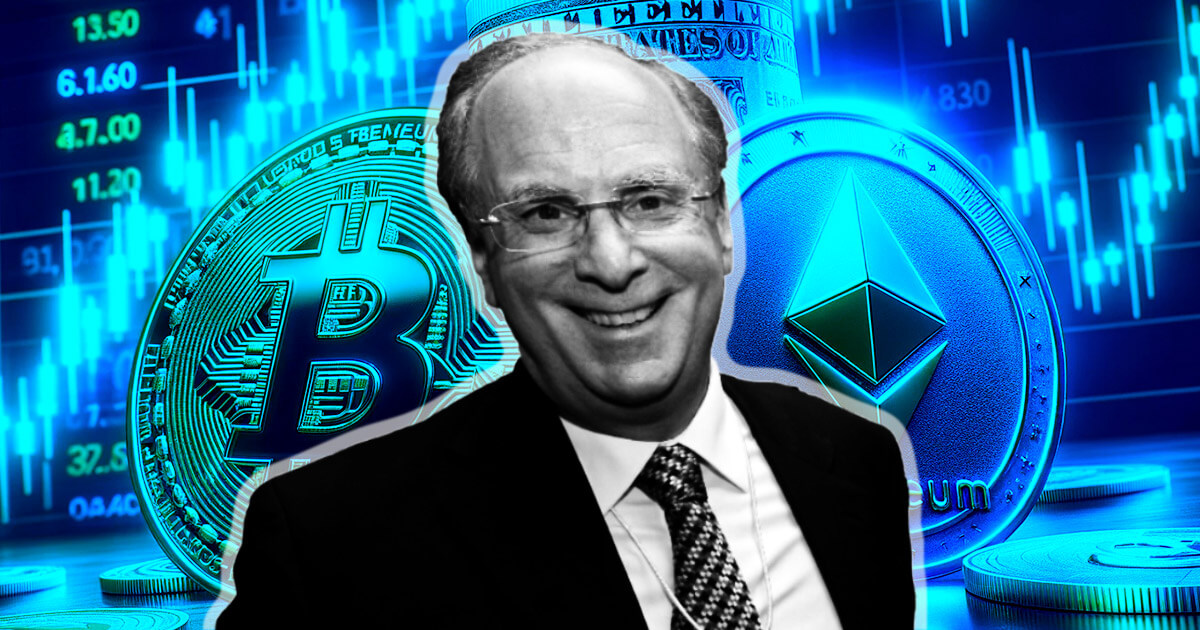

The launch of BlackRock's Spot Bitcoin ETF was highlighted in an interview with CEO Larry Fink on CNBC. Fink has beforehand expressed skepticism about Bitcoin, however now sees it as a viable asset class, if not a possible forex. This variation in stance is in step with BlackRock's broader technique to embrace technological advances within the monetary sector, primarily by means of ETFs and finally the tokenization of monetary property.

In a CNBC interview after BlackRock's Bitcoin ETF's historic first day of buying and selling, Fink revealed a notable shift in notion about Bitcoin. Mr. Fink has come to view Bitcoin as an asset class just like digital gold, appropriate for storing wealth however not as a forex.

Fink's dialogue with the CNBC hosts delved into the that means of Bitcoin's worth, the way it compares to gold, and its potential worth trajectory. He emphasised that Bitcoin, like gold, is a haven asset that will increase in worth amid geopolitical and financial uncertainty.

Nevertheless, in contrast to gold, Bitcoin has a virtually mounted provide restrict, growing its enchantment as a retailer of worth. When requested about predictions like that of Cathie Wooden, who expects Bitcoin to succeed in over $600,000, Fink declined to take a position on a particular valuation, as a substitute specializing in Bitcoin's wealth preservation potential. centered.

The dialog additionally touched on the broader affect of BlackRock's ETF initiative. Fink believes that ETFs are step one in a technological revolution in monetary markets, and that the tokenization of monetary property would be the subsequent step.

He believes this imaginative and prescient is in step with BlackRock's historical past of success in integrating ETFs into numerous asset lessons and demonstrates a constant technique to leverage expertise to remodel the monetary panorama. .

Fink's feedback relating to the first-day inflows into Bitcoin ETFs have been constructive, and BlackRock acquired numerous consideration available in the market. He highlighted the aggressive benefit of ETFs over conventional trusts, pointing to the low charges related to ETFs. This facet, coupled with the tax implications of transferring property from a belief like Grayscale to different low-fee ETFs, poses each challenges and alternatives within the evolving crypto market.

Lastly, when discussing the way forward for crypto ETFs, Fink expressed optimism about the potential of different cryptocurrencies akin to Ethereum being included in ETF merchandise.

He emphasised the significance of tokenization in growing transparency and lowering corruption in monetary transactions, pointing to a future the place monetary property and identities are tokenized to create a safer and environment friendly monetary system. He concluded:

“These are simply stepping stones in direction of tokenization, and I really consider that is the place we have to go… Utilizing a tokenized system eliminates all corruption.”

(Tag translation) Bitcoin

Comments are closed.