- BitMine presently holds roughly 4.07 million ETH, which is roughly 3.37% of the full provide of Ethereum.

- Institutional buyers on Wall Avenue proceed to help Bitmine’s ETH monetary plans.

- Ethereum is well-positioned to outperform Bitcoin in 2026, pushed by growing institutional adoption by regulated means.

BitMine Immersion Applied sciences (NYSE: BMNR) has launched the newest replace on its Ethereum (ETH) holdings. Bitmine, led by chairman Tom Lee, has relentlessly gathered 3.4% of the full ETH provide over the previous six months, strengthening its stability sheet, akin to a method to satisfy its debt obligations.

BitMine experiences robust stability sheet supported by Ethereum Holdings

In line with its holdings replace on December 22, 2025, BitMine has gathered over $13 billion in cryptocurrencies. The corporate reported that it presently holds 4,066,062 ETH, price roughly $12 billion on the time of writing.

BitMine additionally reported 193 Bitcoins (BTC) price roughly $16.8 million. The corporate reported holding $32 million in Eightco Holdings (NASDAQ: ORBS) inventory. Bitmine, however, has about $1 billion in money, just like Technique’s money reserves of greater than $2 billion.

The corporate notes that 5% of the full provide of Ether will likely be supported by institutional buyers.

BitMine reiterated its agency dedication to accumulating 5% of the full provide of Ethereum. Lee stated BitMine has stable help from institutional buyers, particularly Wall Avenue firms.

“We’re quickly progressing in direction of the ‘5% alchemy’ and are already seeing synergies arising from massive ETH holdings.”

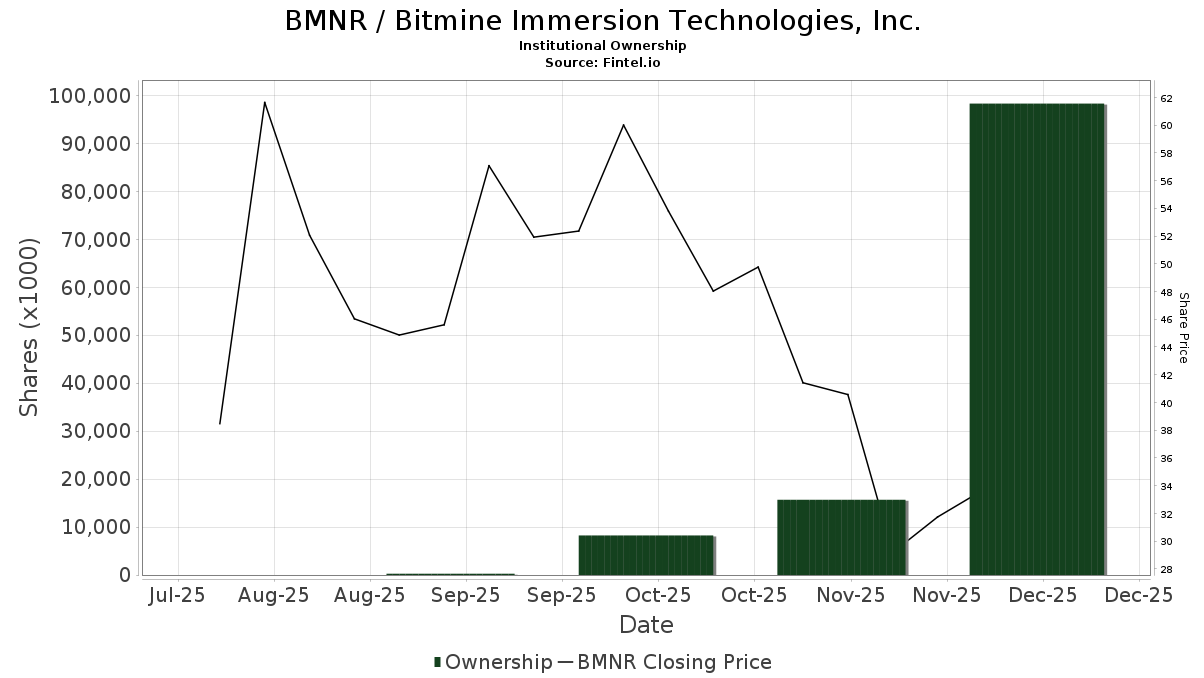

The corporate’s help from institutional buyers, primarily Ark Funding, is clear from the numerous accumulation of inventory within the firm. Over the previous month, institutional buyers have elevated their possession in BitMine inventory from 15 million shares to 95 million shares. Moreover, there are 359 lengthy positions in opposition to 2 quick positions.

Due to this fact, Bitmine continues to buy extra ETH even in a risky market. For instance, Lookonchain’s on-chain information evaluation exhibits that BitMine bought 13,412 ETH price over $40 million on Monday.

Why is Wall Avenue bullish on ETH?

The excessive institutional demand for Ethereum, as evidenced by BitMine’s continued accumulation, exhibits that Wall Avenue may be very bullish on ETH. Though the ETH worth has fallen over 11% for the reason that starting of the yr, institutional buyers have expressed robust confidence within the altcoin’s future development prospects.

Wall Avenue buyers stay bullish on ETH, primarily due to clear rules and enabling mainstream adoption of real-world asset tokenization (RWA). In line with Lee, BitMine has performed an necessary position as a monetary firm in bridging the hole between Wall Avenue and the Ethereum ecosystem.

“We’re a key group bridging Wall Avenue’s transition to blockchain by tokenization, and we’ve been deeply engaged with key organizations driving cutting-edge developments within the defi neighborhood,” Lee added.

Within the US, Ethereum’s stablecoin market capitalization has surged to over $166 billion resulting from continued enforcement of the Genius Act. In any case, institutional buyers are betting that ETH will outperform Bitcoin (BTC) within the quick time period in 2026, within the wake of impending transparency laws in america.

Associated: Cathie Wooden’s Ark Investments Provides $10.56 Million to Bitmine Inventory Throughout Newest Buying and selling Session

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.