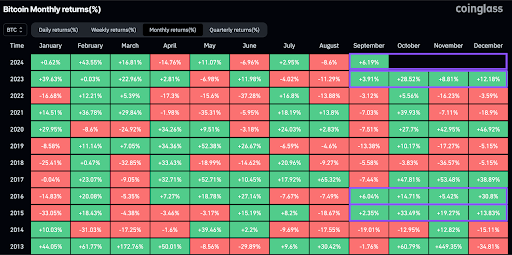

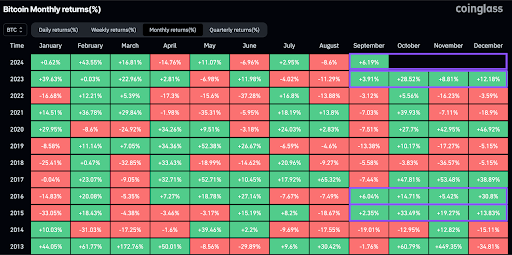

Lark Davis, a widely known YouTuber and cryptocurrency analyst, tweeted that “every time September is inexperienced, This fall is tremendous bullish for Bitcoin,” attaching a chart displaying Bitcoin's historic efficiency in September and This fall, hinting at sturdy occasions to return.

In one other put up by X, Rekt Capital famous that 161 days have handed since Bitcoin's halving. He reminded his followers that throughout the 2020 bull run, Bitcoin noticed an enormous rally 161 days after the halving, reaching an all-time excessive of $69,000 in November 2021.

Additionally see: Authorities Bitcoin Rankings: US tops the checklist, adopted by Bhutan and El Salvador

Within the present cycle, Bitcoin hit an all-time excessive of $73,750 in March after a spot Bitcoin exchange-traded fund (ETF) was accredited within the U.S. in January. In line with information from CoinMarketCap, BTC is buying and selling at $64,022.38, up 1.44% previously 24 hours, 9.52% previously week, and 0.04% previously 30 days.

Bitcoin Worth Evaluation Suggests Additional Rise

Bitcoin worth evaluation reveals big bullish potential for the cryptocurrency amid a surging market, and if the main digital asset manages to maintain ranges above $64,000, it should seemingly see even greater new highs within the close to future.

The chart under reveals that Bitcoin has fashioned seven consecutive bullish candlesticks and rising shopping for quantity, suggesting that the upside could proceed within the brief time period.

The Relative Power Index (RSI) is displaying a worth of 64.25, which implies that the bulls are in total management of Bitcoin worth motion and the slope of the road means that the value could transfer greater.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. This text doesn’t represent any sort of monetary recommendation or counsel. Coin Version is just not answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.