- Bolivia is negotiating a $9 billion mortgage package deal with the World Financial institution and CAF.

- The brand new administration plans to chop spending by 30% and combine stablecoins into banks.

- Cryptocurrency adoption has surged 530% as residents search alternate options to depreciating native currencies.

The Bolivian authorities is in search of greater than $9 billion in multilateral financing to stabilize the forex and restart development, because the nation enters a brand new financial part. This capital injection coincides with a elementary coverage shift to combine stablecoins instantly into the regulated banking sector.

The plan is the primary main coverage shift below President Rodrigo Paz, who took workplace earlier this month, in line with Reuters information. The administration goals to reverse years of inflation and declines in international trade reserves brought on by state-led interventions.

$9 billion rescue plan: World Financial institution and CAF lead assist

Financial system Minister José Gabriel Espinoza confirmed that the proposed package deal exceeds earlier forecasts. He expects a few third of the cash to be raised inside three months.

The World Financial institution and CAF will lead the financing group to assist infrastructure, renewable vitality, and monetary inclusion. Moreover, the plan would broaden entry to financing for personal companies, which officers imagine is crucial for long-term restoration.

The federal government has additionally launched tax reforms to assist this transformation. Authorities abolished wealth taxes and eradicated taxes on monetary transactions. So policymakers wish to encourage funding after years of strained relations with international capital.

Congress nonetheless must assessment the reforms, and the administration is anticipated to debate components of the 2026 finances. The finances displays a extra austere method, focusing on a 30% lower in public spending.

Monetary markets reacted shortly. Greenback-denominated bonds traded close to their strongest ranges since 2022. In consequence, traders are hoping for extra predictable coverage path after months of uncertainty.

Cryptocurrency integration: banks provide stablecoin providers

One other main change is underway within the monetary system. The federal government plans to combine stablecoins and different cryptocurrencies into regulated banking providers.

Banks will quickly assist financial savings merchandise, playing cards, and loans tied to digital belongings. Officers imagine the transfer may enhance day-to-day monetary entry and cut back dependence on the depreciating native forex.

Associated: Bolivian automobile sellers deal with Tether (USDT) as greenback reserves attain disaster level

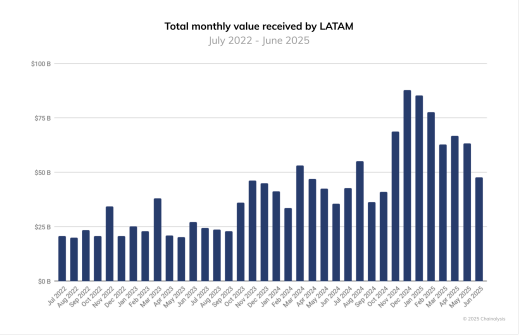

Chainalysis information exhibits why this coverage is essential. Bolivia processed practically $15 billion in cryptocurrency and stablecoin buying and selling quantity from mid-2024 to mid-2025. Moreover, central banks have tracked a surge in supervised digital asset transactions.

Exercise elevated by over 530% in lower than a yr. Could 2025 was our strongest month with $68 million processed. Most cash transfers contain people, and platforms like Binance performed a giant function.

Associated: Greenback-starved Bolivia turns to crypto to pay for gasoline, altering international commerce norms

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.