Matt Hogan, chief funding officer at Bitwise, blames the current crypto market selloff on overinflated expectations relating to the potential impression of a newly launched Bitcoin exchange-traded fund (ETF). Acknowledged.

In a Jan. 23 submit on X (previously Twitter), Hogan defined that the present market decline is being pushed by what he calls an “ETF expectation-driven” phenomenon.

He stated traders anticipating “larger internet inflows into[these]ETFs” moved forward of the approval information by loading into each spot and spinoff positions in flagship digital property. Nevertheless, because the anticipated capital inflows didn’t materialize, these traders are actually “unwinding their bets”, inflicting the present market scenario.

“Simply because the market is overestimating the short-term impression of ETFs, it’s also underestimating its long-term impression,” Hogan concluded.

The worth of the highest cryptocurrency has been on the decline for the reason that Securities and Trade Fee (SEC) accepted the launch of a number of spot Bitcoin ETFs in the USA. In keeping with , the digital asset fell to lower than $39,000 on January 23, however has recovered to $40,389 on the time of writing. crypto slate information.

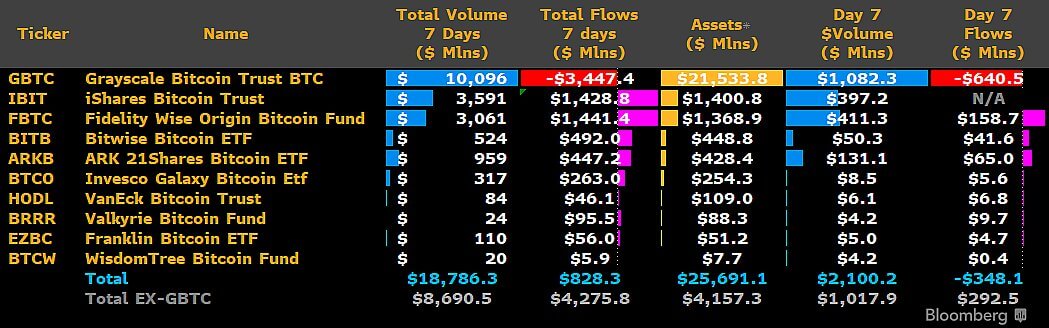

This downward pattern brought on concern throughout the crypto neighborhood, with some blaming it on outflows from Grayscale's Bitcoin Belief ETF (GBTC).

In distinction to this opinion, analysts together with CryptoQuant founder Ki Younger Ju share an analogous view to Hougan.

Younger Ju just lately emphasised that Bitcoin operates in a futures-driven market and is much less prone to identify promoting exercise on account of GBTC-related points.

“The decline in BTC is because of a sell-off within the derivatives market, not GBTC. The OTC (over-the-counter) market may be very energetic, however there isn’t a impression on the worth.” Added.

ETFs are internet patrons of BTC.

In the meantime, Bitwise's head of funding additionally revealed that the just lately launched ETF is a purchaser of Bitcoin, regardless of outflows from GBTC.

Hogan identified that whereas GBTC is performing as a vendor, the cumulative BTC acquisition from the brand new ETF exceeds the offload BTC acquisition by Grayscale.

Bloomberg information helps Hogan's view. As of January 23, GBTC outflows reached $3.45 billion, whereas the mixed inflows of property underneath administration of the 9 newly launched ETFs exceeded $4 billion.

This information underscores a compelling story that ETFs are receiving vital curiosity from the neighborhood and are resulting in speedy and vital accumulation of main cryptocurrencies.