- Bloomberg’s Mike McGlone predicts that macro dangers may see Bitcoin plummet by 90% to $10,000.

- Analysts cite “information promoting” exercise after the ETF approval and MicroStrategy’s 10x rally.

- McGlone warned that almost all of the 28 million altcoins will drop to zero throughout the S&P 500 correction.

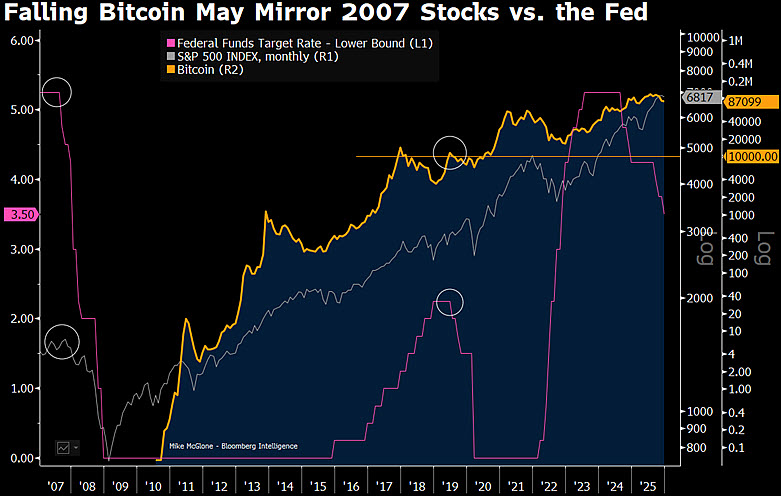

Bitcoin (BTC) worth has hit a ceiling and is on the verge of a serious crash to $10,000. That is based on a daring prediction from Mike McGlone, senior commodity strategist at Bloomberg Intelligence.

“Whether or not you personal it or put on it, we anticipate Bitcoin to maneuver again towards $10,000,” McGlone mentioned.

Associated: Why Bitcoin stays risky after the most recent US jobs report

Path to $10,000 in Bitcoin: McGlone slams news-selling merchants

In accordance with McGlone, Bitcoin costs are in a bear market, with a 90% probability of a crash to $10,000. He in contrast the present worth development of Bitcoin with the market construction in 2019 and since 2007.

Within the 2019 situation, Bitcoin costs entered a multi-month bear market after the Federal Reserve started decreasing rates of interest and implementing gradual quantitative easing (QE). Notably, the worth of Bitcoin fell over 71% throughout the 2019-2020 bear market earlier than experiencing the 2021 bull market.

Associated: Why cryptocurrencies are collapsing as we speak: macro dangers, clearing, and central banks

McGlone mentioned main Bitcoin buyers have already made large income, and far of the future-proofing is already occurring. For instance, McGlone mentioned Michael Saylor’s technique has already skilled 10x returns, and forward-looking occasions such because the approval of exchange-traded funds (ETFs) in america and the legalization of cryptocurrencies by main jurisdictions are already occurring.

As such, McGlone argued that Bitcoin costs will head in direction of $10,000, particularly if the S&P 500 index crashes just like the 2007-2008 market reset.

28 million altcoin nightmare

In accordance with McGlone, nearly all of the 28 million altcoins listed on CoinMarketCap will crash to zero. Moreover, altcoins are inclined to have a excessive correlation with Bitcoin worth actions and exhibit very excessive volatility.

Moreover, McGlone agreed with Saylor’s argument that buyers purchase Bitcoin with cash they cannot afford to lose.

“We purchase Bitcoin with cash we are able to’t afford to lose,” Michael Saylor mentioned at a Miami Financial Membership occasion.

What now?

Amid obvious fears of additional capitulation, the final word medium-term destiny of Bitcoin and its 28 million altcoins might be closely influenced by US transparency legal guidelines. The US Home of Representatives has already handed the Transparency Act, however authorized transparency for altcoins may very well be delayed till 2026 as a result of delays in bipartisan efforts within the Senate.

In accordance with CryptoQuant, crypto holders ought to watch to see if Bitcoin worth sustains above $81.5 earlier than capitulating.

“If Bitcoin stays above TMMP ($815,000) whereas AVIV stabilizes (0.8-0.9), it suggests buyers are absorbing provide and defending their price base. If worth loses TMMP and AVIV continues to compress, it means profitability is fading and confidence is weakening,” CryptoQuant mentioned. seen.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.