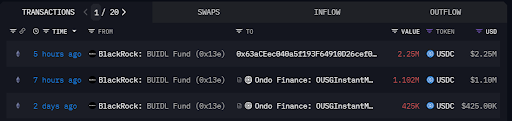

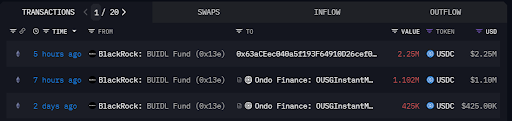

- BlackRock's BUIDL fund moved $3.35 million price of USDC to a number of addresses.

- Ondo Finance obtained a notable switch of 1.1 million USDC.

- Injective launched a tokenized index for its BUIDL fund, offering on-chain entry to leveraged U.S. Treasury securities.

BlackRock's BUIDL fund continues to develop its involvement within the cryptocurrency house, not too long ago sending $3.35 million in USDC to a number of addresses, together with OndoFinance, in keeping with ArcamData. The transfer builds on BlackRock's rising exercise in decentralized finance (DeFi), particularly its efforts in tokenizing real-world property (RWA) earlier this 12 months.

Latest transactions from the BUIDL Fund embody the switch of $1.102 million in USDC to Ondo Finance, a platform specializing in tokenized monetary companies, adopted shortly thereafter by a further $2.25 million in USDC to a newly recognized deal with.

These transfers are the most recent in a sequence of serious capital actions over the previous few weeks and sign BlackRock's rising dedication to DeFi.

Strategic Positioning and Tokenized Finance

Whereas the precise objective of those transfers has but to be made public, they display BlackRock's strategic positioning within the decentralized finance ecosystem. Ondo Finance can be a notable recipient of the fund's switch, highlighting its rising significance within the tokenized finance sector.

Along with these developments, Injective is rolling out a tokenized index for its BUIDL Fund, furthering BlackRock's DeFi ambitions. The brand new product will permit customers to entry U.S. Treasury securities instantly on-chain with leverage, strengthening BlackRock's function in connecting conventional finance and DeFi.

Past USDC transfers, BlackRock's foray into crypto continues to garner consideration, notably with its Spot Bitcoin ETF, which has reportedly obtained a big allocation of BTC from Coinbase Prime.

BlackRock has additionally up to date its custody settlement with Coinbase to set the withdrawal window for Bitcoin ETFs to 12 hours, a change aimed toward streamlining transaction processing for the cryptocurrency ETF.

Moreover, BlackRock operates its personal blockchain nodes to confirm BTC balances and supply transparency to its shoppers, which permits BlackRock to confirm every day that the Bitcoin saved within the ETF is actual and never simply “paper BTC”.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent any sort of monetary recommendation or counsel. Coin Version just isn’t liable for any losses incurred on account of using the content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to our firm.