BlackRock, the world’s largest asset supervisor with over $9 trillion in property below administration, has made waves within the cryptocurrency market with its current submitting for a Bitcoin Alternate Traded Fund (ETF). Regardless of the presence of a number of the largest cryptocurrency exchanges in america, there are not any ETFs monitoring the spot value of Bitcoin resulting from regulatory restrictions.

An ETF is a basket of securities, akin to shares, that monitor an underlying index. For Bitcoin ETFs, they’re designed to trace the spot value of Bitcoin. This can be a nice benefit for buyers as they will contact the worth of Bitcoin with out worrying concerning the challenges of shopping for and storing cryptocurrencies themselves. Like different ETFs, Bitcoin ETFs will be purchased and offered on conventional inventory exchanges.

As evidenced by Glassnode’s on-chain knowledge, the expectation that business giants like BlackRock will launch bitcoin ETFs is sparking a brand new wave of bitcoin hoarding within the US.

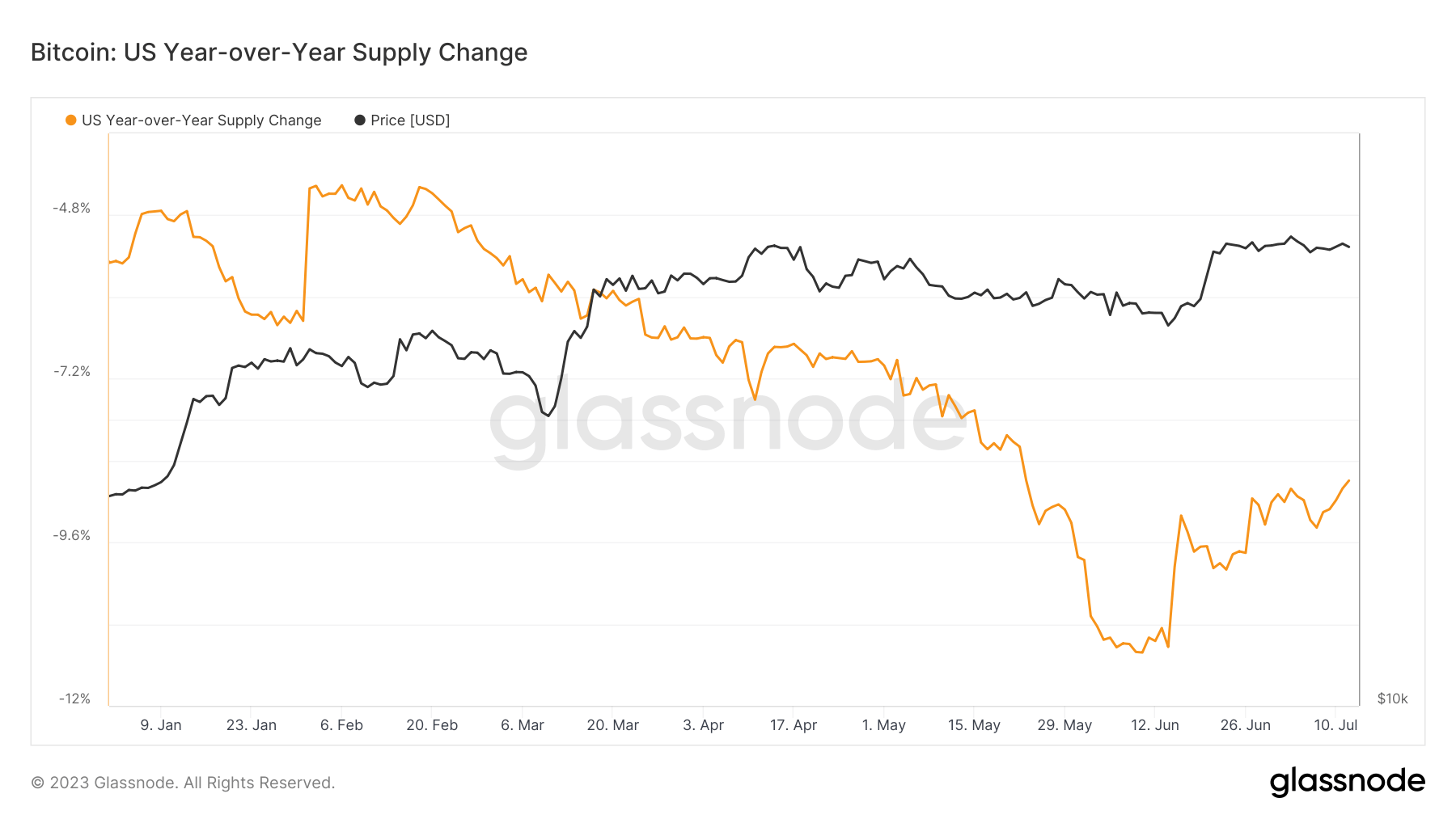

Glassnode knowledge reveals a rise in Bitcoin holdings by U.S. firms for the reason that starting of the month, regardless of a year-on-year decline. Notably, the start of this surge seems to coincide with the announcement of BlackRock’s Bitcoin ETF submitting.

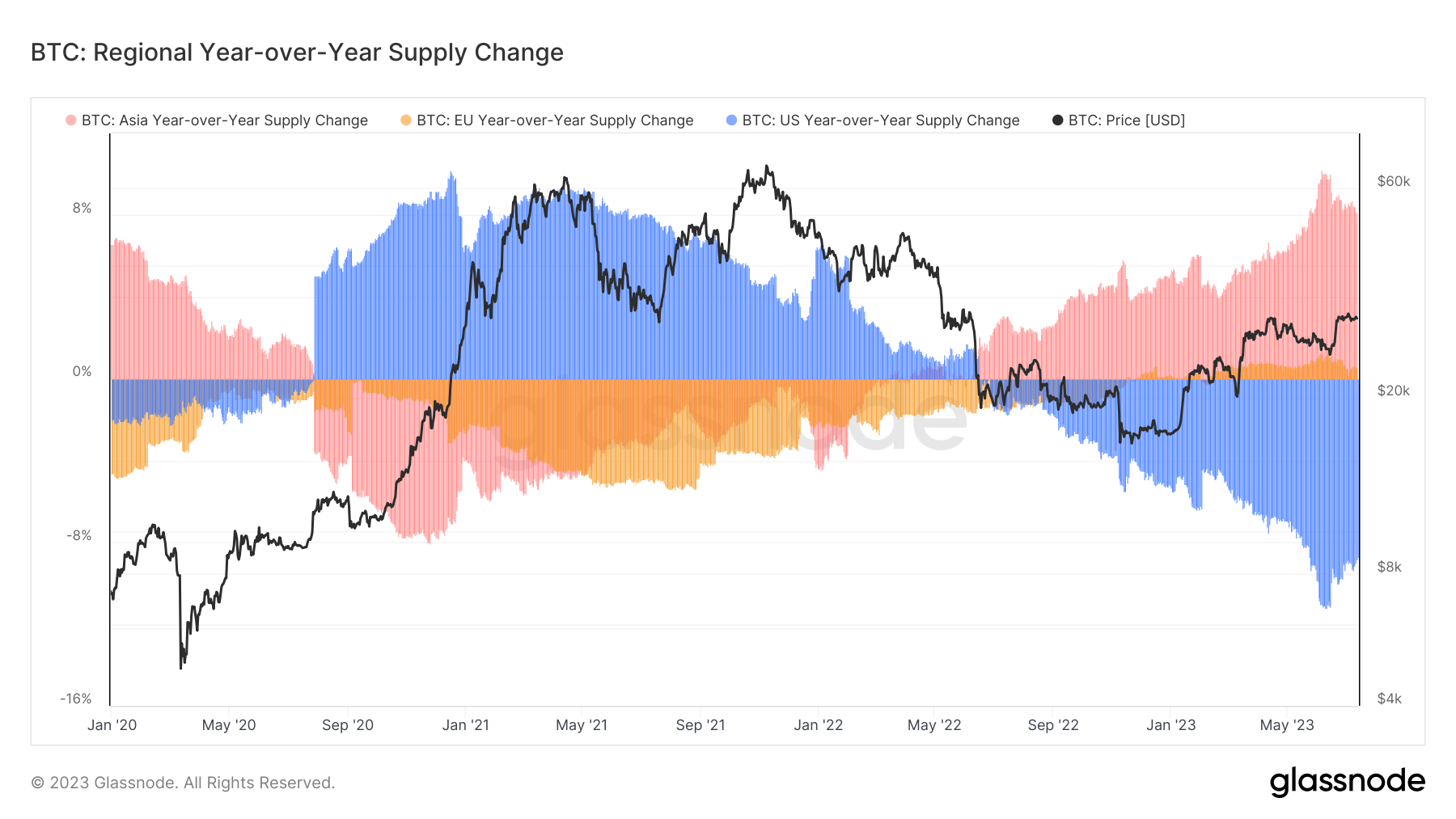

To find out the geographic location of Bitcoin entities, Glassnode compares transaction timestamps with uptime in numerous geographic areas. By way of this technique, we are able to establish the more than likely location of an entity and achieve a broader understanding of the dynamics of native Bitcoin provide.

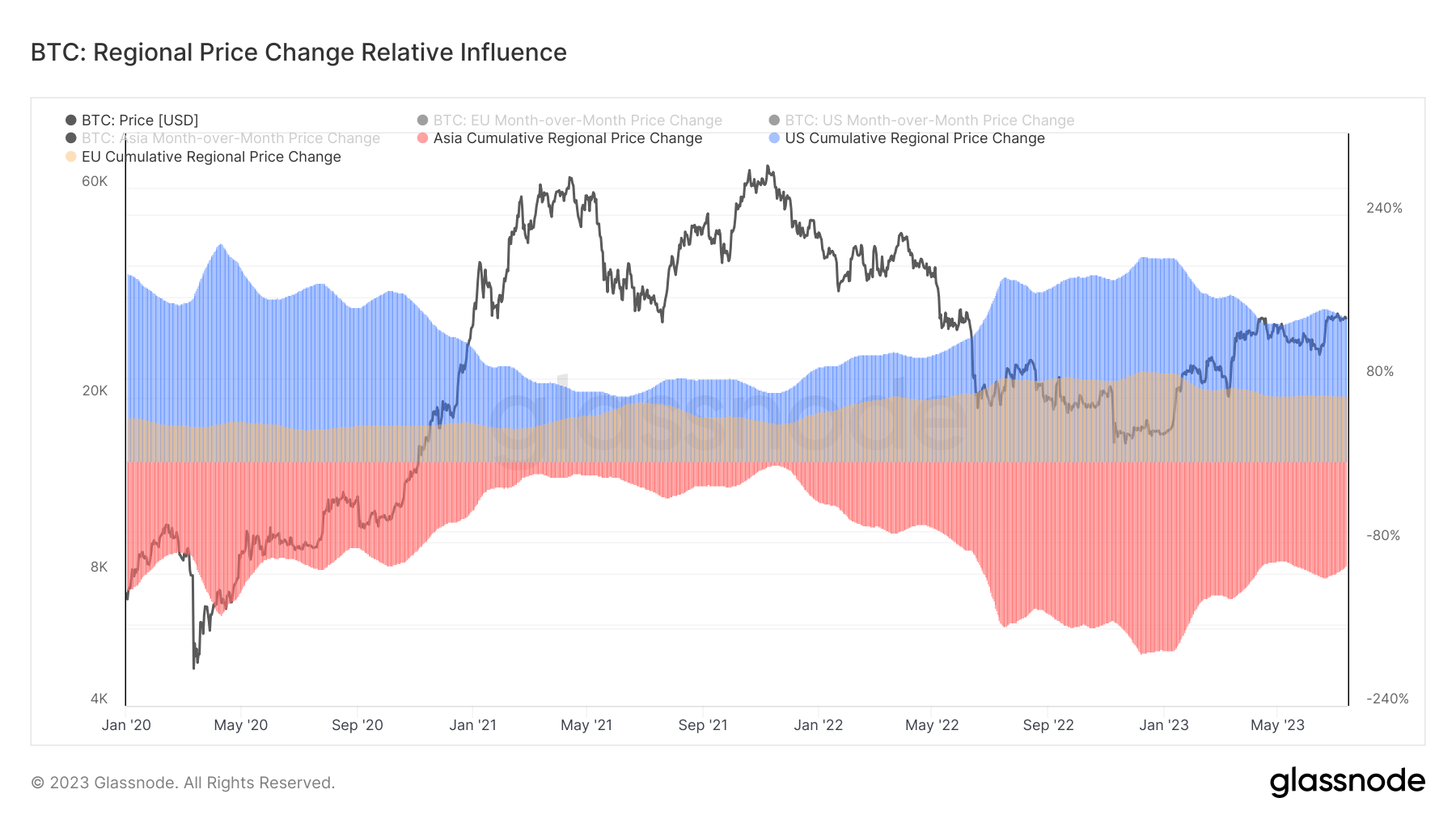

Given the widespread affect of the US market on bitcoin costs, the resurgence of bitcoin accumulation within the US might mark a pivotal change for the cryptocurrency market. Glassnode makes use of two fashions to calculate this impact. One appears on the cumulative value efficiency throughout buying and selling hours within the EU, US and Asia. The opposite compares the cumulative efficiency by area to the grand complete. In line with these fashions, america has 139.2% of the regional market’s affect, a disproportionately excessive determine that highlights the distinguished function of america in international Bitcoin buying and selling.

The importance of BlackRock’s Bitcoin ETF submitting goes past simply value actions. Bitcoin ETFs, particularly these launched by monetary giants like BlackRock, might usher in a brand new period of institutional and particular person funding in Bitcoin, creating higher market liquidity. Nonetheless, it’s also vital to think about the potential regulatory challenges and dangers related to broader cryptocurrencies. handed.

The story that BlackRock’s Bitcoin ETF submitting will speed up US accumulation first appeared on currencyjournals.

Comments are closed.