Bitcoin noticed a major decline over the weekend, with Bitcoin falling from $70,090 on April eleventh to $64,400 on April thirteenth. Bitcoin's value managed to stabilize at round $400,000 regardless of preliminary considerations that broader conflicts within the Center East would develop and a possible market decline would start. $66,000 as of April fifteenth.

Understanding the character of those fluctuations, whether or not they signify only a short-term correction or a extra vital change, requires the evaluation of varied market individuals, particularly short-term and long-term holders. You will need to look at individuals's conduct.

Quick-term holders (STH) and long-term holders (LTH) react in a different way to market volatility. STH is often extra delicate to cost fluctuations and exterior occasions, and tends to promote its holdings throughout market declines. In distinction, LTH sometimes maintains its place via volatility, reflecting its dedication to Bitcoin's long-term worth.

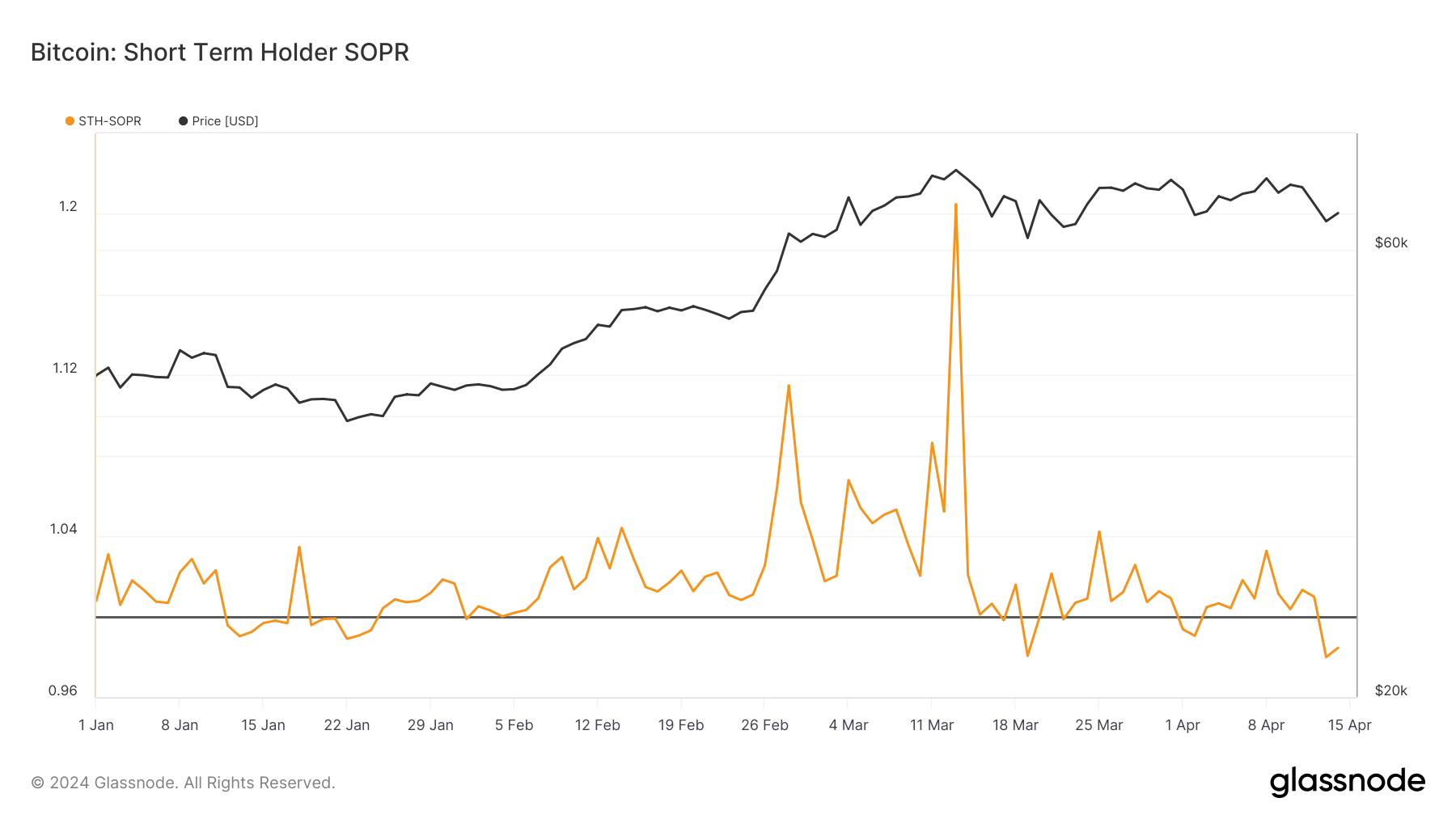

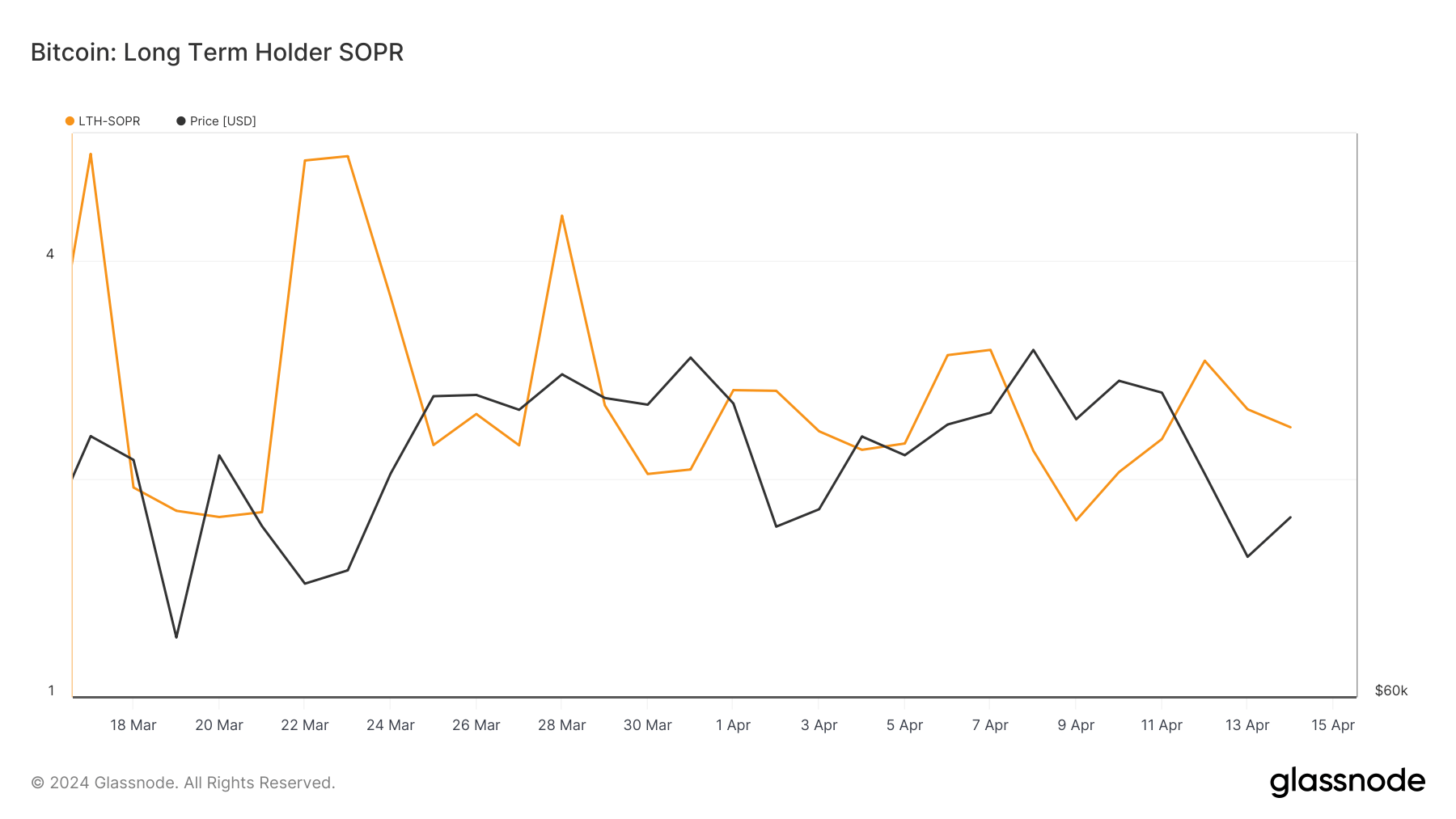

Among the finest indicators to evaluate the quick market response is the Spent Manufacturing Return (SOPR), which measures the revenue margin realized by cash moved on-chain. A SOPR worth better than 1 signifies that the coin is promoting at a revenue on common, whereas a worth lower than 1 signifies it’s promoting at a loss. To know the nuances, it’s essential to analyze this metric individually into STH SOPR and LTH SOPR to know the totally different conduct of those two teams.

Throughout the decline, STH SOPR plummeted from 1.009 on April twelfth to a year-to-date low of 0.979 on April thirteenth, indicating that short-term holders had been promoting Bitcoin at a loss. This indicator has recovered barely to 0.984 by April 14th, however continues to be under the break-even threshold of 1.

Earlier this 12 months, when Bitcoin reached a excessive of over $73,000, STH SOPR peaked at 1.204, indicating worthwhile promoting by short-term holders. Moreover, the value of Bitcoin spent by his STH on April thirteenth was $65,130, which is increased than his spot buying and selling value of $64,900, and a major variety of his STHs are promoting at a loss. It exhibits that.

However, long-term holders confirmed a lot better resilience. As Bitcoin value fell under $70,090, LTH SOPR rose from 2.271 on April eleventh to 2.913 on April twelfth, with long-term holders nonetheless promoting at vital income regardless of the financial downturn. This implies that By April 14th he had adjusted barely to 2.358, however remained effectively above break-even.

SOPR alone, we will see that the weekend decline didn’t shake the arrogance of long-term holders. Lengthy-term holders' balances have elevated over the previous week or so, however fewer holders bought through the decline and realized income.

In the meantime, the conduct of short-term holders confirmed panic, with many selecting to chop their losses and promote their BTC. This implies a reactive strategy to market information and value fluctuations, additional confirming the long-term pattern related to STH.

Variations in responses from these two cohorts show the significance of segment-specific evaluation and point out that whereas short-term sentiment could waver, the long-term outlook stays sturdy .

The publish Bitcoin's weekend selloff wipes out short-term holders appeared first on currencyjournals.