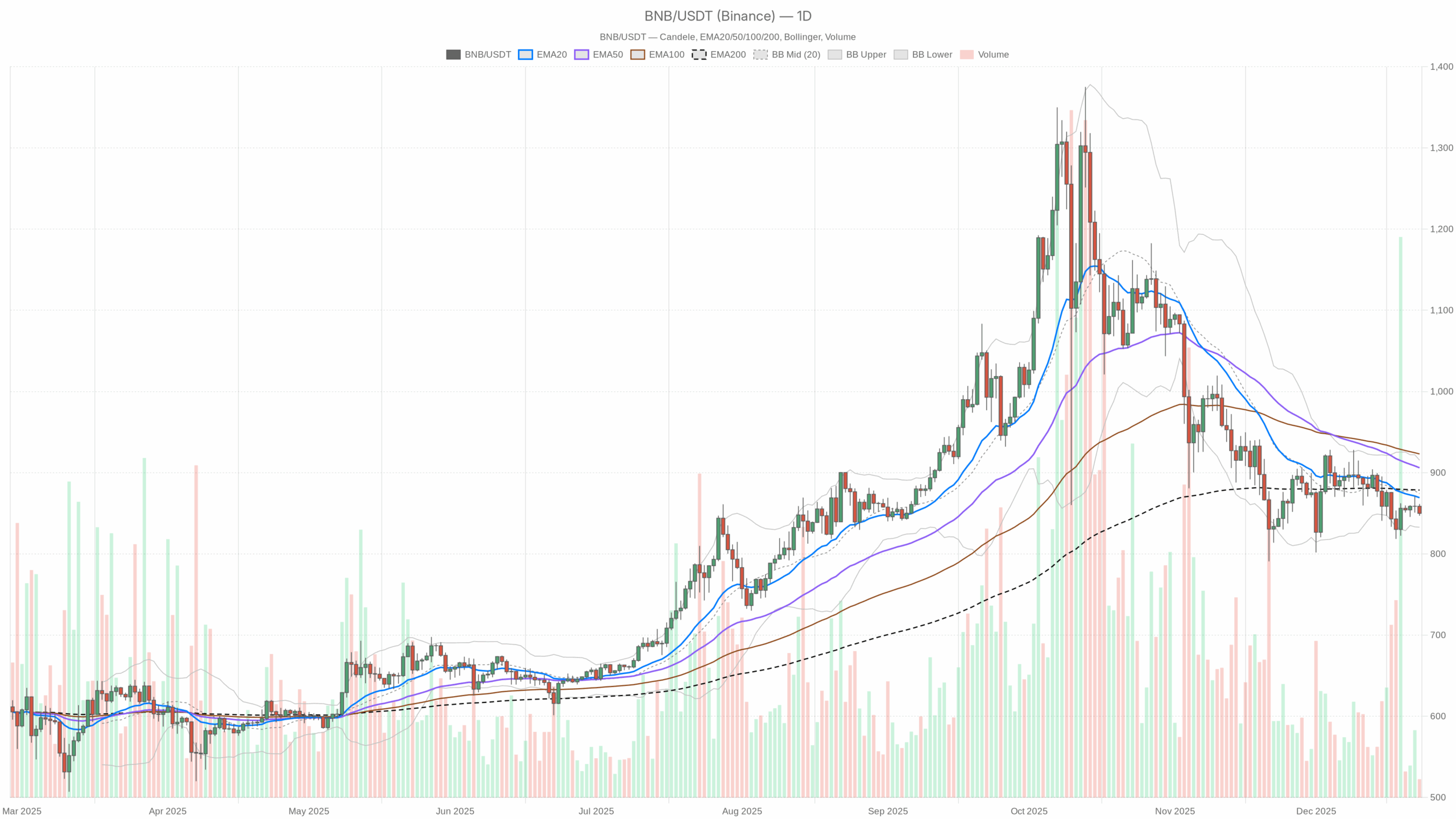

Whereas merchants flock to stablecoins and danger sentiment stays defensive, market situations stay fragile as BNB trades based mostly on a key day by day shifting common.

Day by day Bias (D1): Barely bearish/sideways beneath resistance

Each day, BNB closed round 849.9beneath all main EMAs and simply above the decrease Bollinger Bands. This makes the principle situation appear to be this Cautiously shifting from bearish to impartial: The market is correcting extra broadly and has not but collapsed, however it’s clear that consumers will not be in full management.

Day by day EMA (pattern and construction)

– EMA 20:869.25

– EMA50:906.06

– EMA200:878.61

– Worth (closing value): 849.92

All main EMAs can be found On prime of that The value will likely be beneath 200 days on 20 days and above each on 50 days. This isn’t a clear uptrend or downtrend, however a messy construction. Worth buying and selling beneath 20/50/200 signifies that the quick and medium time period crowd is retreating from aggressive shopping for. For now, BNB I’m buying and selling with Orthodontic pockets with much less resistanceit isn’t but in a full long-term downtrend, but it surely’s clearly not on wholesome bullish footing.

Day by day RSI (Momentum and Participation)

– RSI14:42.43

RSI within the low 40s is traditional weak momentum area. It is not oversold, so we have not reached a robust panic low but, however sellers definitely have the higher hand. Consumers aren’t in a rush, they’re simply nibbling. One of these RSI typically tends to: sluggish, harsh pullback Somewhat than a violent reversal.

Day by day MACD (pattern affirmation)

– MACD line: -15.09

– sign line: -15.47

– histogram:0.38

of MACD is adverse, however the histogram is small and optimistic. In different phrases, the downward stress that pushed BNB down was lose energybut it surely has not turned bullish. The Bears aren’t urgent as laborious anymore, however the Bulls aren’t taking the ball away both. That is per a state of affairs the place the market is attempting to stabilize after a decline, however continues to be buying and selling beneath the main averages.

Day by day Bollinger Bands (Volatility and Vary)

– center band:874.13

– higher band:915.41

– Low band:832.85

– value: 849.92

Costs stay near that low band Contained in the band moderately than within the center. Which means that BNB decrease half of current vary Nevertheless it’s not an explosion of volatility. There was downward stress, but it surely was managed moderately than capitulating. That is normally the imply reversion zone the place a rebound towards the midband begins, or a second leg decline if situations deteriorate.

Day by day ATR (Threat and Volatility)

– ATR14: 29.03

Ann ATR Roughly 850 asset factors for roughly 29 Average day by day variation Roughly 3-3.5%. Volatility has risen sufficient to harm tight stops, however not in a whole panic. For merchants, this can be a market the place place sizing is necessary. It is because a single day by day candlestick can simply disappear if the leveraged wager is sized incorrectly.

Day by day pivot stage (short-term reference)

– Pivot level (PP):852.81

– R1:858.57

– S1:844.17

Worth was wedged between PP and S1 and ended just under the day by day pivot. it’s Balanced, however slightly heavy Perspective: Sellers are pushing costs beneath the equilibrium line, however they don’t seem to be forcing a transparent breakdown. So long as BNB stays beneath the pivot cluster, an intraday rally is prone to be bought.

Intraday affirmation: H1 & M15 bearish pattern

H1 chart: short-term sellers take management

– shut:850.08

– EMA 20: 855.00

– EMA50:856.18

– EMA200:858.92

– RSI14:38.07

– MACD: Line -2.81, Sign -1.64, Hist -1.17

– bollinger mid:857.12 (Band: 844.64-869.59)

– ATR14:3.69

– Pivot PP: 850.05 (value stays the identical)

On the hourly timeframe, all EMAs are stacking above the value and are slowly trending downwards. it’s Stunning short-term downtrend. The RSI close to 38 signifies continued promoting, and the adverse MACD histogram helps aggressive draw back momentum. Costs are holding down the hourly pivot from beneath, confirming that intraday good points are rapidly turning into restricted. this era Helps bearish or impartial day by day biasnot a recent bullish impulse.

M15 Chart: Microbounce inside a bearish construction

– shut:850.09

– EMA 20:850.46

– EMA50:853.44

– EMA200:856.58

– RSI14:43.89

– MACD: Line -1.25, Sign -1.65, Hist 0.40

– bollinger mid:849.55 (Band: 847.51-851.58)

– ATR14:1.31

– Pivot PP:850.07

At quarter-hour, the value is just under the 20 EMA of the pivot, and the 50 EMA and 200 EMA are increased than that. The RSI within the low 40s and a small optimistic MACD histogram inform a delicate story. Quick-term shopping for inside a broad intraday downtrend. That is the kind of surroundings the place scalpers can catch a fast pullback, however swing merchants must respect that the intraday higher construction continues to be bearish.

Macro context: concern, stablecoins, and DeFi exercise

Your entire market is in risk-off mode. The concern and greed index for cryptocurrencies is as follows: 24 (excessive concern)the overall market capitalization fell about 2.1% in 24 hours. BTC’s dominance of over 57% implies that capital is concentrated in comparatively protected currencies. Bitcoin. Moreover, stablecoins comparable to USDT and USDC nonetheless maintain a big share of market capitalization. For trade tokens like BNB, this usually appears like this: Speculative curiosity has been subdued, and follow-through has waned in rising markets..

On the DeFi aspect, the next main DEXs pancake swap and uniswap I’ve seen it earlier than Month-to-month payment goes down Nonetheless, day by day expenses might enhance within the quick time period. PancakeSwap AMM specifically has seen its day by day charges rise sharply after a 7-day plunge. That sample is nicely mirrored Fast enhance in reactive buying and selling moderately than steady danger onflow. So even when BNB has structural connections like BSC DeFi, its background doesn’t recommend sturdy and sustained demand.

BNB situation

Bullish situation: imply reversal above 880-900

The bottom case for bulls is imply reversion bounce From the decrease half of the Bollinger Bands again in direction of the day by day midband and EMA.

What bulls ought to see:

1. Maintain above the underside band or S1 zone (830-845) at closing time day-after-day. So long as BNB defends 832.85-844, the market is saying that is corrective moderately than catastrophic.

2. Get well day by day pivot and quick EMA. Step one is a sustained transfer above 855-860 the place the H1 20 and 50 EMA and the D1 pivot or R1 cluster are positioned. This can break the intraday downtrend.

3. Day by day RSI exceeds 50, MACD histogram flips to extra optimistic. This may point out that the draw back momentum is really fading and the bullish shopping for is turning into bolder.

4. A push in direction of D1 midband and EMA 200 round 875-880and ultimately Round EMA 50 906. The market will now resolve whether or not that is only a rescue rally or the start of a brand new rally.

What invalidates the bullish situation?

A stupendous finish to every day 830 to lower than 835because the RSI slides deeper into the 30s, beneath the Bollinger Band decrease certain and S1 assist, the thought of imply reversion turns into invalid and the story shifts to an lively downtrend. Even when BTC stabilizes, if H1 continues to rack up lows, the bulls will lose their largest macro ally.

Bearish situation: breakdown from the low vary

The bearish case is that what appears like a gentle correction just isn’t truly a correction. Distribution earlier than reducing the legamplified by continued risk-off sentiment throughout cryptocurrencies.

What bears wish to see:

1. Failed to gather 860-880. If all the things bounces again to the 1H EMA of 855-860 and the day by day midrange sells, that confirms the provision overhead is excessive.

2. Day by day shut beneath 844 then 832. Shedding S1 and sliding alongside the skin of the Bollinger Bands or the underside of the Bollinger Bands would point out that the sellers are prepared to push into weakening, not only a fade rally.

3. RSI falls in direction of 30-35, MACD turns additional adverse. If this occurs, it’s going to sign a transition from consolidation to stability after a decline. downward pattern. You may see that the histogram has instantly turned purple once more.

4. H1 and M15 stay capped beneath 200 EMA. Even when the short-term construction by no means reverses, quick shares will nonetheless profit from timeframe corrections.

What would invalidate the bearish situation?

If BNB can Regain and preserve 880-890 With day by day closes above the 200 EMA and mid-Bollinger and hourly RSI lows above 50, the thought of an impending bigger breakdown begins to lose credibility. Bears will likely be confronted with a traditional squeeze backdrop, particularly if widespread market concern begins to take maintain.

Impartial/Vary-Restricted Situation: Chop between 830 and 900

Day by day momentum is reasonable however regular, given the conflicting alerts of clearly bearish intraday flows. Impartial and range-limited path Very believable. In that case, BNB will commerce roughly between: 830 and 900 In the meantime, the market awaits macro triggers comparable to regulatory headlines, Bitcoin volatility, and currency-related information.

In a spread situation, the indicator stays indecisive. The RSI fluctuates between 40 and 55, the MACD hovers round zero, and the value continues to ping-pong between the decrease and mid-range bands with none actual pattern growth both method. Tape turned a double-sided market, Breakout trades fail repeatedlyrewards solely disciplined vary merchants.

Positioning, danger and uncertainty

For now, Most important situation is barely bearish each dayconfirmed by the hourly downtrend and if 830-845 holds, there’s room for a imply reversion rebound. This isn’t an surroundings the place it is sensible to blindly chase breakouts. The market is scared, liquidity is gravitating in direction of Bitcoin and stablecoins, and BNB is caught beneath a serious shifting common.

The important thing questions for anybody buying and selling this are:

– Are you treating it as such? vary between 830 and 900, or tendency continuation?

– Does your measurement assist round 3-4% day by day ATR and frequent whipsaws throughout the day?

– Does the entry respect the multi-timeframe construction and purchase close to assist in a concern market or promote to resistance when volatility is reasonable?

Charts present data and don’t present certainty. Day by day alerts are displaying stress however not panic, intraday alerts are bearish and macro sentiment is clearly risk-off. These on both aspect ought to plan for spikes in volatility, failed ranges, and shifts within the narrative as new macro and regulatory headlines roll to tape.

Open an Investing.com account

This part accommodates sponsored affiliate hyperlinks. We might earn commissions at no extra price to you.

Market evaluation is inherently unsure and might change quickly. This text is an analytical opinion and doesn’t represent a advice to purchase, promote, or maintain any asset. All the time make your individual selections and contemplate your danger tolerance fastidiously.