Bitcoin costs hit $50,000 at present, one month after the U.S. Securities and Alternate Fee accepted 11 purposes for Spot Bitcoin ETFs.

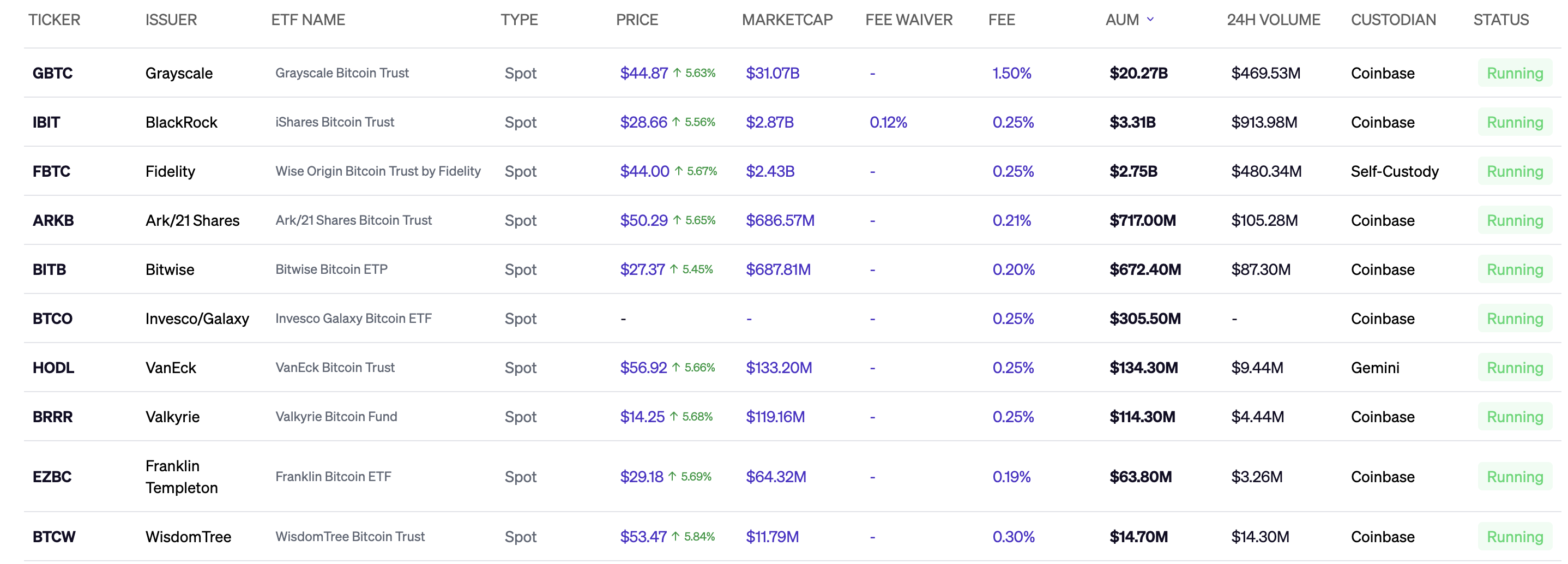

Issuers of those ETFs have seen demand soar past the billions initially predicted. These issuers have a complete of roughly $28.35 billion in belongings underneath administration and a market capitalization of $39.8 billion, based on Blockworks knowledge. The 24-hour buying and selling quantity was $1.38 billion.

Topping the Spot Bitcoin ETF pack is Grayscale Bitcoin Belief with $20.27 billion, adopted by BlackRock's iShares Bitcoin Belief with $3.31 billion and Constancy's Smart Origin Bitcoin・The belief is price $2.75 billion.

Picture credit: Blockworks Bitcoin Spot ETF Tracker (Opens in new window)

“Sustained inflows and volumes have exceeded expectations,” stated Matt Hogan, chief funding officer at Bitwise Asset Administration. “The truth that we not solely had inflows on the primary day, however sturdy constructive inflows in 18 of the primary 19 days is actually pleasing. And I grew to become very optimistic about its significance on this planet.”

Bitwise operates Bitwise Bitcoin ETP, which is at present the fourth largest spot Bitcoin ETF by market capitalization. Nevertheless, the highway to get right here was not straightforward. In reality, Hogan stated Bitwise held greater than 20,000 conferences with monetary advisors final 12 months in preparation for anticipated approvals.

“We had been nervous about launching, we're not BlackRock, however we're not new to this area. (However) we provide crypto funds, so we must be related. ,” Hogan stated. Now, he believes ETFs have reached escape velocity and are “giant sufficient to be sustainable from an financial standpoint.”

Bitwise's 0.20% payment is the second-lowest of those, however Hogan believes it's a “fairly whole lot” for competitiveness. However he stated it's unclear whether or not these charges will likely be maintained if the fund turns into extraordinarily giant.

“Proper now we like our place.”

Hogan additionally believes demand will proceed to extend as extra nationwide account platforms come on-line and inbound curiosity from giant establishments will increase. “It’s not like they’re shopping for $100 million of Bitcoin at present, however there’s quite a lot of inbound and assembly with platforms which have billions of {dollars} in belongings.”

A month after it was accepted, Hogan believes the Spot Bitcoin ETF will maintain the title of “largest ETF launch in historical past.”

“Regardless of being within the ETF business for 15 years, it's in contrast to something I've ever seen…It's not just a bit bit greater. It's a lot greater.”

Over the subsequent 11 months, Hogan is optimistic that buying and selling volumes will proceed to extend as time passes and Bitcoin worth stimulates demand. He added that the product's pure viewers takes time to be taught and make choices, and it takes time to enhance public accounts.

“I feel it's going to be an uptick, a plateau, after which a re-acceleration,” Hogan stated. “We don't see demand slowing down over the subsequent 18 months. We count on these ETFs to set data.”

As for what occurs subsequent, Bitwise is leaving the door open for different merchandise.

“We don’t have an software, however we’re actually Ethereum (spot ETFs) and you may think about what we’re fascinated by what we will do with Bitcoin and Ethereum,” Hogan stated. Ta. “Now we have entered the ETF period of cryptocurrencies and have confirmed that buyers wish to entry cryptocurrencies by way of ETFs. We intend to supply these merchandise to the extent potential underneath rules. is.”

Comments are closed.