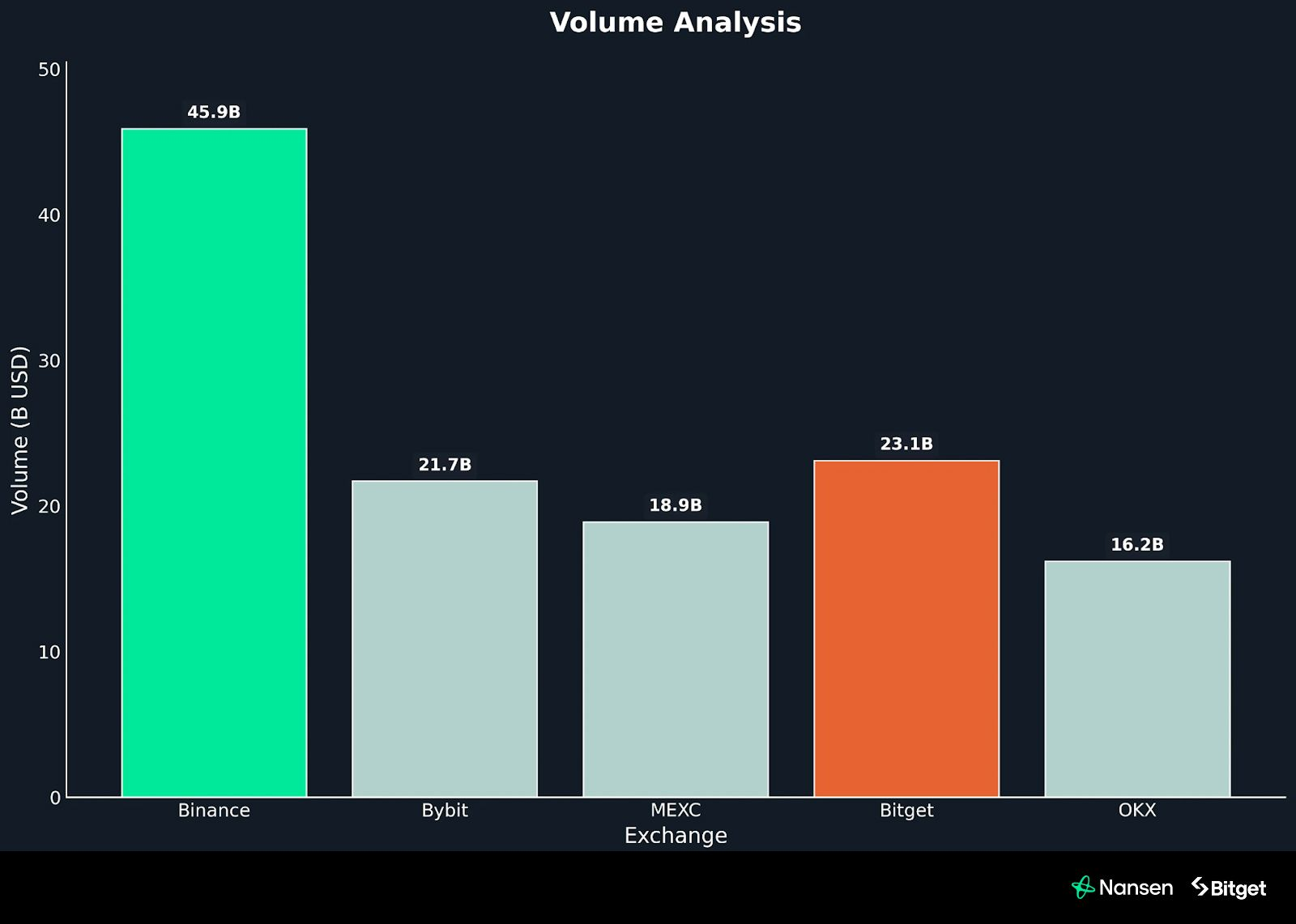

- Bitget ranks second on this planet with $23.1 billion in buying and selling quantity.

- Institutional spot and futures buying and selling surged via 2025.

- The alternate has expanded its providers to accommodate bigger clients, providing enhanced liquidity and financing choices.

New evaluation from Bitget and Nansen exhibits that crypto exchanges are quickly turning into essential hubs for institutional traders. Bitget’s buying and selling quantity reached $23.1 billion this 12 months, making it the world’s second-largest alternate after Binance, in response to a report launched Tuesday.

This development displays a pointy improve in institutional investor engagement with skilled funds and market makers driving liquidity in each spot and derivatives markets. This variation represents a significant step within the evolution of the cryptocurrency market in direction of a extra institution-driven construction.

Associated: AI-focused COMMON goes stay on Bitget with $36 million in token rewards

Institutional buying and selling surges throughout Bitget markets

BitGet’s spot market buying and selling quantity from institutional merchants soared to 72.6% by July from 39.4% in the beginning of 2025, in response to Nansen knowledge. Within the futures market, institutional investor participation elevated from simply 3% to 56.6% over the identical interval.

These modifications have improved Bitget’s liquidity and execution high quality. The alternate has seen deeper order books and tighter bid-ask spreads throughout main pairs reminiscent of BTC/USDT, ETH/USDT, and SOL/USDT, even during times of volatility.

Bitget’s liquidity metrics assist this with an Amihud illiquidity ratio of 0.0014 and a roll unfold estimate of 9.02 foundation factors, just like Bybit and OKX.

These numbers show that trades will be executed effectively with out massive value fluctuations, an essential issue for institutional traders.

Big funds to drive on-chain actions

The research additionally tracked on-chain flows from 31 institutional funds on Bitget from January to September 2025. 5 of those funds, Laser Digital, Fenbushi Capital, Asteroid Capital, LD Capital, and Hashed, accounted for greater than 95% of the entire constructive internet inflows.

Laser Digital led the best way with $2.6 million in internet deposits, whereas Fenbushi Capital achieved a 100% internet effectivity charge. This implies you made a deposit with out withdrawing cash. This focus highlights each elevated institutional belief in Bitget’s infrastructure and the potential for extra numerous institutional involvement.

Liquidity, custody and lending drive institutional development

Bitget has expanded its providers to assist massive institutional clients. The corporate’s lending program gives USDT-backed loans of as much as $10 million with as much as 5x leverage, versatile compensation phrases, and no pressured liquidation to eligible debtors.

The alternate has additionally enhanced its custody choices by integrating with suppliers reminiscent of Fireblocks, Copper, and OSL. These strikes mirror broader business traits, with monetary establishments prioritizing clear custody, low execution prices, and dependable liquidity over speculative buying and selling.

Institutional adoption will outline the market in 2025

This report highlights Bitget’s development as a part of broader market modifications. At present, institutional traders account for nearly 80% of the entire buying and selling quantity on centralized exchanges. Moreover, the U.S. Bitcoin Spot ETF holds $153 billion in belongings, led by BlackRock’s iShares Bitcoin Belief, which holds $88 billion.

Analysts predict that institutional holdings might attain 4.2 million BTC by 2026, accounting for a couple of fifth of complete provide. Regulatory modifications such because the repeal of SAB 121 within the US and European MiCA frameworks are additionally strengthening institutional confidence within the crypto market.

Bitget’s Common Change Imaginative and prescient

Bitget CEO Gracy Chen described liquidity as “the heartbeat of each market.” The alternate’s transfer to a Common Change (UEX) mannequin goals to unify centralized and decentralized finance, offering deep liquidity, institutional-grade buying and selling instruments, and entry to tokenized belongings on one platform.

Within the first half of 2025, Bigget’s month-to-month buying and selling quantity averaged $750 billion, with derivatives accounting for about 90%. Spot market exercise elevated 32% in Could alone, and institutional accounts almost doubled in the course of the ETF launch interval earlier this 12 months.

Associated: Bitget GetAgent Mission Evaluation: AI-powered buying and selling assistant revolutionizes the DeFi expertise

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.