Bitcoin costs have plummeted following the US Federal Reserve's current rate of interest cuts, however market consultants like Bitwise CIO Matt Hogan stay optimistic about Bitcoin's long-term trajectory. I’ve a sure viewpoint.

On Dec. 18, the Fed introduced a 25 foundation level charge minimize, lowering its outlook for 2024 to 2 cuts from the beforehand anticipated 4.

Additionally, and maybe extra importantly for Bitcoin, Chairman Jerome Powell stated whereas answering questions on President-elect Donald Trump's strategic preparedness plans that the Fed can’t maintain BTC underneath present rules. added.

This triggered an enormous market response, with the value of Bitcoin dropping to $98,839 earlier than stabilizing at $101,586 earlier right this moment. Equally, different high digital belongings reminiscent of Ethereum, XRP, and Solana additionally recorded losses of round 5%, 5.5%, and three%, respectively.

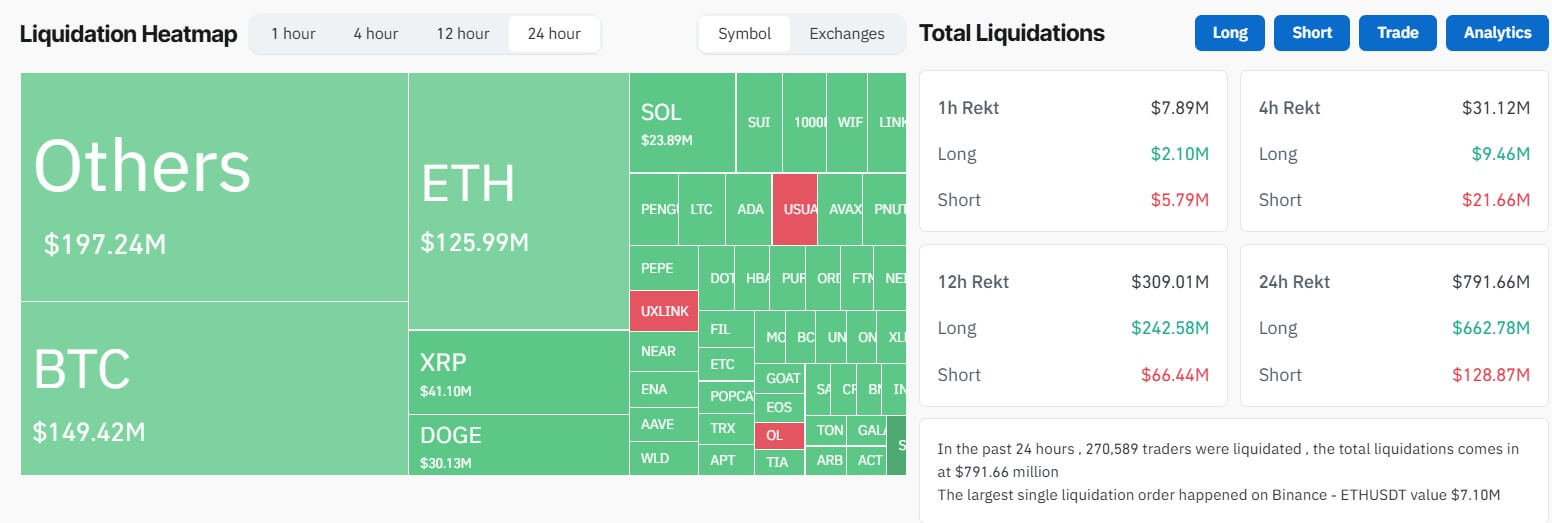

In line with CoinGlass information, this pink market efficiency led to roughly $800 million in liquidations and affected greater than 270,000 merchants. Merchants speculating on value will increase suffered essentially the most losses, shedding $662 million up to now 24 hours.

In addition to cryptocurrencies, conventional markets such because the S&P 500 index and the Russell 2000 index skilled declines of three% and 4.4%, respectively.

Bitcoin’s long-term trajectory

Regardless of this pullback, Hogan reassured buyers that Bitcoin's fundamentals stay robust.

Bitwise CIO attributes Bitcoin's current resilience to inner crypto-specific elements, together with elevated adoption by institutional buyers, a shift in U.S. coverage to advertise crypto, and authorities and company purchases of Bitcoin. I defined.

He additionally highlighted vital advances in blockchain and elevated ETF flows as elements additional driving market power.

Moreover, Bitcoin's technical indicators stay optimistic, with the 10-day exponential transferring common ($102,000) nonetheless above the 20-day exponential transferring common ($99,000). Hogan sees this as a bullish sign, reinforcing his perception that the present decline is a short-term fluctuation reasonably than the tip of an ongoing bull market.

Regardless of exterior strain, Hogan predicted that Bitcoin will proceed its multi-year upward trajectory, supported by robust adoption developments and technological advances within the cryptocurrency house.

He concluded:

“Cryptocurrencies are in a multi-year bull market. The anticipated 50bps charge minimize won’t change that.”

talked about on this article

(Tag to translate) Bitcoin