Bitcoin surpassed the $57,000 stage on February 27, reaching its highest stage since November 2022. This surge, which noticed the worth rise from $54,000 to $57,300 in lower than 24 hours, led many to see it as the start of a very notable bull run in Bitcoin. Half a 12 months.

Regardless of explosive income, the anticipated wave of liquidations didn’t comply with.

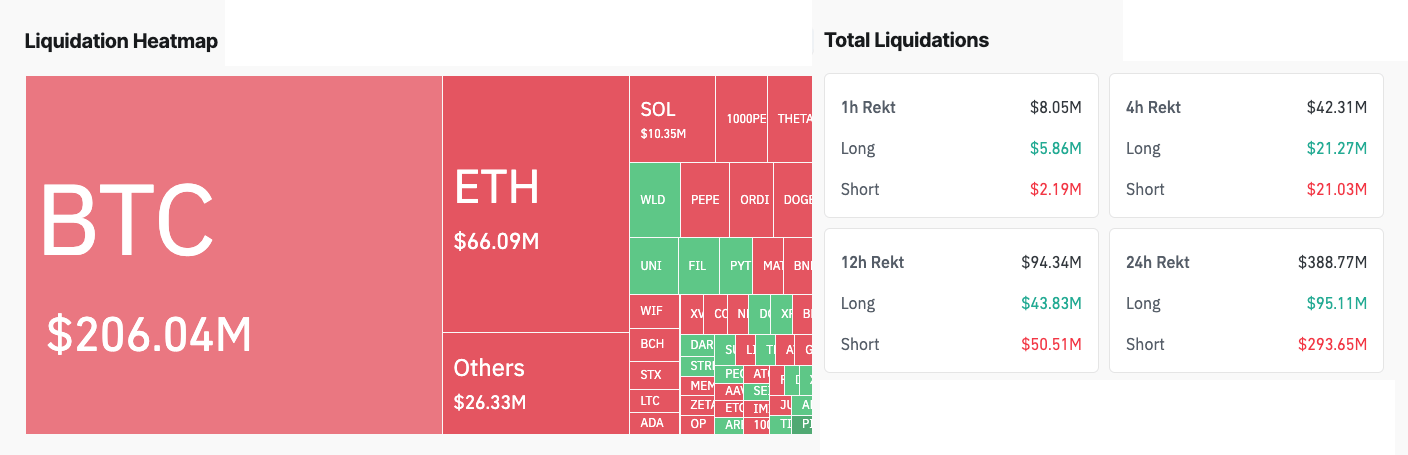

Between February 26 and February 27, 86,351 merchants confronted liquidation, totaling $387.15 million. Nevertheless, the quantity of Bitcoin-specific liquidations reached roughly $206 million. This quantity is cut up into $175 million quick and $30 million lengthy, indicating that the market has remained unexpectedly resilient to giant liquidation triggers.

The relative lack of response when it comes to liquidations after Bitcoin's worth spike might be attributed to a number of components that cushion the impression of those unstable actions on the derivatives sector of the market.

First, the distribution of liquidations signifies that the market was underutilized. In situations the place market sentiment is overwhelmingly bullish or bearish, sudden worth actions on majority positions can set off a sequence of liquidations.

Nevertheless, the extra balanced positioning on this case means that merchants weren’t leaning too closely right into a bearish outlook, which might have been extra prone to be weighed down by a worth spike.

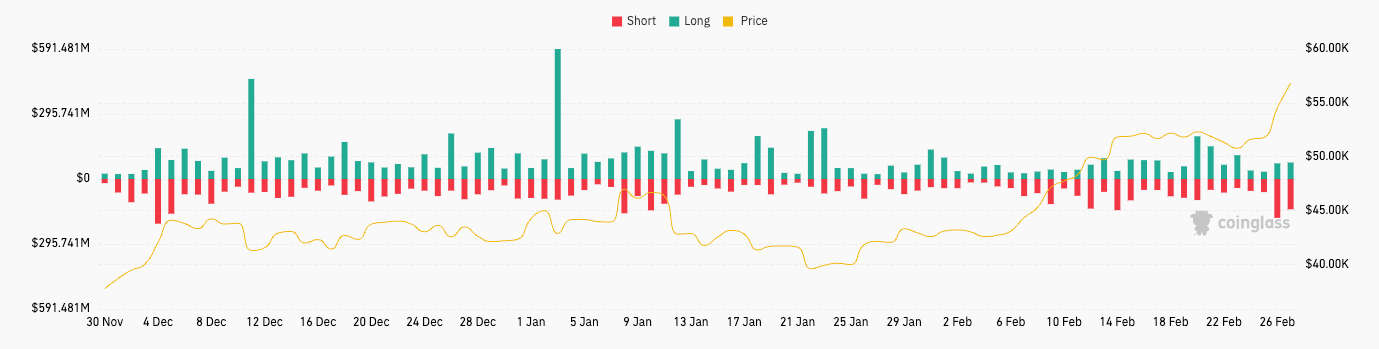

These balanced liquidations aren’t an outlier, however somewhat a part of a constant sample noticed in latest weeks. His complete BTC liquidations on February twenty seventh, whereas vital, didn’t deviate considerably from his each day common seen in earlier weeks.

This stability means that market individuals are shifting in the direction of extra conservative leverage ranges and a extra even distribution between bullish and bearish positions. Such strategic positioning primarily buffers the market towards sudden worth shocks and reduces the chance of large-scale liquidations.

that is crypto slate Earlier evaluation of the derivatives market discovered that calls and places for Bitcoin choices are virtually evenly cut up. Whereas the rise in open curiosity in February indicated that the market's bullish outlook prevailed, the balanced call-to-put ratio indicated warning amongst merchants.

This vigilance, seen in defensive methods and a notable rise in bearish bets, could have stopped a cascading domino impact of short-term liquidations that would have eroded Bitcoin's positive factors that day.

The put up Bitcoin surge to $57,000 didn’t end in liquidation storm, going towards anticipated developments and appeared first on currencyjournals.