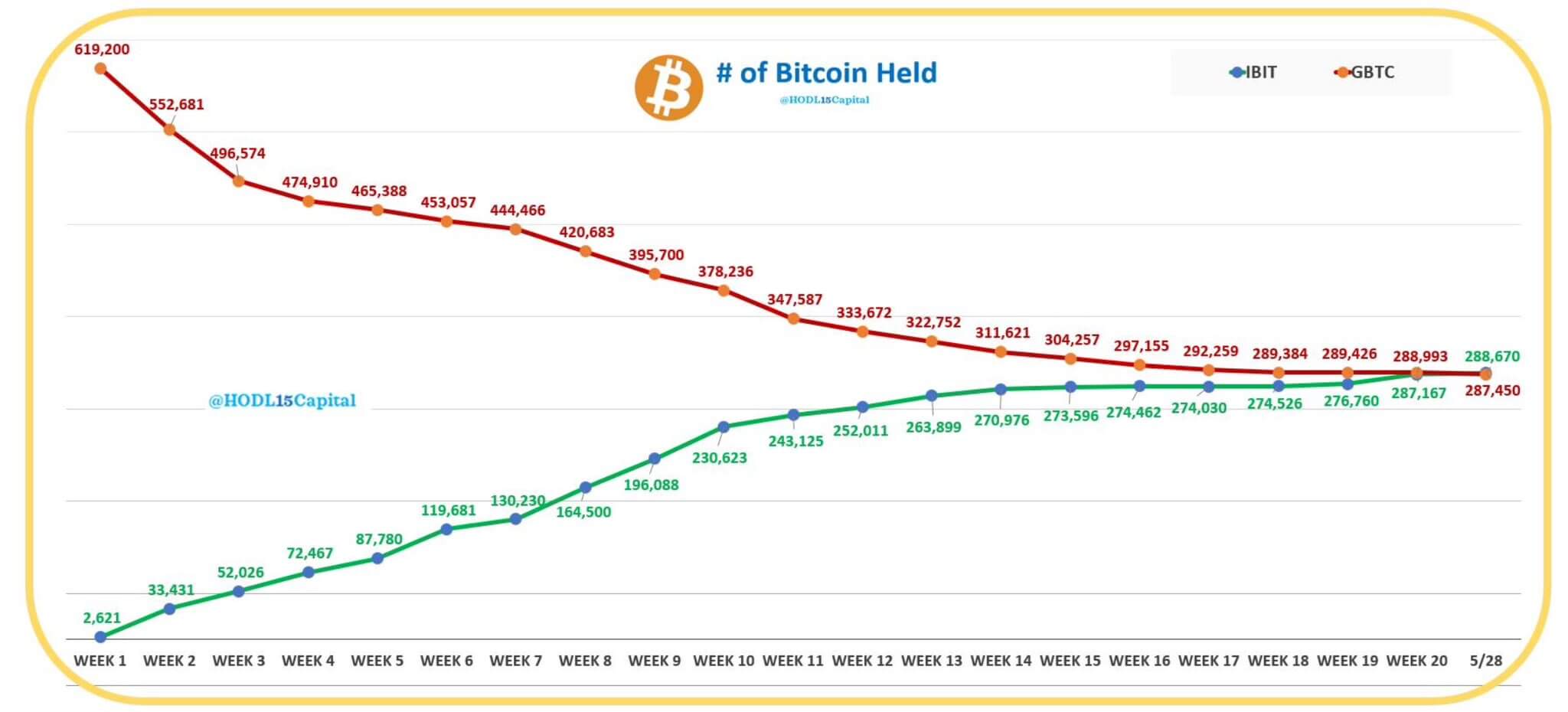

- BlackRock's IBIT has surpassed Grayscale's GBTC in Bitcoin ETF holdings.

- IBIT's holdings surged to 288,670 BTC, whereas GBTC's have been at 287,450 BTC.

One of many prime Bitcoin information tales right now is that BlackRock's iShares Bitcoin Belief (IBIT) has overtaken Grayscale's Bitcoin Belief (GBTC) to turn into the world's largest Bitcoin exchange-traded fund (ETF).

On Could 28, inflows into IBIT reached $103 million, whereas outflows into GBTC have been $105 million. General, the spot Bitcoin ETF market recorded its eleventh consecutive buying and selling day of web inflows on Could 28, totaling greater than $45 million.

IBIT Overtakes GBTC to Change into Largest Bitcoin ETF

Grayscale's Spot BTC ETF recorded an outflow of $105 million, or 1,540 BTC, whereas BlackRock's IBIT noticed inflows of almost $103 million, or 1,501 BTC.

BlackRock presently holds 288,670 BTC for the IBIT ETF, whereas Grayscale's GBTC holdings have additional declined to 287,450 BTC.

Notably, when the Spot Bitcoin ETF debuted in January, Grayscale's ETF held 620,000 Bitcoin. However in accordance with information from HODL15Capital, share On the X program, these shares have shrunk quickly as shares like BlackRock, Constancy and others have soared prior to now 4 months.

In keeping with HODL15Capital, Grayscale's outflows come amid a price difficulty (GBTC fees 1.5% vs. 0.2% for friends).

“Grayscale held 620,000 BTC on the time of conversion (10 January 2024), over 3% of the circulating provide, but refused to decrease charges (1.5% vs. 0.2% for friends) even after buyers withdrew over 330,000 BTC. That is the tip of the 'differentiation' technique,” HODL15Capital famous.

Bloomberg report In keeping with studies launched on Wednesday, BlackRock's BTC holdings reached $19.68 billion as of Tuesday's shut, whereas Grayscale's BTC holdings reached $19.65 billion. Constancy's FTBC, which noticed an influx of $34.3 million on Could 28, now holds $11.1 billion.

IBIT's sale of GBTC got here on the identical time that BlackRock disclosed in a regulatory submitting that its funds had purchased IBIT shares.

Particularly, the BlackRock Strategic Revenue Alternatives Fund (BSIIX) purchased IBIT shares have been value $3.56 million within the first quarter, whereas Strategic World Bond Fund (MAWIX) Maintain The ETF shares are valued at $485,000.